NUGGETS OF ALPHA

Ethereum generates 513.7% higher transaction fees than Bitcoin

The Lindy effect favors BTC over ETH

ETH & ETH L2’s aggregate daily active users are greater than BTC

If ETH were valued at a P/E of 100 it would exceed the current BTC market cap

BTC and ETH are both ~62% off of their all-time highs

ETH has become deflationary after completing “the merge”

ETH staking rewards are generating between 6.9-7.6% yield

ETH is a Turing-complete platform that can create smart contracts

ETH is designed to be scalable; BTC is limited in its scalability

ETH has its own Virtual Machine so developers can create dApps; BTC does not

ETH has a large community of developers; BTC’s development is not as active

Solona is currently at ~26M daily transactions, 25x more than ETH

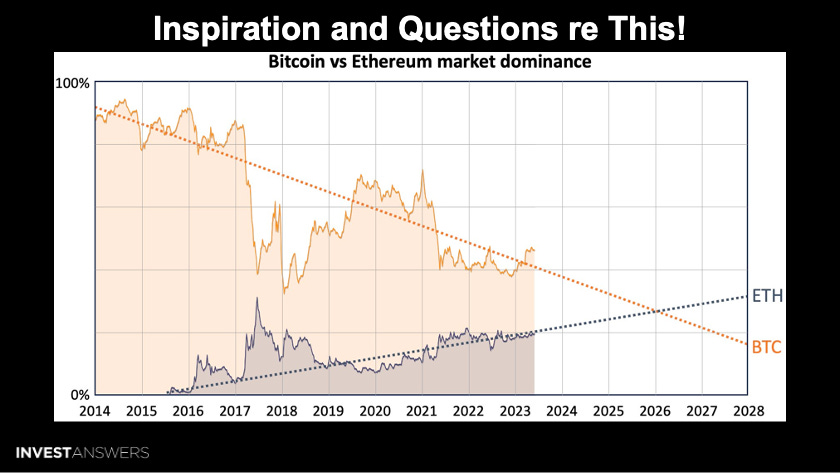

A Twitter user posted a chart that forecasts Bitcoin and Ethereum market dominance by late 2025. The chart shows that Ethereum's market capitalization could surpass Bitcoin's due to Ethereum's accelerated growth.

Since I entered my position in Ethereum in March 2020, ETH has done a 9x while BTC experienced a 3x in performance. Ethereum has been a faster horse, but will it continue to be in this next cycle?

Let’s dig in and look at the long-term trends to see where this could go.

This is a visual of the market cap of these two assets as of today.

Here is a chart comparing the BTC to ETH market cap which demonstrates where they have come from to help us project where they can go. In 2018, this pair shared a ratio of 9.2, and it has been coming down ever since. Presently at 2.32, with its lowest point reaching ~2.0.

Ethereum today generates 513.7% higher transaction fees than Bitcoin. From this perspective, ETH has already flipped Bitcoin.

Currently, the number of active addresses per week sits at 53% in favor of BTC.

BTC and ETH are matched in this category. However, there will be a day when ETH will start moving faster and tweeted a lot more.

The Lindy effect favors Bitcoin in this metric, the oldest and most well-known brand in the space.

The total BTC unique addresses are ~1.14B. However, I know individuals who have over 20 addresses that they manage.

The total ETH unique addresses are ~234M.

This graph displays

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.