NUGGETS OF ALPHA

Global real estate is 340x the size of Crypto’s total market cap

Real estate is 4.12x the size of global GDP

Real estate is the #1 choice of investing for millionaires

Buy corner lots and a two story single family homes as they appreciate best

Real estate prices are falling worldwide due to interest rates rising - but there are some exceptions

Dubai is the #1 place where Super Prime Homes are being sold

Currently, it costs nearly $1,000/month more to buy a house than to rent in the US

The mortgage payment to buy the median-priced US home moved up to $2,566

It costs more to buy instead of rent in 80% of metro areas in the United States

The average house in the UK costs around nine times the average earnings

Germany’s economy is tanking and this will impact real estate

In Australia, one must save for over a decade before getting on the property ladder

Canadian households have over 110% of household debt compared to GDP

Canadian banks bracing for large levels of defaults

54% of all skyscrapers worldwide are in China

Data for May shows China’s property sector is still struggling

Real estate outperforms Gold consistently over time

So why do we care about global real estate?

This channel is about financial freedom and real estate is one of our stool's three legs for achieving this mission.

This graphic shows how small crypto is and how important real estate is today.

Real estate has a global value of over $350T. GDP currently is $85T, so real estate is 4.12x the size of global GDP.

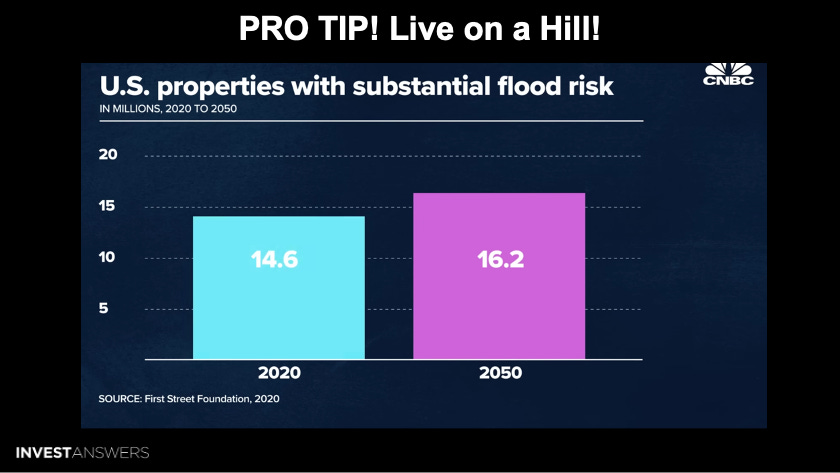

Living on a rock on top of a hill is the first rule for buying a residence. If possible, combine this with buying corner lots, if possible.

Ensure you are not buying into a flood plane, as it is very difficult to insure the property or even find a mortgage.

Real estate prices are falling due to interest rate hikes, which have only happened five times since 1970. Over 80% of countries raised rates in 2021-22, causing global short-term rates to rise almost four percentage points. This is the highest rate hike since the early 1990s. So things are high and coming down quickly.

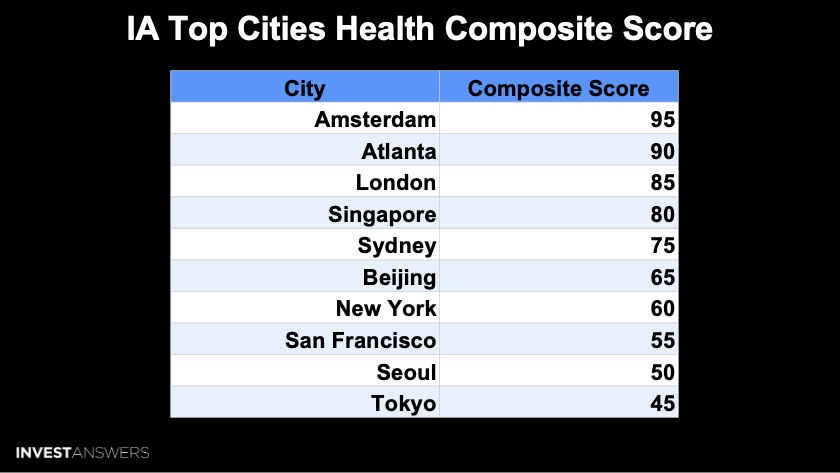

I created a composite score from the data in this chart.

This is a helpful composite score for cities around the world. It is also great for identifying bargains eg SF or Tokyo!

Dubai is the #1 place where most Super Prime homes are being sold. Super Prime are homes with a price of over $10M each. Notice the top two cities are bullish crypto cities.

10 of the cities in the Case-Shiller 20-city index reported price declines over the last

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.