NUGGETS OF ALPHA

After all the good developments, Bitcoin is still down 1.2 percent in 2024

Venture Smart in Hong Kong wants to launch a spot BTC ETF within this quarter

The Office of the President of South Korea is advocating for a local spot BTC ETF

Bitcoin ETF options are coming in about 27 days

Ethereum hit $10 billion in revenue faster than any other major software company besides Google

BTC and SOL reached 75% of NFT deployments at the end of 2023

Paxos is moving its stablecoins to the Solana blockchain

NVDA reached Layer 10 of the LILO model recently as it crossed over $800/share

Time deposits hold $9T, and money market funds are at $6.2T with “cash on the sidelines,” setting a new record high

Per the NY Fed consumer survey, the U.S. inflation rate is now below 3.0%

Crypto Market Weekly Summary:

The global crypto market is down to $1.63 trillion, with a 24-hour volume of about $45 billion.

The Fear & Greed index fell to 52 after being in the 60s-70s range for the longest time.

Bitcoin price is at $41,700.

Ethereum price is at $2,465.

Other developments this week around the world:

Gold is up to $2,032

S&P 500 hits an all-time high, driven by big-tech

Meta closes at an all-time high, up 175% in 1 year

Nividia hit a new all-time high

Microsoft employees hacked by Russian group

Sports Illustrated is set to shut down

Altman aims to raise billions for chip factories

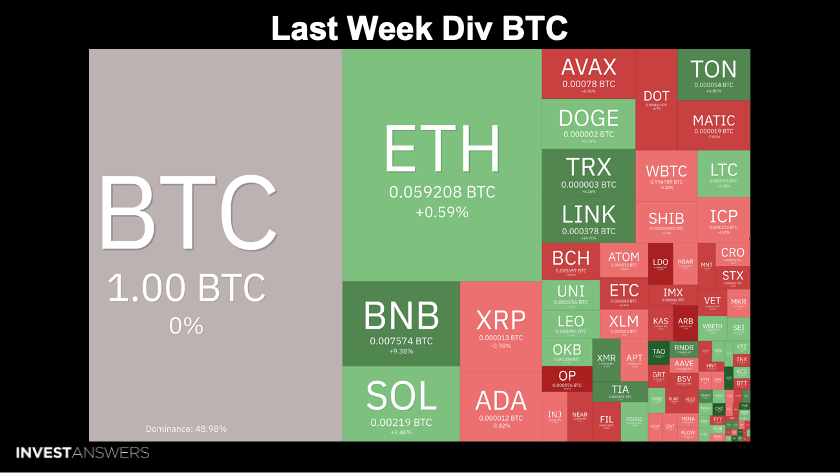

There was lots of red in the crypto market this week. However, the following tokens were in the green: BNB, TRON, LINK, SOL, and ETH.

BTC -2.98%

ETH -2.44%

SOL +0.3%

LINK +11.94% (best performer of the week)

After all the good developments, Bitcoin is still down 1.2 percent in 2024. This is not exciting, but it is also not tragic! The negative sentiment is as high as it was during the depths of the last bear market.

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.