Today’s Nuggets

Top 75 Crypto Movers and Losers of the Week/Month

L1 L2 Delta’s This Week: SOL, ARB, AVAX Highlights

Happy Birthday, Solana: Celebrations, Reflections, and Liquidations

Jupiter Breaks 1.7BN Market Cap Flipping Polygon

Why You Buy When Circle Prints Money

Stock Market Winners and Losers of the Week

Tesla FSD 12.3 Review and Analysis

A Milestone for Space Exploration with SpaceX

The Growing U.S. Debt Analysis and Implications

Inflation is a Wealth Destroyer

Last week, the two big standouts were Solana and Avalanche, which were up nearly 25% compared to Bitcoin. Of course, Ethereum tanked after the news of the Denkun upgrade, which did not solve world hunger.

It was a big week for Solana and Avalanche.

The social sentiment would have you believe that Bitcoin got flushed down the toilet last week, but it was only down 1% week over week. It is basically where it was a week ago. However, people are freaking out as this is how the short-term human mind works sometimes.

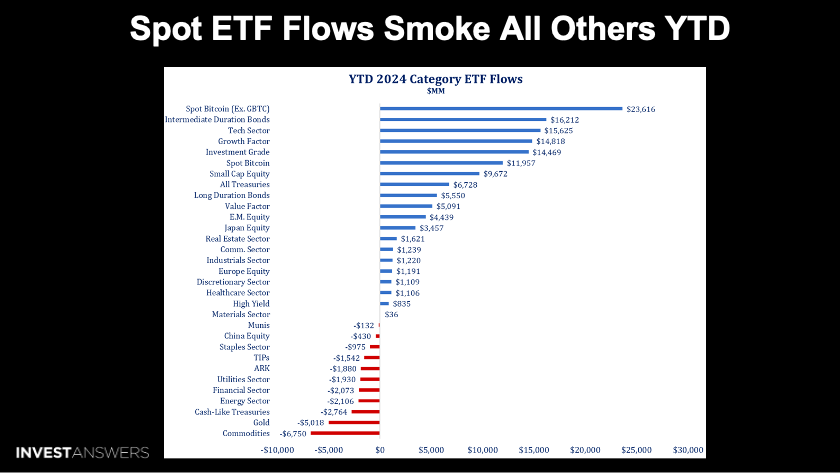

The story of the year so far is U.S. growth stocks and Bitcoin.

The spot ETF flows smoke all others.

Corporate bonds are also higher on the list this year.

Japan and emerging markets are making some rare appearances as well.

The Gold ETFs are in the gutter despite the gold price seeing all-time highs.

I decided to expand the crypto compendium performance to the top 75 and adjust how it is displayed. The first block on the left shows the last seven days of the top 75 digital assets, and the right shows the last thirty days. What is interesting about this is that two of my biggest alt positions—Jupiter and Pyth—are at the very top. Solana is also in the top five. Avalanche is also up there, but I do not hold a position in it.

Over the last 30 days, the big story is the meme coins. A little bit of AI is sprinkled in there as well. Overall, the market has been wild and crazy.

Here is a chart of the deltas over the last week covering the things I know well and can relate to—financial applications. This chart covers the chains with the most growth in a give category as these change from week to week:

TVL = Solana

Stablecoin Volume = Solana

Developer Commits = Arbitron

Active Developers = Avalanche

Daily Active Users = Solana

Daily Transaction Growth = Avalanche

There is a lot of activity happening in crypto, which is very real this time around, unlike 2020. Records are being smashed across the board really fast.

Anyone who follows me knows that my focus is on identifying winners early, whether it be MicroStrategy, CleanSpark, or Tesla, which has yet to pump. Because of Solana, I was mocked heavily in 2021 and 2022. I never wavered, never deviated from my strategy, and stacked as much as I possibly could. When it fell to $8, that was almost organ donation time.

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.