Today’s Nuggets

The Japanese Messed Up?

Rarely Do I Agree with Peter Schiff

ETHE Dumping Faster than GBTC

JUMP Has More To Go

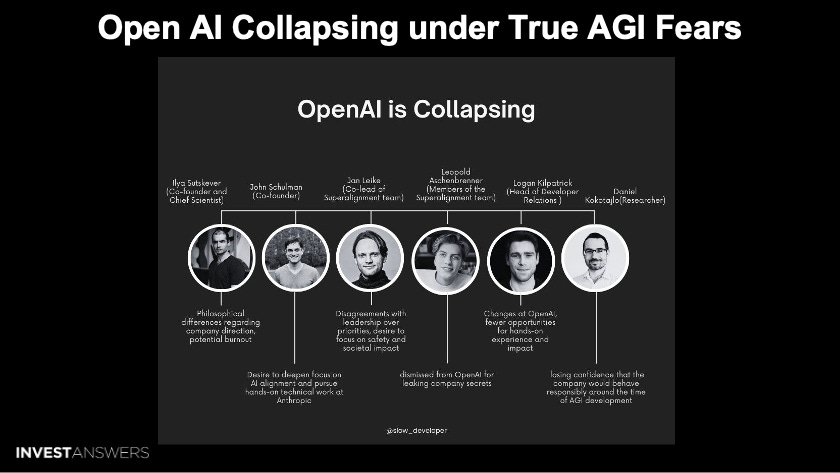

OpenAI is Collapsing

DePIN Wins

Tesla FSD Much Safer Than Humans?

Global Central Banks Cutting Fast

In this OCTA, we will explore what is happening with crypto and a bit of macro, covering some surprises and a few not-so-surprising developments.

We will also review some V-shaped recoveries for some assets but not all…

This meme from Sylvain discusses the perspective of the markets.

Despite what has happened, some people have called it a ‘Financial Armageddon’. However, everything is relative when it comes to the type of asset you are holding.

We have the same usual suspects here literally every single week.

It is very, very difficult to make money when you have assets that continue to dump tokens.

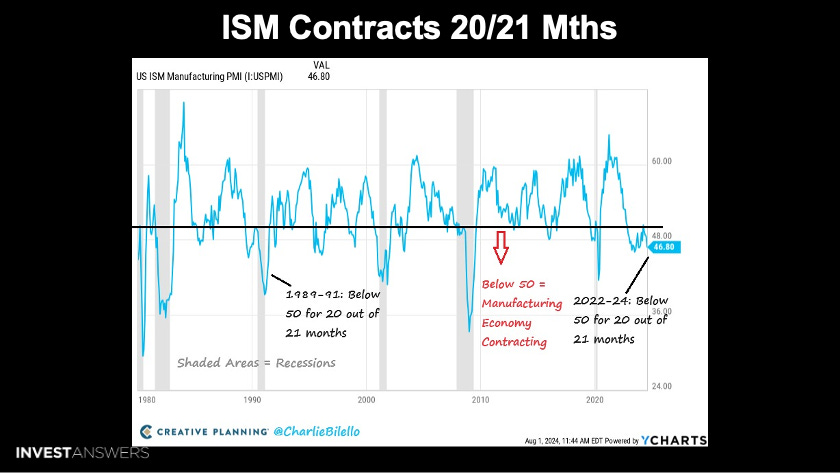

The ISM contracts measure manufacturing in the U.S. What is scary is that PMI has been below 50, i.e., contracting for 20 out of the last 21 months.

This chart displays data from the 1940s, which has only happened once (in 1989) leading to a recession in 1990-91.

This is scary, as basically everything is grinding to a halt.

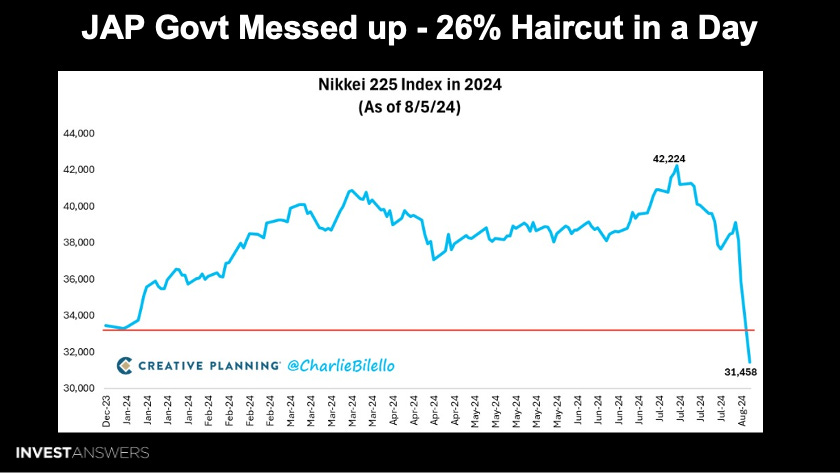

The Japanese government caused a lot of ruckus over the weekend when they increased interest rates from 0 to 0.25%, causing the stock market to fall 26% - in a single day! That was a historic move and the Japanese stock market is basically below levels not seen in years.

This illustrates just how fast risk happens…

As a sign of how recession-like, depression-like things are, 17% of 25 to 35-year-olds in the U.S. now live back with their parents.

This is the highest share since the period following the Great Depression in 1940.

