NUGGETS OF ALPHA

The Bitcoin dominance is holding, but it is down from the highs of this cycle

The halving has never occurred without BTC reaching the 78.6% Fibonacci retracement level

Dencun has several features that will help reduce transaction fees on Ethereum

Eclipse's use of SOL’s virtual machine (SVM) to launch an ETH L2 is significant

SOL is up 20.56% against BTC YTD, hovering just under the 200 and 50-DMA

SOL is up 46.63% against ETH YTD, and the trend is up

NEAR CEO resigned this week, the General Counsel is assuming her office

Tesla received approval to clear areas in stages for the Gigafactory Mexico

The Fear & Greed Index for stocks has moved down to the Fear territory at 36

The U.S. Treasuries have experienced a significant value loss, around $1.398T

The average American worker in the U.S. spends over $2,000 per year on credit card interest

UAW is only accelerating the demise of the big three U.S. ICE manufacturers

Bybit stated it will suspend services to residents of the U.K. starting in October

Weekly Market Overview:

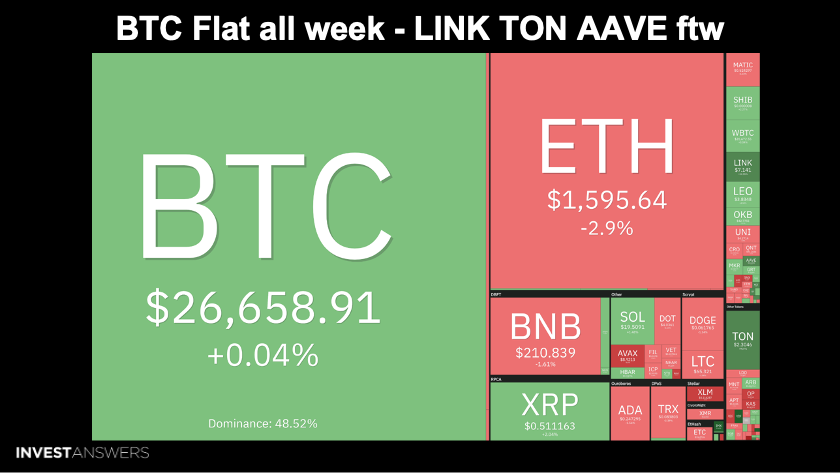

The global crypto market cap is $1.05 trillion, with a 24-hour volume of $17.69 billion, which is low

The price of Bitcoin is $26,570.20 and BTC market dominance is 49.2%

The price of Ethereum is $1,590.11 and ETH market dominance is 18.2%

The best-performing sector is eCommerce, which gained 35%

The Crypto Fear & Greed Index is currently Neutral at 47

While traditional markets were crashing this week, Bitcoin was flat. LINK, TON, and AAVE experienced a deep green week.

Will Bitcoin hit $20,000 or $30,000 first?

Barring any unforeseen black swan, I would say $30,000. For this chart, I have overlaid Mean Reversion Model onto BTC's price, and as you can see, we are at the bottom end of the mean reversion. This means the most probable path is up from here, as we are way over-sold for the year. Mean reversion in this area is correct 80% of the time. In addition, 200 DMA is $28K, 50 DMA is $27K, and a huge support level is at $20K.

The Bitcoin dominance is holding, but it is down from

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.