NUGGETS OF ALPHA

FOMC paused rate hikes in June but signaled two more rate hikes in 2023

Ordinals 2.0 with recursive inscriptions is coming to the BTC blockchain

Bitcoin will likely surpass Silver's market cap of ~$1T

BlackRock BTC ETF application is confirmed to be a spot ETF

USDT FUD signals buying opportunities

Circle's USDC is the most liquid stablecoin on centralized exchanges

The SEC and Binance agree to move all U.S. customer funds onto U.S. soil

Despite the SEC lawsuits, May was an incredible month for crypto growth

Musk stated that Tesla’s market cap is tied to solving autonomous driving

Musk believes full self-driving capabilities could go live by the end of 2023

The U.S. Fed does not appear to be monitoring what is happening in the credit market

The U.S. added another trillion dollars worth of debt over the last 255 days

This week we heard from Jay Powell that the FOMC would pause rate hikes in June but will probably raise rates two more times in 2023. The market did not receive his remarks well and immediately sold off. Then the news confirming that Blackrock is filing for a spot BTC ETF was released, and the price of Bitcoin rebounded.

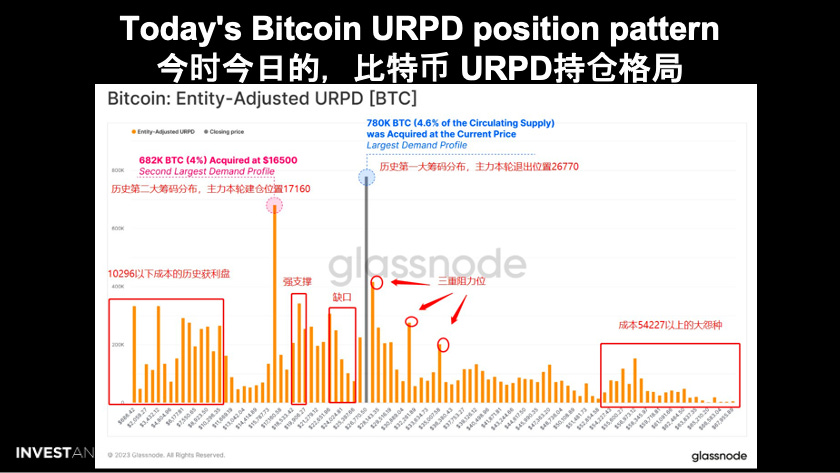

Two key takeaways from this chart:

The Chinese are coming, and they are investing in Bitcoin

780K of Bitcoin was acquired around the current price just above $26K, referred to as the "largest demand profile" - this is the new critical level

Staying above the $26K price level is important moving forward.

This chart shows how the Bitcoin miner transaction fees spiked in May '23, which should positively impact miners' earnings this quarter and for 2023.

The ordinals created this "flash in the pan" spike. But could it return?

Ordinals 2.0 introduces recursive inscriptions, which allow inscriptions to reference one another. This brings high-res images utilizing recursive inscription that expands the possibility of what can be inscribed, streamlines the process, and reduces the associated costs. This development will help create higher-quality NFTs and more complex applications.

This period will go by quickly. April 15th is our best estimate for the next halving.

From the rational root, this graph depicts how Bitcoin has grown in each cycle against Silver, Gold, and Real Estate. In this cycle, Bitcoin will likely

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.