Today’s Nuggets

ETH Wins?

FTX Finalizes Sale

Crypto Adoption Faster Than Web?

Phantom Wallet - #1 Finance App?

NVDA Market Cap Larger than Countries’ Stock Markets?

NVDA Outperforms BTC

Tesla Becoming Pure AI Play

The Clean Energy Giant

U.S. Home Sales are Indicating a Recession is Coming

Chinese Gold Trading Activity Explodes!

Today is a compilation of super interesting stuff I put together throughout the week, including many things you may have missed. I spent enough time this week talking about the political implications of crypto, so I am not even going to touch that today.

This will be a fascinating journey as we enter the intricate world of crypto and finance, including DeFi, liquid staking, AI, macro, oil, and geopolitical risk.

Ethereum went bonkers this week, up 21.39%.

It had its day in the sun because the ETH ETF was approved, something we knew would happen eventually. However, it came about a little bit sooner than many expected.

Risk happens fast!

Bitcoin, at $69,200, is up 0.38% for the week. This is interesting because despite the fact that a billion entered the ETFs last week, it did not move. However, over the last two weeks, it went up 13.5%.

What typically happens in these markets is that once there is a big event like what happened with Ethereum, it sucks in all the liquidity.

Real-world assets is the sector that won the month of May. DeFi finished number two.

I invest in DeFi because it is what I understand most.

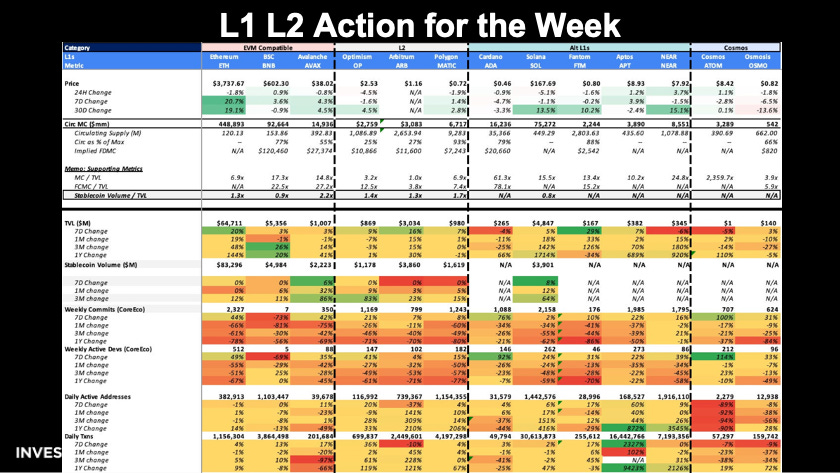

30-day gains = ETH +19%, NEAR +15%, and SOL +14%

Total Value Locked = FTM

Stablecoin Volume = SOL

Development Commits = ADA

Daily Active Users = APT

Daily Transactions = APT

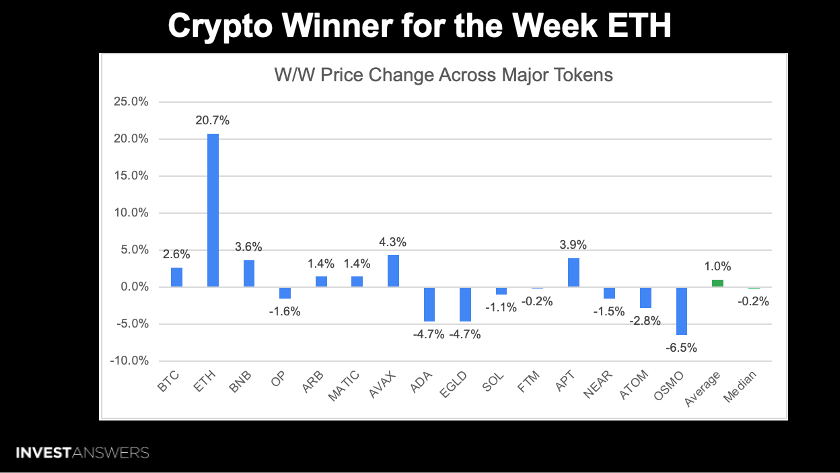

Here is a visual of the major tokens for the week.

The big blue stick is Ethereum, up 20.7%. Bitcoin was up 2.6%. The average gain for the week was 1% but if you pulled out Ethereum, it would be a lot worse than that.

