Today’s Nuggets

Chills Down My Spine

WICKed Rekking

BlackRock’s End Game

ETFs Surpass Satoshi?

Florida’s Bitcoin Reserves

The Normies are Coming

Three World-Changers

One Chain to Rule Them All

SolStrategies Looking for Nasdaq Listing

The Off-Exchange Short Volume Ratio

Institutions Piling Tesla

Friday Fire is where everything packs a punch as we recap the recent action today.

Today, it is called ‘WICKed Games’, with a little shout-out to Chris Isaac, who used to have breakfast at the same restaurant in San Francisco in the 90s.

Enough of the trivia, let us get into the alpha.

The last seven days in crypto have been pretty bonkers.

Ethereum shot up above $4,000, up 6.69%;

Bitcoin had just shy of $102K;

Tron is in the dark green; and

Solana is light green alongside Cardano, XRP, and everything else.

People are asking why certain things are pumping and certain things are not. We will get into that.

This scared me and sent chills down my spine!

We are at $100,000 Bitcoin and the second biggest money runner on the planet after BlackRock, just pounded its fist on the table saying you need to be at least 10% Bitcoin.

That spooked me and made me ask if I have enough Bitcoin.

Schwab is a very large money manager with $9 trillion and BlackRock has $11 trillion.

The two of them are fully in on Bitcoin, which has a market cap of only $2 trillion. And they are telling all their customers to get some now. This is like the Bernstein story about a month ago, where they said to ‘forget everything else and just buy Bitcoin’.

Be very careful with leverage and stop losses in crypto as the market makers play wicked games.

Be very careful with leverage because people will hunt you down. This beautiful little chart from Coinglass shows how Bitcoin wick’d down $10,000 in less than an hour. For me, this has become normal but for the people who have leverage, they got wrecked.

The people who were new to the space got terrified.

They went down to the yellow and wiped it clean of the leveraged longs. They will go up to the top for the yellow bar at $103,000 BTC. This is what they are going to hunt next, probably over the weekend. When you see where the leverage is stacked, that is where they will go.

How much was lost? Well, $436 million in Bitcoin in essentially an hour. All longs.

$78 million in ETH. Nearly $40 million in XRP. $86 million in others. Do not expose yourself to a wick, but you can play it - we did this during the bear.

When these big dumps happen, you have your little limit order dangling like $90,100 or $91,000, and let it get filled. Then you win because it bounces back $10,000 in another hour or two.

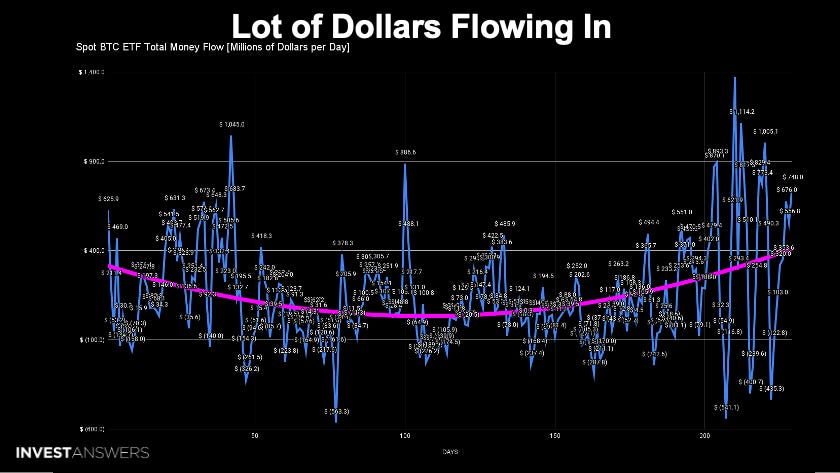

I have been tracking this daily for 230 days, which is hard to believe.

230 days of unplugging numbers into a spreadsheet and analyzing them. The key thing I want to point out here is that BlackRock stacked $2.5 billion in just one week.

The red is BlackRock on the chart. They are the ones grabbing all of it.

Day 20 to 50 was phase one of accumulation. Then, from day 140 to 150, we had a little bit of snacking. We have had heavy accumulation since day 200, which is in line with October and Moonvember. December is shaping up to be incredible so far.

I know it is against the ethos of one player to have a lot of Bitcoin but that is just how it works.

The game is about when you sit on money. Larry is following the money. When you have the money and sit on it, you make more.

Phase three of accumulation is demonstrated on the right-hand side.

It is monstrous.

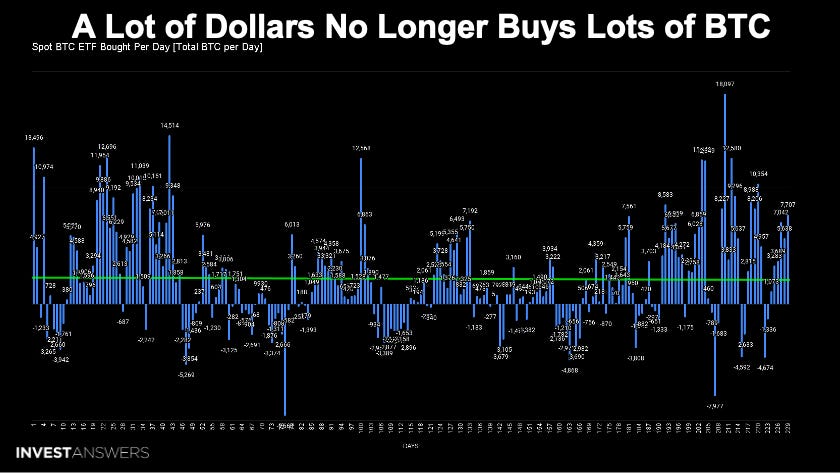

What is very interesting, though, is that there is a catch. That huge amount of ever-increasing money, is no longer buying as much Bitcoin because Bitcoin price is going through the roof.

Many dollars no longer buy a lot of Bitcoin like it did in the early days when you were spending a billion dollars.

At the beginning of the year, it was 3,000 BTC for a billion dollars and now it will only buy you 1,000 BTC. 7,707 Bitcoin were purchased yesterday, most of them by BlackRock. This is 17 times the daily issuance.

The day before, it was 7,042. Again, the money flows are insane. The reason we are above $100,000 is because of Saylor and Blackrock.

This is a shout-out to Chewie, who has tried convincing me to watch this movie for years. I have never done it because I cannot sit still for three hours.

Robert Breedlove stated that number go up (NGU) technology is fun but

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.