See, we are talking about the 1940s twice in three slides!

The Fear & Greed is back up at 30, rebounding pretty fast.

Think of crypto and Bitcoin like a big beach ball.

You are trying to keep the ball under the water and it is very difficult!

LEO, TRON, SOL, and DOT are the only things that have beaten Bitcoin over the last seven days.

Pretty much everything else has been red.

Despite what we have gone through, we are flat, which is unbelievable.

Ethereum is down 5%, so they got hammered alongside Binance. However, Solana is up 5% and DOT is up.

Select assets have held together despite the storm we have been through over the last seven days in dollar terms.

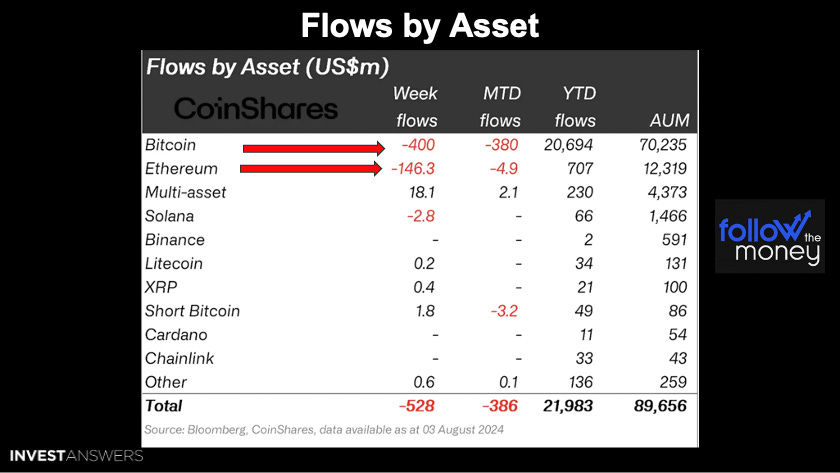

We experienced outflows for the first time in four weeks, totaling $530 million.

I theorize that some people knew the carry trade was unwinding, which was rumored to happen. However, I did not expect it to unwind so fast. There are also many fears of a recession in the US, geopolitical concerns, and other broader market liquidations across most asset classes.

Many ETFs felt something was up, so they removed some risk from the table, which is completely normal.

Ethereum is down $146 million - a big deal as it amounts to about 1/7th of the assets under management.

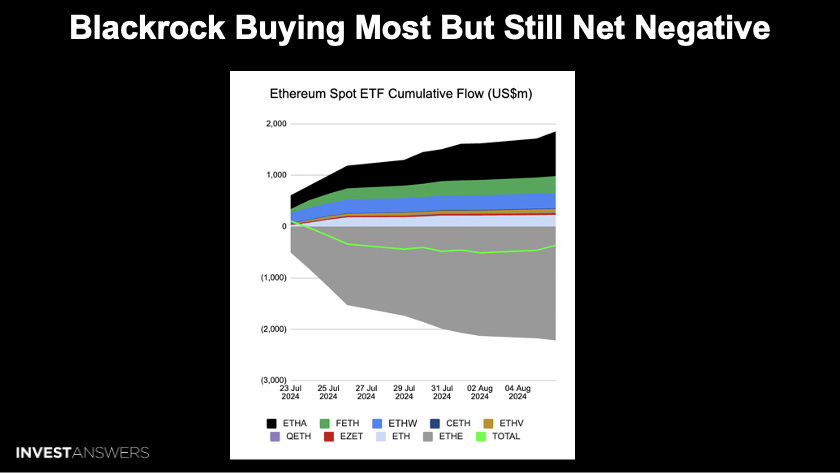

Remember that it is less than $400 million out of Bitcoin. The net outflows of the ETH ETF are nearly half a billion dollars, which does mask the positive inflows, primarily by BlackRock.

I rarely agree with Peter Schiff but this statement is interesting…

This is only true if all the Bitcoin ends up in ETFs. Schiff has changed his tune as he is looking to throw fear and FUD at Bitcoin in any way he can.

We should be alarmed if we reach 20% of Bitcoin in the ETFs. Up until then, there is no need to fret or worry.

The money coming in from these ETFs is floating all boats - a good thing!

I always discuss the challenges of Ethereum Layer 2s, value capture, and the whole ‘Band-Aid’ issue. It is just too complex. A new Ethereum Layer 2 appears every 19 days.

How can hundreds of these things survive?

It looks like what we expected to happen is happening quickly.

It will bleed out soon. They have lost almost 25% in a very short window - a week or so. At this rate, it should be gone soon.

Looking at the money flowing into the new ETH ETFs, we can observe that BlackRock is buying many of them. ETHA is up to about $1.8 billion, but the bleed-out from Grayscale is north of $2.2 billion.

Again, it is still a net negative, $600 million or so. The gray bleed will slow down like it did with Grayscale and I expect it to happen much faster.

Other stuff is happening with Ethereum, because I have many questions about it.

Many believe that Jump Crypto needed liquidity, wanted to stake somewhere else, or knew the carry trade was unwinding. Crypto-native institutions like Jump Trading were using Binance and inflows from retail investors were low, while the outflows from Jump were extreme.

There will be more ETH to be redeemed and more to be sold.

Perhaps we will encounter some more headwinds for Ethereum as we move forward…

Normally, when Microsoft buys something, things go

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.