NUGGETS OF ALPHA

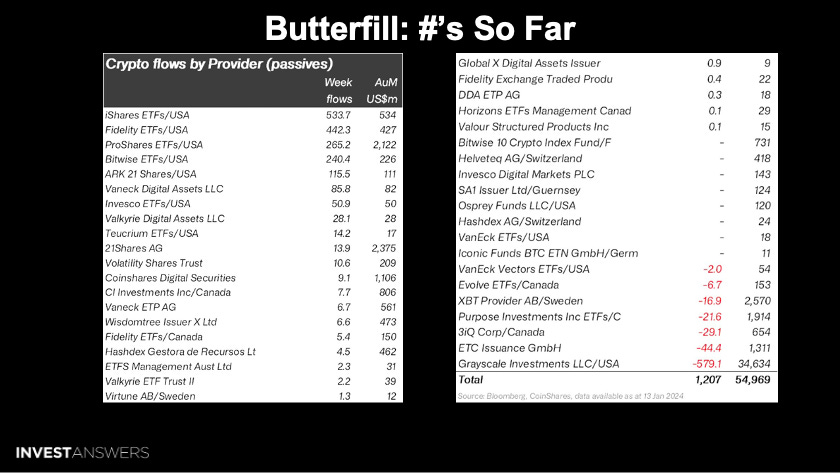

Grayscale experienced $579M worth of outflows

BlackRock pulled in 11,500 BTC in the first two days of the ETF

111,000 BTC were sold at a loss by short-term holders this week

JPMorgan analyst predicts 50% chance of spot Ethereum ETF in May 2024

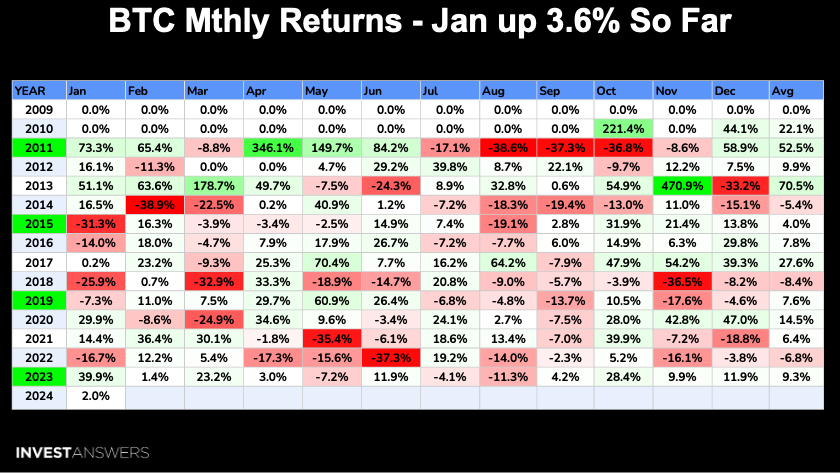

The Bitcoin return is at 2% for the year despite the historic ETF announcements.

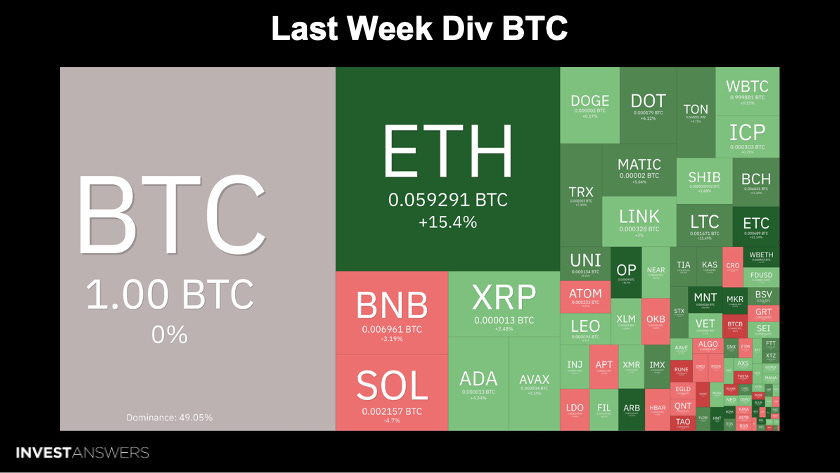

While last week was Bitcoin's ETF week, Ethereum rallied up 15.4%. The other ETH chains did well. Solana was down 4%. Binance was down 3%.

