TESLA: Specter of Delaware Overreach

How this case could disrupt corp comp plans and US future in general

The Elon Musk Compensation Package and the Specter of Delaware Overreach:

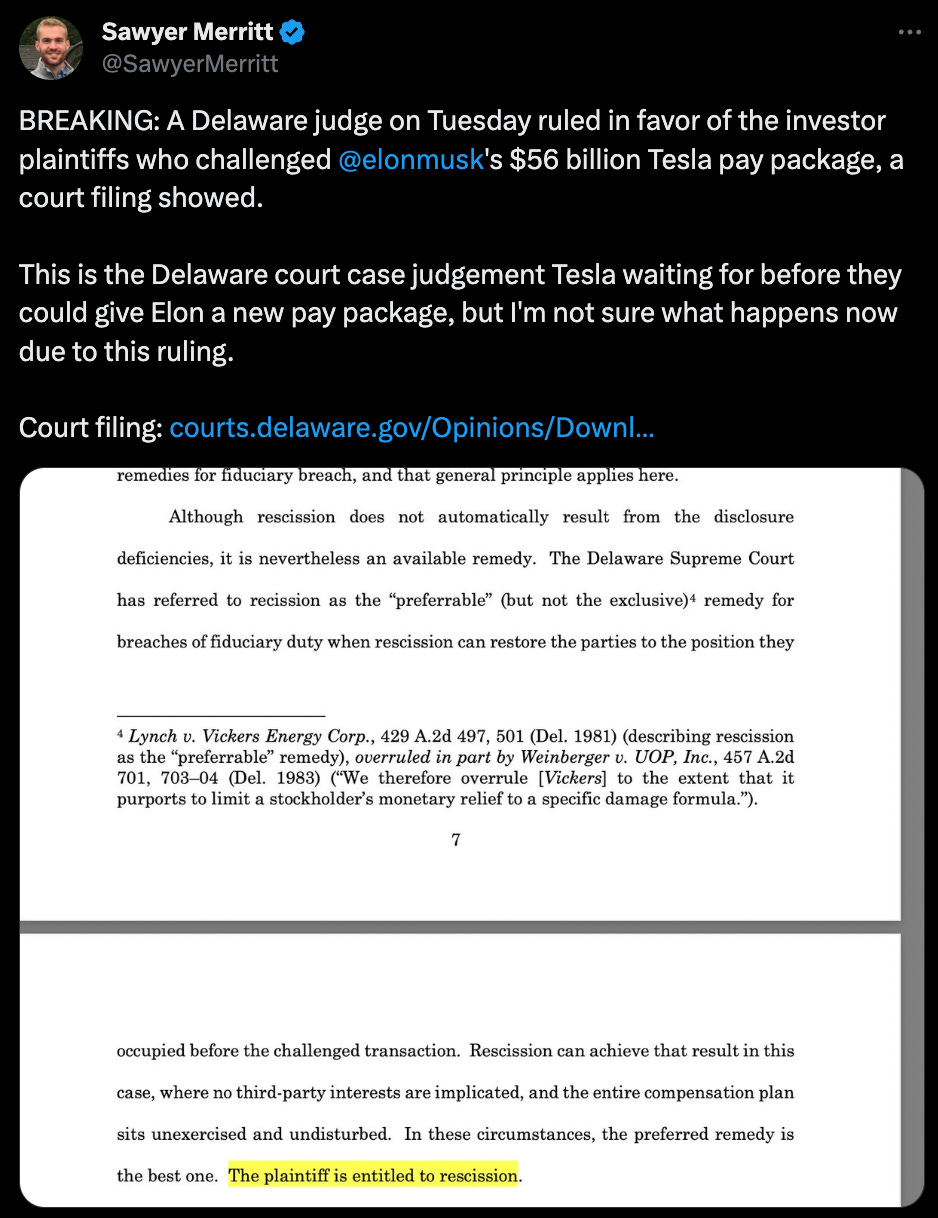

The recent ruling by a Delaware judge to retroactively nullify Elon Musk's $55 billion Tesla compensation package from 2018, despite overwhelming shareholder approval and the achievement of all set milestones, is nothing short of shocking. This decision comes as a staggering blow, especially considering the phenomenal 800% surge in Tesla's stock value since then. It's a move that defies logic and shakes the foundations of corporate trust and governance. This could very well mark a turning point, deterring businesses from incorporating in Delaware or even in the United States. Today, we stand witness to a disheartening and troubling chapter in America's history of business and innovation.

