RECAP: WHAT HAPPENED THIS WEEK

BTC support, ETH ATL, Tether Thriving, Miners Stacking, Offices Empty

NUGGETS OF ALPHA

5.84% is the lowest BTC supply on exchanges since December 2017

Short-term holders realized price has historically been a strong BTC support level

The % of ETH on exchanges is at its lowest since public trading began trading publicly in 2015

The stablecoin rate of outflows has been slowing, revealing confidence returning to digital assets

Tether improved its net profits by $1.48B and circulating supply by 20% this quarter

The Bitcoin Season index remains at ~4, which is also an all-time low reading

The Solana network recently hit 945K daily active addresses in an exponential move

Bitcoin holdings by public miners have stabilized and are increasing again

CleanSpark is clearly the best-performing BTC miner over last 30 days and holding its 10-day EMA

BTC miners’ performance beat Bitcoin by ~35% this last month

SPX Q1 earnings were far better than expected

CBDCs are moving into the political forefront, with them recently being banned in Florida

One-fifth of all office space is not being rented in the US

Small banks hold 70% of the loans for commercial real estate - next shoe to drop

US inflation is still high, but core services have finally begun to come down

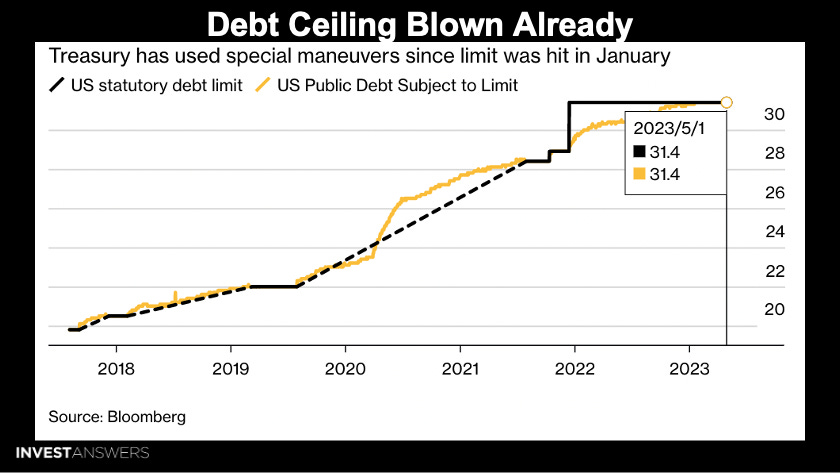

US Treasury has been utilizing special maneuvers since the debt limit was hit in January

Per Santiment, BTC supply on exchanges hits 5.84% - a 5 year low.

In December 2017, Bitcoin had a wild ride and hit an all-time high of ~$19K, and then it crashed to under $11K within 10-12 days right before New Year’s Eve. The lesson from this experience is that great volatility also comes with great alpha opportunity!

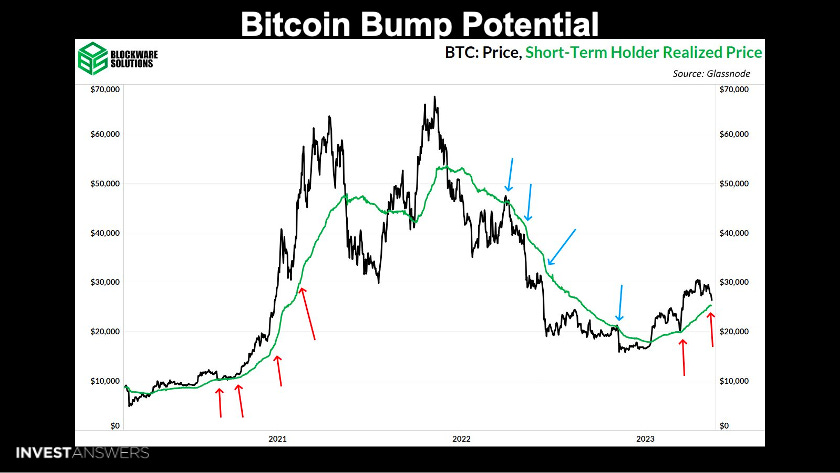

The key takeaway from this chart is that short-term holders realized price has historically been at a strong support level during the recovery or bull market stage. This level has already held support once this year with a price of just under $27,000. Given that the short-term holder realized the price is just over $25,000, price action appears to be headed for another test. If the support holds, we could be looking for a strong bounce-up.

