NUGGETS OF ALPHA

CME Bitcoin futures trading has surged

Since September 2022, Bitcoin’s dominance rose from 39 to 52%

U.S. Presidential candidate RFK Jr. holds up to $250K in BTC

Proto-Danksharding is a promising Layer 2 scaling solution to make the Ethereum network more scalable, efficient, and secure

Arweave processed an ATH of ~95M transactions in June 2023

If Bitcoin’s price is not at $55K by April 2024, half of the miners could be in financial jeopardy

Tesla is crushing its competition in Norway

Motor gasoline consumption in Norway is down 40%

Market performance determines the quality of your retirement

This chart from K33 Research shows that Bitcoin institutional investment is on the rise. CME Bitcoin futures trading has surged, and ETP flows have reached their highest level ever. The inflows were driven by BlackRock announcing on June 15 that it would launch a Bitcoin ETF. Canadian ETFs saw the most significant inflows, with 6,674 BTC added in June. European, Brazilian, and Australian ETFs also saw inflows, while futures-based U.S. ETFs saw an 8% increase in net inflows.

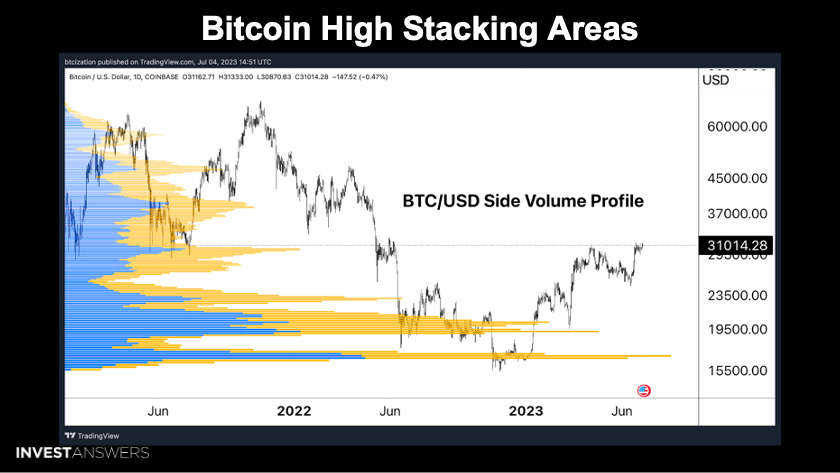

Here is a sideways volume chart from the Bitcoin Pro magazine that displays where the major buying spots happen. These price points are important to know because

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.