NUGGETS OF ALPHA

Per my calculation the lost BTC supply is ~20%

Hong Kong will allow BTC and ETH retail trading on licensed digital asset platforms June 1

The Lido APR of 4.8% supplies a strong yield with the ability to capture the future ETH appreciation

While MATIC is not experiencing new users, the existing users are very dedicated

The top 1.4% of the S&P captured 44% of the YTD returns

A stock price with an RSI above 80 is considered overbought

NVIDIA is now expected to grow at 35%+ for years to generate reasonable returns

Artificial Intelligence is delivering real empowerment and results now

The first AI robot officially entered the workforce as a security guard in manufacturing sites

Using AI, Swiss Scientists helped a paralyzed man regain control of his lower body

All macro indicators point towards a global financial crisis

Interest rate futures are now pricing in another 25 basis points rate hike in June

The trend for oil continues to be down; oil benchmarked against other commodities is cheap

NatWest Bank imposed a daily withdrawal limit of £250 per day

This is the implied volatility index that indicates Bitcoin and Ethereum have flat-lined. Remember, there is always the calm before the storm, which I believe we are absorbing right now in BTC/ETH.

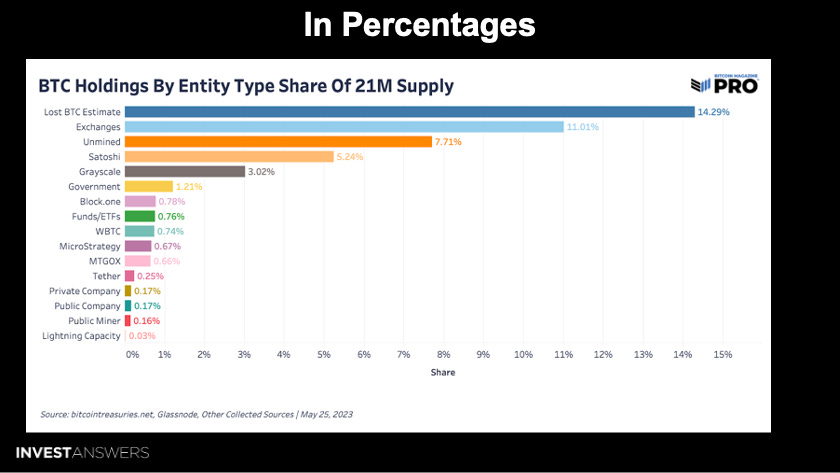

Bitcoin Pro only projects that ~3M of the supply is lost. This chart displays who has the largest BTC holdings:

~1.6M BTC unmined left until the year 2140

~2.3M BTC on the exchanges

~164K are held at Block.one

Tether’s bag is growing

Here is my recent video on this subject:

I calculate that the lost BTC is more like 20%.

The Chinese stock market is sending a strong signal that investors have significantly reduced their expectations of an economic rebound, with the CSI 300 Index this week reaching its lowest level this year. In addition, this week we got confirmation that Hong Kong will allow BTC and ETH retail trading on licensed digital asset platforms as of June 1. This is a big deal. The Hong Kong market is not that large but it’s a gateway between China and the Western markets. The rules have been drafted with tacit Chinese approval, and the Chinese market is massive.

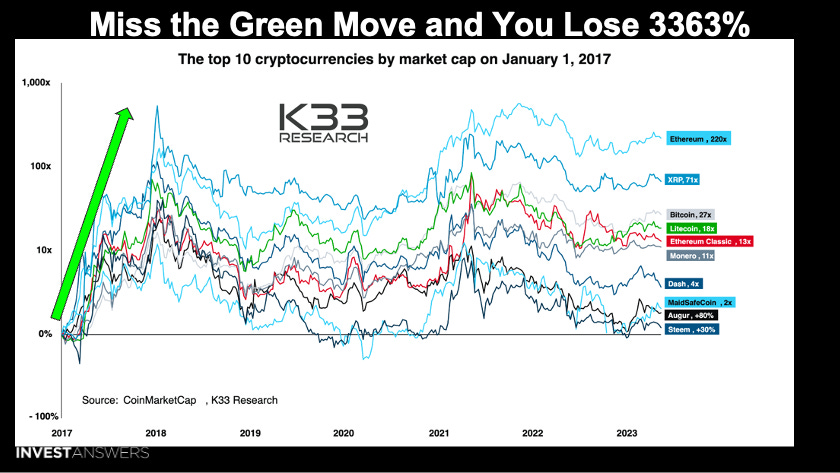

Remember, get in early; get in hard. Ethereum's 220x return is staggering compared to Bitcoin's 27x. This is why we allocate some of our portfolio to altcoins, as the top projects have the potential to outperform Bitcoin.

You must be positioned early in the investment narrative.

All of the moves happened in 2017. If you were not in early, you missed the entirety of the last movement with the top 10 cryptos.

In 2013, Americans believed $58,000 was enough to support a family of four. Today, they think you need to make at least $85,000. In 2013, it took 77 Bitcoin to equal $58,000. Today, it takes ~3 Bitcoin to equal $85,000.

As staking interest in ETH is surging…

More than 4.4 million coins have been locked since the Shapella upgrade. This trend, driven by Ethereum's deflationary forces, is expected to

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.