NUGGETS OF ALPHA

The U.S. 30-year mortgage of 8.347% is the highest rate in a quarter of a century

Bitcoin is up 26.31% in October

The Fear & Greed index spiked up to 66

Bitcoin's recent parabolic move went through four layers in a single trading day

Digital asset investment products saw inflows for the fourth consecutive week

Miners have slowed down their BTC selling, indicating the price is going up

Tesla has a cost basis of $17,156 in BTC, resulting in a 97.36% ROI ($179M worth)

China's PPI is beginning to rise once again

Every ten years, there are 30 days that matter. October 23 was one of those days for Bitcoin.

Weekly Crypto Market Overview:

The global crypto market cap is $1.25 trillion, with a 24-hour volume of $101.14 billion. The volume is up 5x, so the action is back in crypto.

The price of Bitcoin is $33,870.95, and BTC market dominance is 53.1%.

The price of Ethereum is $1,782.40, and ETH market dominance is 17.2%.

Crypto Fear & Greed Index is currently Greed (66).

Last week, I shared many points as to why the Bitcoin ETF was inevitable. BlackRock is preceding its ETF, which means buying bags. They must complete it by the end of October, which means November could be bonkers.

Remember, do not jump in front of a freight train!

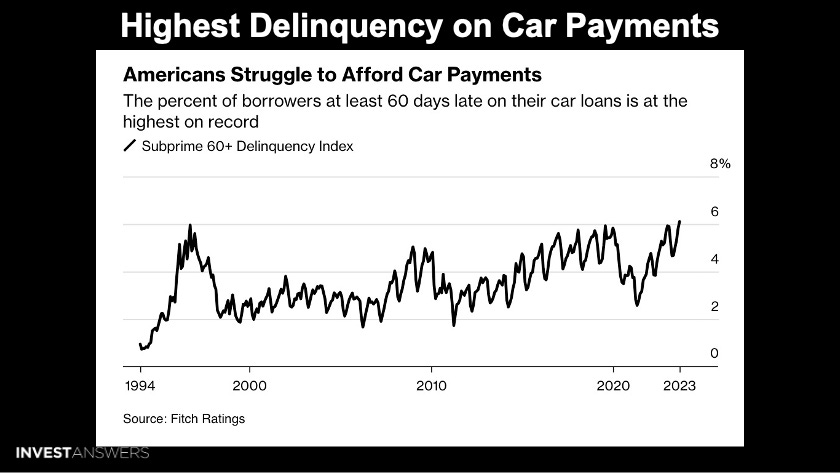

It was a nasty week in the markets, with red across the board, but also with few exceptions. Walmart was up and usually does well during times of recession. The pains and cracks from the high-interest rate regime are finally beginning to show.

Be careful if you own any of these tokens. All of these are money grabs, with the big ones this week being:

EUL

GAL

YGG

OP

DYDX

We share this stuff to help you avoid the pricing pressure that is known to be coming.

Here is another point of

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.