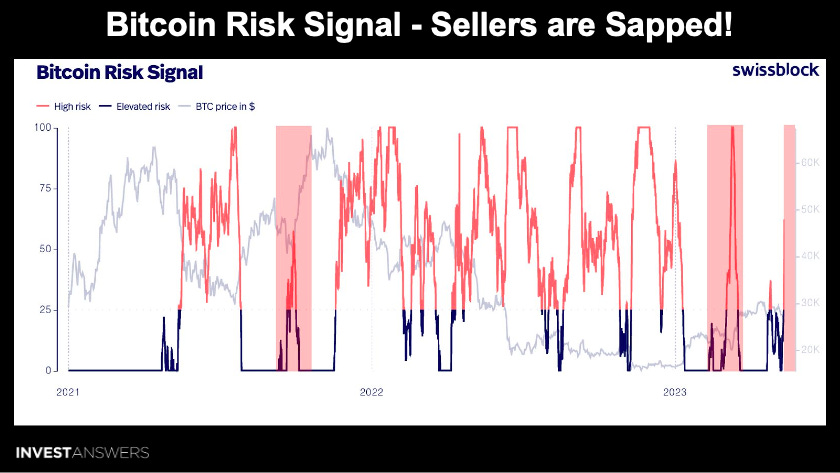

Swissblock’s Bitcoin Risk Signal indicator is displaying that shorts have gained control of the market with Bitcoin below $27K. However, sellers’ exhaustion could be taking over now. The Bitcoin Risk Signal has risen since Tuesday, reaching the high-risk area. It can be observed that this rapid increase also happened in March, coinciding with Bitcoin's drop and rapid recovery.

Ethereum has dipped to $1,780 today, and exchange supply continues to decrease. The percentage of ETH on exchanges is at its lowest (10.1%) since public trading began trading publicly in 2015. This is essentially the all-time high for non-exchange holdings as everybody avoids keeping assets on exchanges.

All of the action on the central exchanges is taking place with the whales as retail continues to purchase and move to self-custody. This is a noteworthy change in buying behavior, which dictates that this cycle is developing differently.

The stablecoin supply has been experiencing severe outflows since the collapse of TerraUSD. In May 2022, the total stablecoin supply fell by $8.6B, the largest monthly outflow on record. However, the rate of outflows has been slowing in recent weeks, suggesting that investor confidence in the digital asset space is starting to recover.

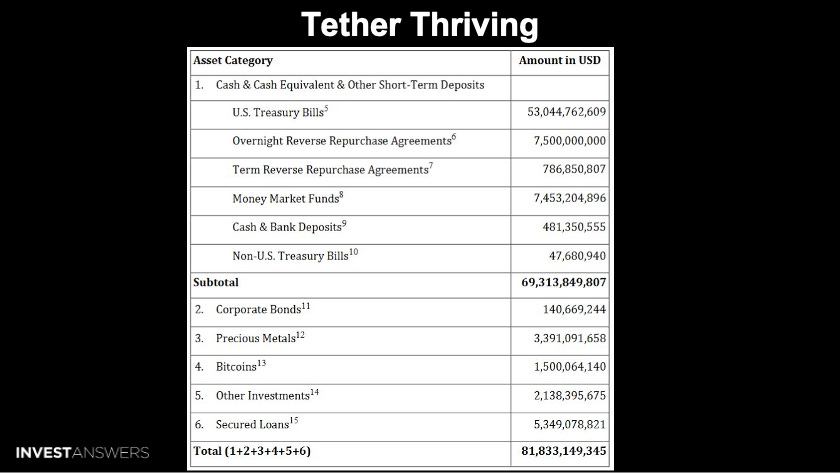

Do not wait for Tether to blow up as it continues to thrive. Tether released its Q1 2023 attestation report, which showed that the company has $81.8B in assets, exceeding its liabilities by $2.44B. Tether is “printing money” in the current environment with 5% treasury bills. Tether had an "excellent quarter," improving its net profits by $1.48B and increasing USDT's circulating supply by 20%.

Tether also reported that 85% of its reserves are invested in US Treasury Bills, cash, and other short-term deposits. The company also holds 4% of its reserves in gold and 2% in Bitcoin. Tether claims to be reducing its reliance on bank deposits and is instead using the repo market as a source of liquidity.