This is a summary of my thoughts regarding the ongoing legal challenge to Elon Musk's 2018 compensation package at Tesla, awarded by the board and approved by a majority of shareholders. It analyzes the arguments for and against its validity, explores the potential consequences of the lawsuit, and considers the broader implications for corporate governance and Delaware's position as a popular incorporation state.

Note above - Rescission is a legal remedy that essentially nullifies a contract and restores the parties to the positions they were in before the contract was executed.

Justification for the Compensation Package:

The following points justify the original package:

Shareholder Approval: The package received 73% shareholder vote, demonstrating a democratic and transparent process.

Ambitious Milestones: The compensation hinged on achieving the most audacious targets, demonstrably met by Musk and Tesla, leading to substantial corporate growth. If you had seen these targets in 2018 you would believe they were impossible to achieve.

Market Cap Safeguards: Built-in measures, like maintaining specific market capitalizations, discourage manipulative practices like pump-and-dump schemes.

Stock Options, Not Cash: Musk received stock options, not direct payouts, requiring his own investment for gain, aligning his interests with shareholder value.

Broadly Shared Benefits: Achieving the stipulated milestones significantly increased Tesla's value, positively affecting all shareholders.

The Legal Challenge and Potential Consequences:

Apparently someone who owns only 9 Tesla shares brought this suit. That in itself is nonsensical but putting that aside lets ’s dig into some more details.

Minority Shareholder Lawsuit: The lawsuit originates from an individual with a small stake, raising questions about the proportionate influence of minority shareholders in corporate governance.

Market Impact Concerns: A potential unfavorable legal outcome could negatively impact Tesla's stock value, potentially harming all shareholders, including those with minimal holdings.

Delaware's Business-Friendly Environment Under Scrutiny: This case casts doubt on the attractiveness of Delaware's business-friendly legal framework, potentially influencing future incorporation decisions by various companies.

Keyman Risk and Leadership Stability: The legal challenge could elevate Tesla's "keyman" risk, jeopardizing Musk's future involvement and the company's trajectory.

Precedent for Executive Compensation: This case sets a disconcerting precedent for the potential legal vulnerability of approved and shareholder-endorsed compensation agreements, potentially discouraging future ambitious executive compensation plans.

DELAWARE OPTICS

The Judge is from Deleware, the Court is in Deleware and the President is from Deleware. The optics are bad as we are all well aware of the current administration's disdain for Elon!

This ruling sets a significant precedent that could potentially disrupt corporate America. Going forward, executives and companies may be hesitant to accept multi-year compensation plans, as they now face the risk of a court, such as one in Delaware, revoking the plan even if it was initially agreed upon. This uncertainty could significantly impact the way businesses approach executive compensation.

This case dares to go where no court has ever gone before!

Conclusion:

The legal challenge to Elon Musk's compensation package presents a complex scenario with implications for corporate governance, investor confidence in Delaware, and future executive compensation strategies. A thorough analysis of this case and its outcome is crucial for all stakeholders involved in the corporate landscape.

Future:

Comp plan voided so start over?

Appeal but it could take years - and that distracts Elon from the mission

The ongoing developments in the lawsuit and the eventual legal decision should be closely monitored to assess the true impact on not only Tesla, Delaware, but also all executive compensation practices across all industries.

This ruling is potentially a short term boost to EPS for Tesla

Potential Solutions

Get out of Delaware

Move Tesla to a safe place like Texas

Reinstate the comp plan and add a new one to get Elon to 25% with heavy milestones eg X Trillion market cap.

The board may need to be shuffled

Stock is down $5 in after-hours