Today’s Nuggets

Saylor Snags Another 12,000 Bitcoin

MicroStrategy’s $6.6B Profit

German Government Selling?

$3B in Shorts at Risk

Bitcoin Transfer Volume Crashes

Bullion Booms, Bitcoin Booms More

Switzerland’s Central Bank Pressures Other CBs

Miner Supply Hits Historical Low

We had some good news, which we expected to happen because of the MicroStrategy ATM issuance - we will break this down.

In addition, we will assess why commodities like gold, silver, and Bitcoin are needed in a crisis. Review how miners sell hand over fist but are nearly out of BTC supply.

Crypto Market Update:

The global crypto market cap is $2.36 trillion, with a 24-hour volume of $67.25 billion.

The price of Bitcoin is hovering around $65,000, and the price action has been extremely stable.

The price of Ethereum is $3,500.

The Crypto Fear & Greed Index is currently Greed (60).

The Bitcoin monthly returns are down 3.8% for June, a nothing burger in the Bitcoin space.

Saylor is back!

The key news is that he bought at an average price of $65,883, which is not bad. MicroStrategy now holds about 226,331 Bitcoin.

Here is another view of MicroStrategy's BTC position. The company's average price per Bitcoin is now $36,800, which means they have made $6 billion.

We have a bunch of other companies doing a "Saylor look-a-like" treasury play.

Yes, it will be volatile over the short term, but not in fiat terms over any significant period. Bitcoin is going to go up because fiat is going down. Even if you have it as a hedge against your fiat, you will do just fine.

James Van Straten's chart shows that MicroStrategy's latest Bitcoin purchase boosts shareholder value, with MicroStrategy increasing its Bitcoin per share to 0.013163. Investors could have bought MicroStrategy for $160 a year and a half ago, which would have been a very cheap way to buy Bitcoin.

Saylor removes Bitcoin from the system because when he grabs 12,000 BTC, he is not buying them to sell them in six months or a year.

He is holding them forever because he says he will always be buying the top.

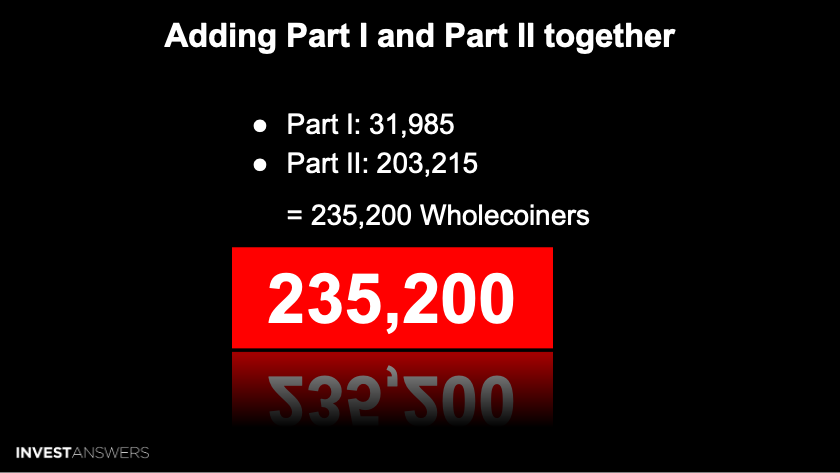

This chart from Glassnode displays the number of Bitcoin addresses with a balance greater than or equal to one whole Bitcoin.

The number of addresses is about 1.011 million. However, that is not the number of wholecoiners that exist as some people have eight wallets or more.

According to my calculations, back in the middle of 2023, the real number of whole coiners is about 235,200.

When I first did my wholecoiner research, I estimated no more than 350,000 would exist.

Now, it is even less and becoming rarer because of players like Saylor.

You need about 76 shares of MicroStrategy today to be a wholecoiner.

Javier Mileif, the head of Argentina, is saying that we have to move away from fiat currencies and move to things that matter, like energy storage. If you want to use Bitcoin in Argentina, there will be no problems.

Who wants to sell a hard commodity like oil for fiat that is just printed to infinity?

