RECAP: WHAT HAPPENED THIS WEEK

BTC Price Stagnant As Whales Continue To Stack, Crypto Weekly Recap

NUGGETS OF ALPHA

Whales are bullish on Bitcoin and believe the price will continue to rise

Miners are fully deploying their rigs to produce more Bitcoin, indicating price is going up

SOL and APT experienced the best price-performance this week

SOL continues to lead with the number of new developer commits

ATOM, ADA, and SOL experienced significant transaction growth this week

Trezor sales soar 900% amid Ledger’s seed recovery controversy

Trezor stated a remote seed phrase extraction is impossible on its hardware wallets

Bloomberg thinks Tesla could receive $41 billion in credits by the end of 2032

In China, real estate-related activities account for nearly 30% of GDP

The risk-free rate, the rate of return on a Treasury bill, has reached a 22-year high

FRED is now reporting $928B in federal interest expenses

US interest payments are about to exceed the national defense budget

In 2008, the banks were too big to fail; in 2023, the stats are too fake to tell

Per our IA Bitcoin Top & Bottom Model, we are at the third layer of this cycle with a big journey upward to go.

Per Swissblock’s state of the system model, we have entered back into bullish territory on week 22. I am not sure how they calculate this, but I found it interesting to look at.

There is an interesting divergence in the Bitcoin Accumulation Trend Score, as the largest whales (those with over 10,000 BTC) continue accumulating while all other major cohorts are experiencing heavy distribution aggressively. This suggests that the whales are bullish on Bitcoin and believe the price will continue to rise. They are therefore accumulating Bitcoin in anticipation of future gains.

On the other hand, the different cohorts are likely selling Bitcoin for various reasons. Some may be taking profits, while others may be selling to fund other investments. It is also possible that some of these cohorts are simply moving Bitcoin between wallets. The divergence in the Accumulation Trend Score is worth watching, as it could provide clues about the future direction of the Bitcoin price.

Then when retail wakes up and starts to buy, the whales dump on them. So you want to follow what the blue is doing right now. Typically, the higher up the food chain, the better the cohort's investment decisions over time.

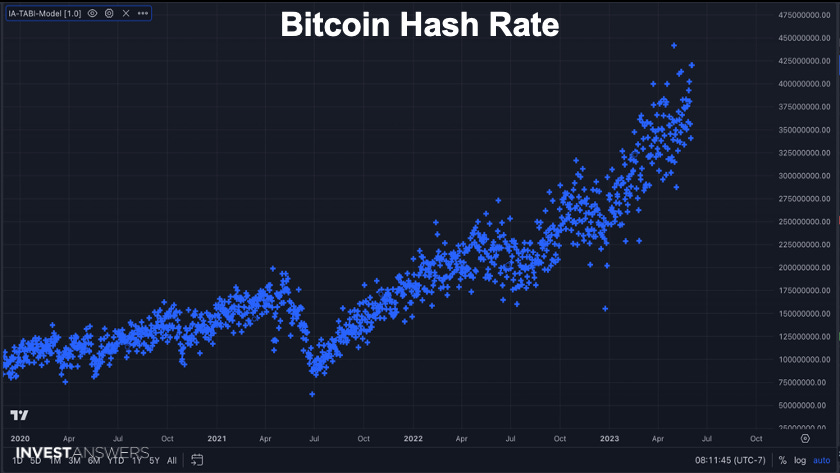

While the trend has slipped from the all-time highs, it is still up and to the right. This means that miners are fully deploying their rigs to produce more Bitcoin because they know where the price is going.

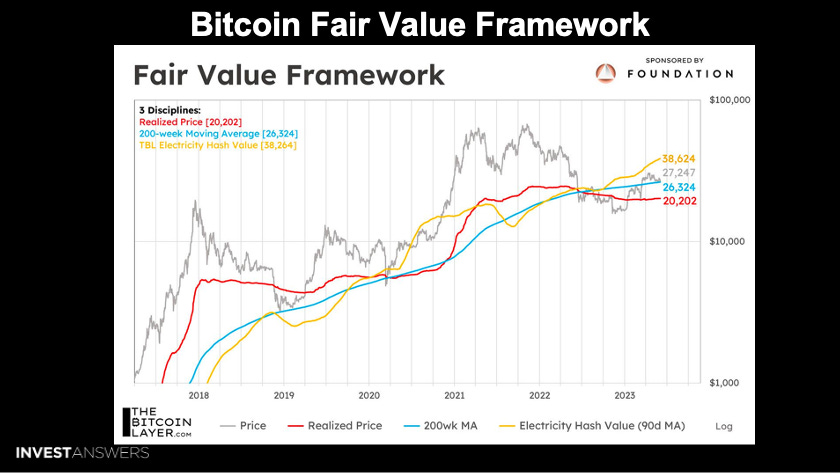

Bitcoin electricity hash value is the energy miners consume to solve the complex mathematical problems required to add new blocks to the blockchain. The hash rate is measured in terahashes per second (TH/s). Bitcoin is more than just an asset that is traded using algorithms.

The Bitcoin network is growing increasingly competitive even though the price has been relatively flat since March. The average cost of producing one Bitcoin has increased by $10,000 since the beginning of the year. This is because miners compete to mine Bitcoin as efficiently as possible. As the hash rate rises, the Bitcoin protocol systematically adjusts the mining difficulty upwards, which prunes inefficient miners. The current dynamic is one in which miners are not yet capitulating. Instead, the hash rate is increasing daily, indicating that the network is becoming more secure and competitive.

MVRV Z Score 7 DMA is a technical indicator that measures the deviation of Bitcoin's market value to its realized value over a 7-day moving average. A high MVRV Z Score indicates that Bitcoin is overvalued, while a low MVRV Z Score suggests that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.