Today’s Nuggets

Good Week Despite China Tariff Scare

Summer Doldrums This Year?

Good Week Despite China Tariff Scare, Pushing $70BN in 17 Months

BTC ETFs Buy 111x Issuance in May

Saylor “Bank of England on the Brink of Buying BTC”

Tax Free BTC in Florida?

Beneficiaries of the New ETH Pectra Upgrade

Living Longer, Stacking More

Over 184 Million Records Leaked

This story will focus more on where we are going next, as it is the last day of May.

People used to say, ‘Sell in May and go away.' However, as I argue, we lost two months due to the tariff tantrums. I will review a large amount of data today and attempt to determine whether it is time to move forward or if we have bright skies ahead.

This is the last seven days against Bitcoin.

Both Binance and Hype performed well this week for several reasons. However, many other things were slightly off.

Bitcoin was down 2.4% on the week.

Everything was somewhat flat, but nothing too out of the ordinary. We had the Bitcoin conference, which many people thought was crap. The feedback was terrible.

While crypto was down on the week, the stock market was up.

We had a big scare on Thursday and Friday due to the China tariff news. Markets did take a dip, but rebounded quite fast.

Overall, stocks in AI disruption were up for the week.

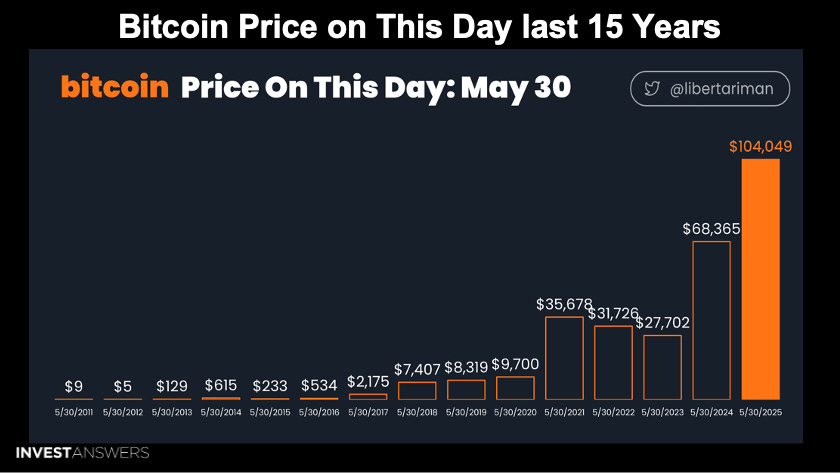

This is fascinating to see, as you can look back over the years to see where we have come from.

This trend, which dates back 15 years, demonstrates that May is a particularly favorable month for Bitcoin. Will we run out of steam? The question sets the tone for where we go next.

I want the green candle to be above the other ones for the last four months.

From a technical analysis perspective, this is very important. If you go back to November 2022, there are 14 green candles and 13 red ones this cycle, so it is like a 50/50 split.

What is important is the

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.