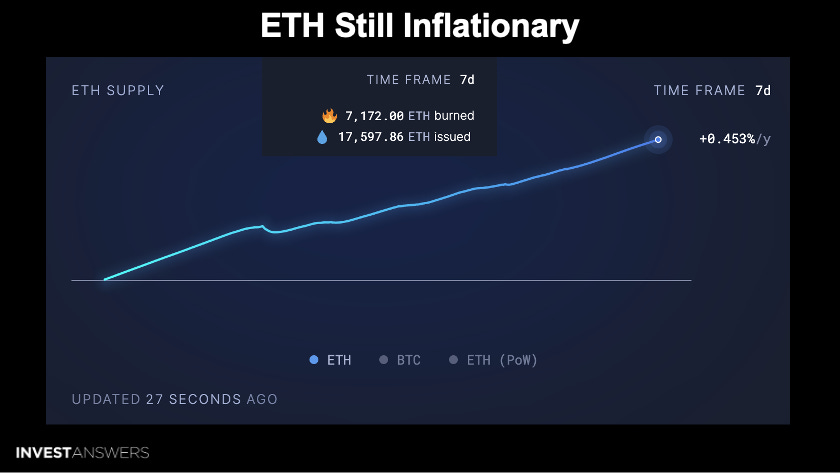

Despite all the excitement about the ETH ETF, there has been no uptick in transactions or activities on the chain. It has gone down a little bit over the past couple of weeks.

ETH has been inflationary ever since it became inflationary a few weeks ago. The amount of ETH burned over the last seven days is 7,000, and the amount issued is 17,600. That translates to about a little bit of inflation. Some of the fees are still heavy.

Someone recently identified a transaction fee of $126,037 that was Uniswap-related.

This is a huge fee but that stuff happens on Ethereum.

FTX sold about completed the sale of $2.6 billion worth of SOL and was purchased by a group called Figure.

Figure bought 800,000 tokens for about $80 million or around $102 a token. They are locked in for four years. Essentially, more of the supply is taken off the market, which makes the asset a little bit harder.

This is stuff that we like to see.

Everybody is asking about Liquid Staking…

Here is a chart breakdown between Ethereum and Solana for staking. The blue is the circulating supply that is unstaked. Solana has 3x the amount of SOL staked versus Ethereum, yet only 6.9% of that is liquid staked, whereas Ethereum has 65% of staked ETH is liquid staked. So, there is more liquid-staked ETH than staked ETH - which is incredible!

What happens next for staked SOL is very obvious, and it is a big opportunity. You will see a lot of activity there, as there is immense opportunity to enter this business.

There is liquidity risk, permanent loss risk, smart contract risk, and many others.

When you break down the huge DeFi sector of crypto, the total is ~$160 billion.

The biggest slice of that DeFi landscape is now liquid staking, of which Ethereum makes up a truckload. Lending is about $50B, DEX is about $24B, Bridges is $25B, Yield is $11 billion, Restaking is $20B, etc.

DeFi is going to disrupt TradFi.

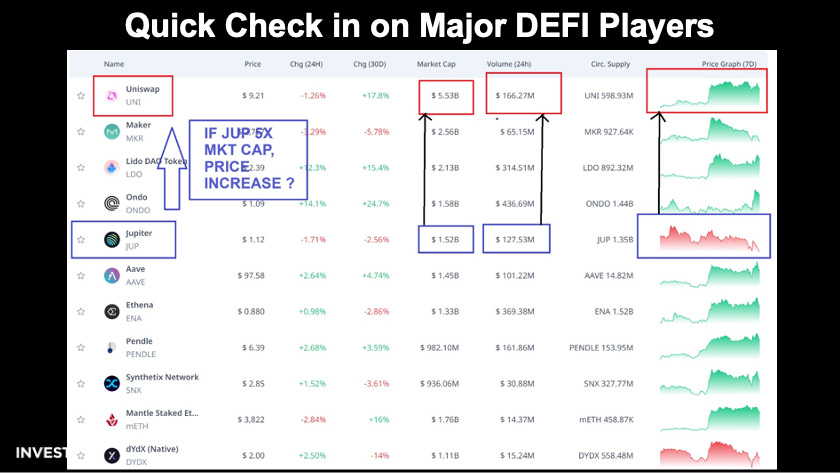

If we look at the leader in DeFi, the king of the hill is Uniswap, with a massive $5.5 billion market cap and $166 million in volume. My thesis for Jupiter was that it could one day topple Uniswap, but it only has a $1.5 billion market cap.

Could it do a 5x price increase from here?

It is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.