Today’s Nuggets

ETFs Up, Yet BTC is Flat

The BTC ETF Black Mirror Continues

Discover When Bitcoin Blow Off Tops Occur

Ethereum Still Lagging Despite the ETF Pump

Solana’s Stablecoin Transfer Volume Rise

PYUSD Bets on the Solana Network

Robinhood Rolls Out Trading for Jupiter and Wormhole

MSTR Added to the MSCI World Index

U.S. Senator Buys Bitcoin Miners

Elon’s xAI Closes Biggest Funding Round In History

Tesla Semi Truck Showcased in Hanover, Germany

Biden Vetos SEC’s SAB 121 Bill

This weekly lesson covers all the stuff you missed that you need to know. This lesson is my attempt to cover all the financial news and weave it into a tapestry to make it as entertaining as possible!

Despite the markets not moving very far, a lot of stuff did happen, so let me catch you up…

Everything was kind of flat last week.

Some things are up half a percent and others are down half a percent. Avalanche, Bitcoin Cash, Ethereum Classic, and Immutable X all got hammered hard.

Bitcoin is exactly where it was a week ago.

Ethereum is exactly where it was a week ago.

Solana is down a fraction from a week ago.

Cardano is the same, slightly down.

While the market is flat, there are some activities that are under the skin.

We will start with Bitcoin...

As usual, we saw the usual phenomenon of Grayscale's massive dump and BlackRock's massive acquisition. It is like somebody runs across the road with the bags.

I pointed that out months ago and it is still happening today. The good news is that BTC still experienced $50 million of positive inflows on day 98.

The inflows have been up fourteen straight days and the BTC price has not gone anywhere...

This is a mystery, but you see the progress over the last 14 days with $2.2 billion inflows. If you divide that by the average Bitcoin price over the last 14 days, then you get about 34,000 BTC.

Remember, the daily issuance is only about 6,300 BTC.

We are at about five and a half times the daily issuance being consumed by these ETFs.

Imagine that you are looking at a flat and still pond.

The bottom is the Grayscale dumpage and the top is the BlackRock acquisition - they mirror each other perfectly! BlackRock is now streaking ahead of Grayscale as the bleed continues out of GBTC and the growth in IBIT.

BlackRock's IBIT is a record-breaking ETF.

No other ETF in history has reached $20 billion as fast as IBIT in just over 90 days.

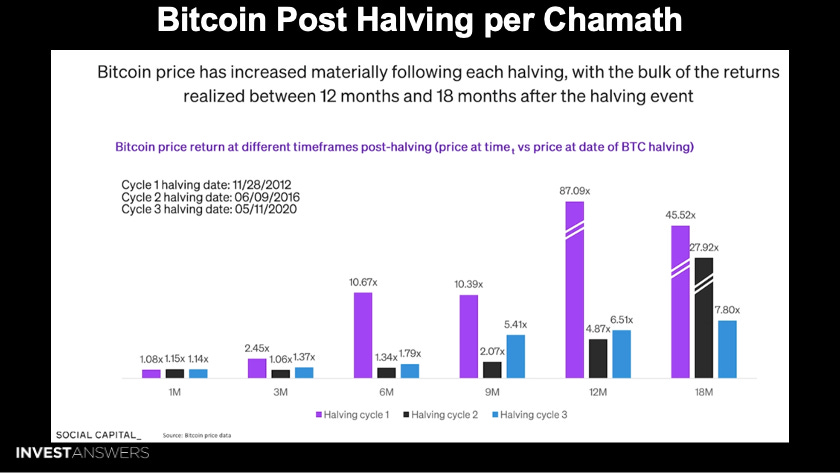

Let us talk about Bitcoin post-halving price targets. This is from Chamath Palihapitiya, who covered this in the All-In pod. In the episode, they had a thing called Crypto Corner:

Basically, they broke down Bitcoin post-halving. As we covered a while back, nothing happens during the first 30 days. Then, during the next 90 days a little bit of action happens, but normally not that much. Over the next six to twelve months, all the action happens, which is when the cookie literally crumbles and goes to the moon.

We are not sure if this will continue this time, but it was nice of Chamath to do this exercise and share it with the world just like we do here.

These numbers are a little bit more aggressive than mine, but here he forecasts that Bitcoin could reach more than half a million dollars per coin by October 2025 if it follows the same pattern as the second and third cycles.

By the way, if it does get to the half-million dollar level, Bitcoin's market cap would surpass Gold's, which would get a lot of attention.

We are currently in

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.