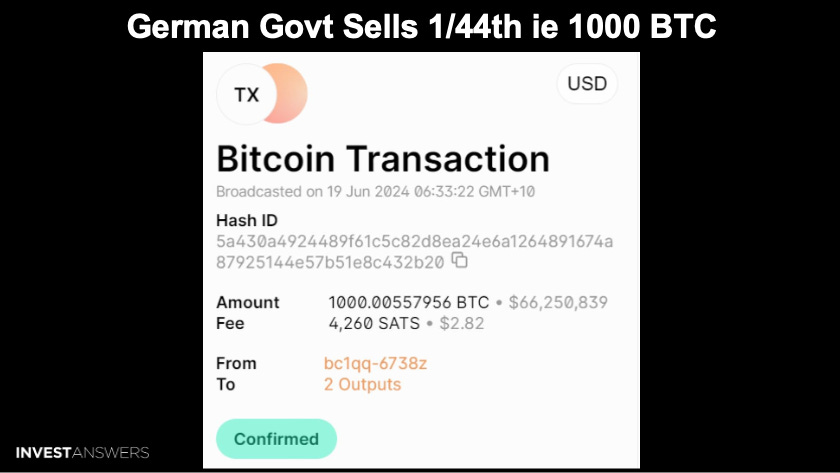

The German government appears to be selling Bitcoin right now - they have a bag of 43,000 Bitcoin that they confiscated. They just sold 1,000 BTC and sent 43,000 BTC to exchanges earlier yesterday.

This is peanuts to put things into perspective when one guy like Michael Saylor bought 12,000 BTC.

This is one player taking up one month's worth of supply.

Per MartyParty, there is $3 billion now in shorts that will liquidated if the Bitcoin price hits $70,000, and it will force a long ladder and catch another $4 billion shorts at $72,500. Such price action could theoretically trigger a squeeze to $80,000.

Remember, there is not much leverage longs left.

My speculation yesterday was the hedge funds are dumping their Bitcoin. They are unwinding their carry trade because the funding rates are going to zero.

This seems to be playing out…

According to @DaanCrypto, we are going back and forth regarding this carry trade and the funding rates. Crypto funding rates are as low as they were in the past three months. The rates are similar to what they were at the end of April when Bitcoin was trading near its range lows. Bitcoin dipped below $60K for a little while down to $59K. Right now, BTC is holding tough above the short-term holder price level.

According to history, Bitcoin rallied after the funding rates turned negative.

We do not know when it will rally, but we know it is scarce.

We know holding onto fiat is a mistake and commodities love a crisis.

The BTC illiquid supply is not for sale and has been going up since May, suggesting that investors are choosing to ‘HODL’. Nobody is going to be selling here at $65K.

This means that Bitcoin is getting harder.

The realized price for short-term holders is now at $64,230.

This represents the average acquisition price of Bitcoin for those who hold their coins for less than 155 days. As time goes on, it will continue to rise and that should be a support level for this bull market. Again, not many people will be selling here on the floor unless they are hedge funds unwinding their carry trades - my theory.

Some negative news…

We hit an all-time high back in April, about $13.5 billion a day. Now, it has gone down to the green level.

It is not dead, but it is way off.

People are not transferring a lot of value on Bitcoin, which does have an impact. Volume and overall Bitcoin activity tend to be quiet in the summer, so this is not unusual.

It is always darkest before dawn.

When people leave crypto and stocks at the bottom of the bear market, they break. That is always the worst time to leave the markets. Leaving in the middle of the bear is a big mistake because billions are made in the bear.

The Bullion Boom chart shows how worldwide central banks are stacking gold purchases in tonnes. Central banks buy 1,000 tonnes of gold a year, and the miners produce about 4,000 tonnes of gold a year. So, the central banks are buying a quarter of the supply. Michael Saylor bought all of the Bitcoin supply for the next month. The Bitcoin ETFs have purchased over a quarter of a million Bitcoin in just five months or one and a half times next year's supply in twenty weeks.

El Salvador and a few other small nation-states are beginning to allocate to Bitcoin. What happens when the first big central bank starts hedging with a 5% allocation into Bitcoin?

That will

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.