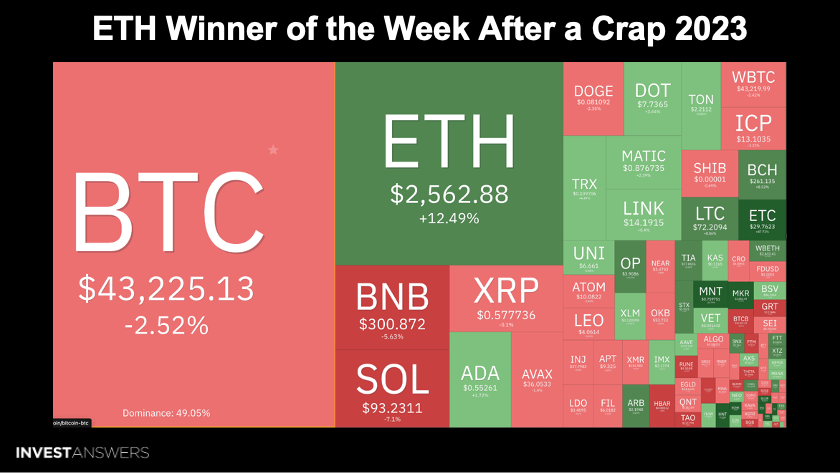

It was a mixed week overall:

ETH +12.49% to $2,500

BTC -2.5%

The dollar's status as the world's reserve currency is facing threats

Bitcoin's remarkable worldwide adoption is stunning

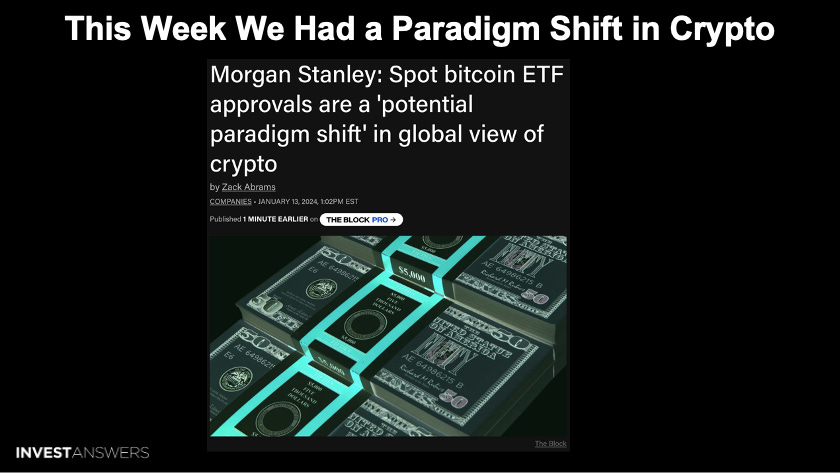

The biggest money runners on the planet having a spot ETF is huge for the space

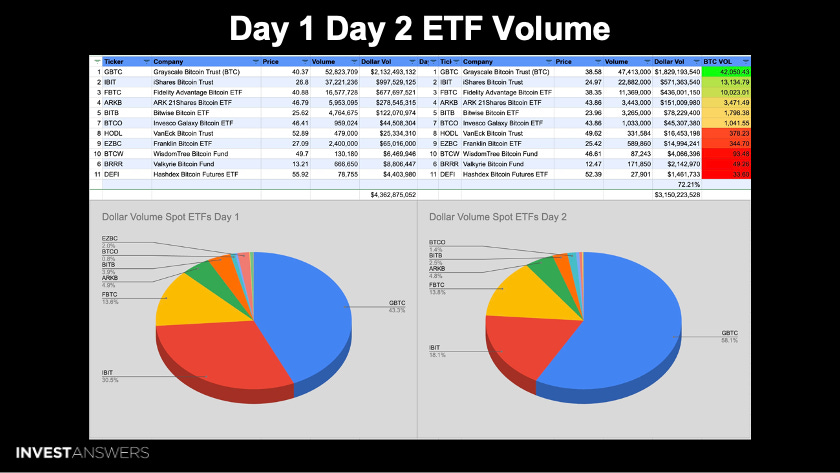

GBTC dominated the volume of the first two days, which is heavy selling. This is attributed to its fatal mistake of charging 1.5% fees when other players charge 0.2%. What transpired is not bad in the long term for Bitcoin investors, so let's further examine why...

According to Butterfill’s' analysis, $1.2B of inflows came into Bitcoin through the ETF last week. However,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.