NUGGETS OF ALPHA

Never click anything dropped into your hot wallet

How to store crypto

The cumulative fees for Bitcoin are growing in a staggering upward trend

BTC miners are the recipients of all the increased fees on the Bitcoin network

GBTC is converging with its NAV

The money flow into Bitcoin is only just starting

Weekly Crypto Market Recap:

The global crypto market cap is $1.66 trillion, with a 24-hour volume of $53.18 billion.

The price of Bitcoin is $43,889.52, and BTC market dominance is 52.0%.

The price of Ethereum is $2,247.71, and ETH market dominance is 16.3%.

The Crypto Fear & Greed Index is currently Greed (70).

Keep only small amounts of money in your hot wallet.

Spread your crypto around different devices for different purposes

Do not click on anything that pops into your wallet.

Yesterday, I did a video with a new ratio that caused some confusion. I will walk through the model again.

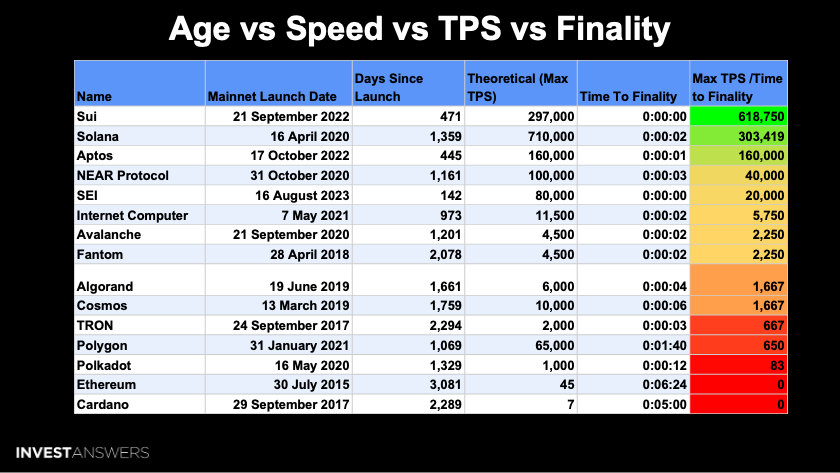

In the realm of Layer 1 blockchains, a crucial aspect for their survival in the future lies in the balance between age, speed, transactions per second (TPS), and finality.

Speed combined with finality is an important attribute to measure when evaluating blockchains. This chart reveals a ratio that divides a chain's theoretical maximum transactions per second by the time to finality. By examining this ratio, we can gain insights into how well a Layer 1 blockchain is positioned to meet future demands.

To better understand this, we have devised a new ratio in collaboration with the team behind the SCP Profiler. This ratio is derived by dividing the maximum theoretical TPS by the time to finality.

In essence, the age of a chain, its speed, TPS, and finality will play significant roles in determining its ability to thrive in the years to come. By focusing on these aspects and striving for the right balance, Layer 1 blockchains can enhance their chances of success in the ever-evolving world of blockchain technology, especially as adoption spikes. There will be no waiting around more than a second for a response.

Be in the stuff with the big red bar. All others likely won’t make it unless they can "change the wings of the aircraft in the air." If the chain is really low on this score, then I do not see a future for it over the next 3-5 years.

Bitcoin is moving through the "calm, before the storm" phase of this year. Historically, January has been a good month in terms of performance for Bitcoin. Let me explain why I think it will be a good January...

Everything is red except for a few exceptions, including WBTC, which is weird. If you are in altcoins and did not make any money last week, don’t feel bad - nobody did.

BTC +4.53%

ETH -2.18%

SOL -10.32%

AVAX -13.75%

This week's attention was on Bitcoin due to the spot ETF approval situation, and, hence, that is where the money flowed.

We know that BTC Gold Crosses only work 65-70% of the time on the daily time frame, but we have never

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.