Who is going to survive the post-halving?

This will be a detailed breakdown of the Bitcoin miners, alongside observations of some interesting twists and turns that will impact them in the next 24 hours with the Bitcoin Halving. We will be punching through over 8,000 data points and 26 ratios with ratios on ratios to supply you with the inside scope.

The other interesting development in the miners is that Marathon has very openly stated that its $6B market cap and $1B war chest will be used to acquire some under-capitalized struggling miners.

The IA Top and Bottom model for Bitcoin is still in the yellow zone and nowhere near orange.

There is plenty of time left in this market—we have not topped already!

This is kind of spectacular, as the hashrate has increased by 863% since the last Halving.

This has had a huge impact on the Bitcoin miners.

The key stat in this chart is the 19,686,262 BTC in circulation and the average daily Bitcoin mining revenue is $39,666,824.

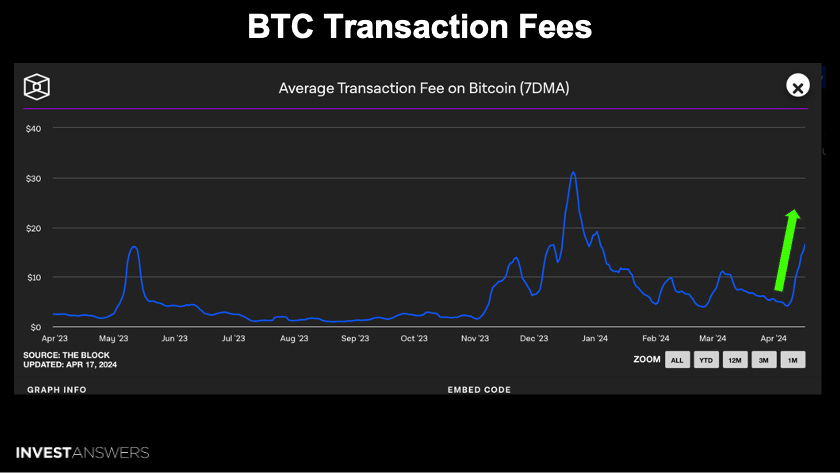

The miner transaction fees are trending back up!

The upcoming Bitcoin Halving will reduce the block reward to 3.125 BTC.

The introduction of the Runes protocol aims to facilitate new token trades on Bitcoin using a more efficient UTXO model, improving upon the BRC-20 standard. The anticipation for Runes is bolstered by platforms like OKX, which plans to support Runes across its wallet and marketplace.

The recent surge in fees has pushed Antminer S19s (or equivalent ASICs) at 0.08/kWh electricity rate above the profitability threshold in the post-halving environment. We will break down the miners' infrastructures a little bit later in this lesson.

As time goes on, Bitcoin miners will be more dependent on fees than block rewards, which will help keep the network secure.

The purple area on this chart shows the new subsidy of 3.125 beginning on April 19th. The transaction fees continuum ranges from $16 for low priority up to $19.65 for high priority.

If you happen to be shipping a billion dollars across the planet in ten minutes, then you can splurge and pay the $19 to make sure it goes safe!

Here is another new exhibit today. This chart displays the percentage of cash to debt.

As you know, for the last year with the Halving, I have been very risk-averse with the minors and focusing on those with the most effectiveness, efficiency, and the least amount of debt.

I am much more partial to miners who issue stock over debt. If you are below the 1 line, then that means you have more debt than cash and I do not like them as investments: ANY, ARBK, CORZQ, DGHI, HIVE, HUT, MIGI, and WULF. This is a personal preference of mine as I would feel very insecure having to make payroll with more debt than cash.

The miners displayed with blue charts are okay.

The green ones are very safe: CLSK (11.59), IREN (67.39), and RIOT (42.56).

The main thing to note from this chart is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.