Bitcoin continues to strengthen against the altcoins. The Bitcoin Season index remains at ~4, which is also an all-time low reading. Eventually, this trend must break and move in the other direction.

Per our IA Dashboard (API data from Artemis), you can see a huge spike in the daily active addresses activity on the Solana network, hitting 945K. This is truly an exponential move we are witnessing, with a level of activity that is now tripling Ethereum. By combining Ethereum and Polygon, the daily active addresses equals ~660K.

My investment strategy aims to find alpha in the market by benchmarking assets against their peer groups. The 26,102,713 in the top right all alone is representative of Solana’s daily transactions by daily users.

Cardano and Ethereum are matched on this ratio at around ~$260K. Sui and Stacks also match at ~$195K. Solana is the cheapest by a wide margin at only $442 per transaction.

Sui is presently valued at ~$2.35M per daily active user. STX, APT, and ETH are high as well. This is a moving target as the users can migrate very quickly.

Bitcoin holdings by public miners have stabilized and are slightly increasing again. When miners begin stacking, there is less selling pressure on BTC. This is a reversal of the trend of public miners selling off their Bitcoin holdings over the past year.

The price rally, hash price rise, and transaction fee increase have all contributed to this change. These factors have put less sell pressure on miners, allowing them to hold more of the Bitcoin they produce.

After holding its 10-day exponential moving average, CleanSpark has emerged as a top contender, showcasing impressive relative strength when compared to BITF and other industry leaders. It's not that BITF is lacking in any way, but the market seems to favor CLSK's potential. And that's not all - IREN, MARA, and BTBT are also demonstrating considerable strength against their peers in the industry. Keep an eye on these players! 💪

The beauty of analyzing the miners is that Wall Street and top financial analysts do not look at them, so you can create an edge for yourself in this market. So there is lots of good fun to be had in this space.🚀

With 89% of companies reported for Q1, the S&P 500 GAAP earnings have come in much better than expected, flipping the year-over-year growth rate back into positive territory (+8% YoY) for the first time since Q1 2022.

Central Backed Digital Currencies are hitting the political forefront. I hope all around the world that this issue becomes a front-of-mind factor for voters. People should be allowed to do what they want with their money. It is called Freedom!!!

Tesla was the subject of media coverage due to a “massive recall” in China, but this was not an actual recall. Instead, the issue was that some Tesla vehicles in China did not have the ability to choose the regenerative braking strategy. Tesla will be fixing this issue with an over-the-air update.

When mainstream media does this type of stuff, they lose their audience. This is why such news outlets are shrinking.

Why do banks’ tightening trigger recessions?

Slower economic growth: When businesses and individuals have a harder time getting loans, it can slow down the economy.

Increased unemployment: When businesses slow down hiring, it can lead to increased unemployment.

Reduced consumer spending: When individuals have a harder time getting loans, it can reduce consumer spending.

One-fifth of all office space is not being rented, and small banks hold 70% of the loans for commercial real estate. When cash flow from empty properties dries up, loans will be defaulted on, which could wipe out many small banks.

The COVID-19 pandemic has accelerated the trend of empty real estate. Many businesses have closed or downsized their operations, and as a result, they are no longer leasing office space. Small banks are particularly vulnerable to the problem of empty real estate. This is because they have a higher concentration of commercial real estate loans than larger banks.

It is quite likely we will see another financial crisis if a large number of commercial real estate loans default. This could lead to a financial crisis for small banks.

The US Inflation has shifted from goods to services in the past year. The shift is likely due to easing COVID-19 restrictions, the war in Ukraine, and the Fed's interest rate hikes. Inflation is still high, but core services have finally begun to come down.

The US is already above the debt ceiling with the federal debt limit of nearly $31.4T, at which point it could lose the ability to meet all payment obligations. Yellen says that moment — the X-date, as it’s known — could arrive by June 1. Since mid-January, her department has been using “extraordinary measures” such as withholding regularly scheduled contributions to federal employee retirement funds.

This is all a joke and just political maneuvering. Why we can not have the people in power not act like children is beyond me.

The green section represents expenditures on military arms in support of Ukraine. The vast majority of the weapons contributing to the war come from the United States.