TODAY’S TAKE

64 years and 3 months later, the S&P500 divided by M2 Money Supply = Zero

Most U.S. tax revenue is generated from individuals, not corporations

83% of the U.S. government’s revenue is tied to payroll

The spending over receipts totaled US$459B for the first four months of 2023

Capital gains revenue will be non-existent due to the 2022 market performance

Social security will increase from more people collecting from it

Interest on the U.S.’s debt will double in 2023

The deficit is forecasted to double year-over-year from 2022

AI and structural job market changes will decrease the U.S. tax revenue base

The government will be required to enforce new taxes to reduce deficits

The “Great Reset” strategy is to weaponize the banking system

Bitcoin’s supply crunch is coming

The motivation for today’s story came from a sleepless night, as I am a little worried about a few things. This story is about governments, regulations, deficits, quantitative easing, taxes, and more.

My concern is, where will the money come from to fund the U.S. government?

While the data I cover today will be U.S.-centric, it applies to all other parts of the world. So use today’s content as an analog for you to do your own research if you are a part of our international community.

This channel is all about helping people find a way forward as much as I possibly can.

When you increase the money supply, you debase the purchasing power by the same amount. In other words, if the supply of money in an economy increases faster than the growth in the supply of goods and services, prices will rise, and each unit of currency will be worth less. This means that people will have to spend more money to purchase the same goods and services, which is a loss of purchasing power.

This report from the U.S. Office of Management and Budget got my attention yesterday. The federal government collected $5.0 trillion in revenue in the fiscal year 2022 or $15,098 per person. The federal government spent $6.5 trillion in FY 2022, or $19,434 per person, including funds distributed to states.

From a quick review of the revenue, it is clear that most tax revenue is generated from individuals and not corporations. On the expense side, the main concern is the interest on the debt will double in 2023.

If this were my personal profit & loss statement, I would be freaking out.

All U.S. revenue is tied to jobs, which is the issue.

What happens if the jobs go away?

Most of the line items on the expense side are growing. However, on the revenue side, it will shrink.

And the federal debt has not begun rolling over its short-term debt into the new higher Fed fund’s rate structure issued over the last 12 months.

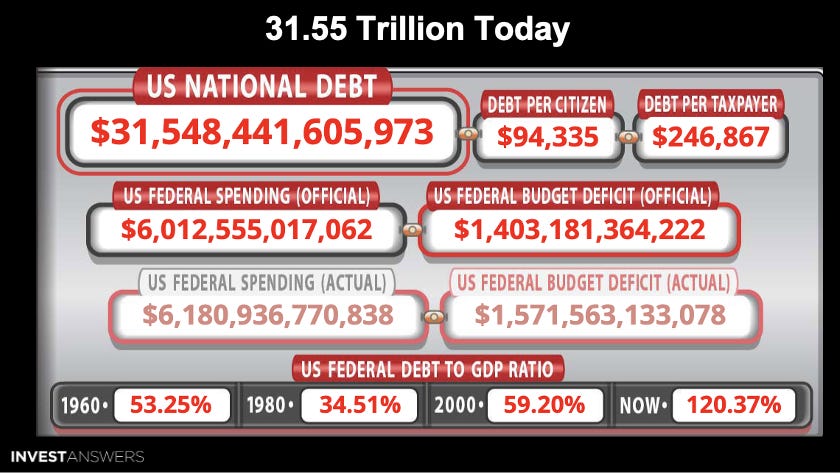

The U.S. debt limit level was blasted through this month.

The U.S. debt clock keeps accelerating while the revenue is stagnating or going down.

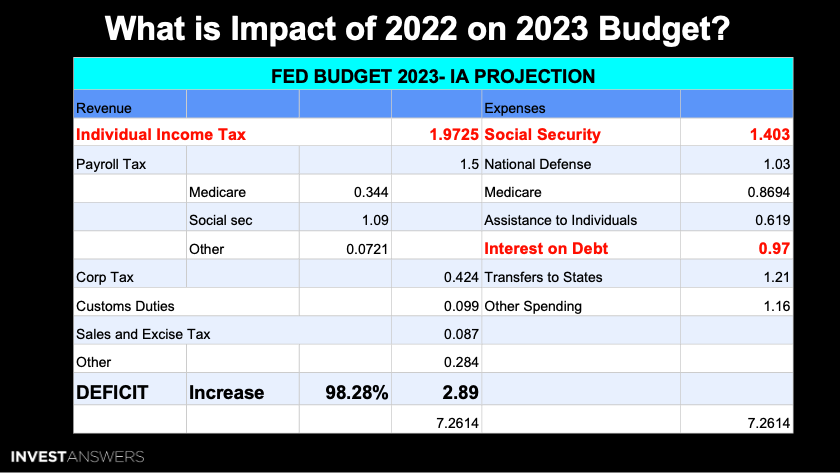

This is what I believe will happen to the U.S. budget deficit in 2023:

Individual income taxes will drop dramatically

Payroll taxes will decrease due to the layoffs

Social security is set to go up substantially

Medicare is rising as medical expenses rise

Interest on the debt will double

The InvestAnswers projection of the three major changes that will impact the fiscal situation for the U.S. government in 2023:

Capital gains will be smashed due to the stock and bond market having their worst year ever

Social Security increases from more people collecting from it, and

Interest on the debt will double

This results in the U.S. deficit almost doubling year-over-year from 2022.

The image on the left pictures a 6ft tall man standing next to ten stacks of cash that could be picked up by a forklift that total US$1B. The picture to the right is the man standing next to US$1T.

AI is already significantly impacting the job market.

All of this will drive the U.S. tax revenue base.

Where will the U.S. get its revenue if it can no longer tax the citizens more?

Democrats finally have a strategy to stop billionaires from fleeing high-tax states by blocking the escape routes. The reforms are not likely to pass immediately, but they illustrate the increasingly open socialist goals of progressives and their public-union backers.

The confiscatory tax alliance emerged late last week when lawmakers from eight states unveiled plans to target wealthy residents. California, New York, Illinois, Maryland, Hawaii, Minnesota, Connecticut, and Washington state are all represented, and several of the sponsors have already released bills.

“We are here today to put billionaires and multimillionaires on notice.”

The one overwhelming takeaway from the chart is that deficits are exploding.

The weaponization of the banking system is exactly what the great reset is all about. The mantra, “you will own nothing, and you will be happy.”

Bitcoin may not be exciting right now, but per my recent video with Bloomberg’s Jamie Coutts, the supply crunch is coming!