Today’s Nuggets

Best September Ever?

Why the Incoming Q4 Matters

BTC ETF Net Flows Since Launch

AI is Still Top Dog

Bitcoin versus MicroStrategy at $66K

Tesla Back in the Top 10

Fed Behind the Most in 30 Years

Global Liquidity Breaks $100 Trillion

Dr. Cooper Heading Back Up

This story will cover all the big stuff that happened this week.

We will also look at a new price prediction methodology for Bitcoin. It is a bit of a stretch - with no guarantees - but it is also fascinating. We will look at the infinite money glitch with a stunning chart you will not believe. Copper is indicating that maybe a recession is not happening.

Crypto Market Update:

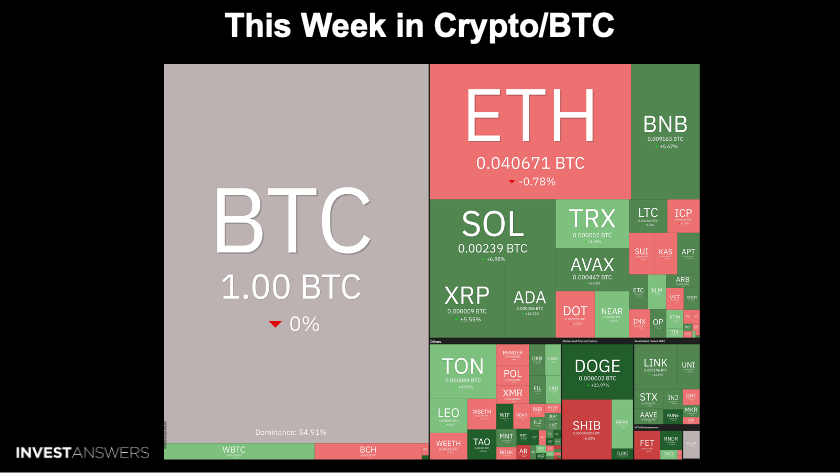

The crypto market cap is $2.31 trillion.

Bitcoin is at $65,737, and the dominance is down to 56%.

SOL, XRP, ADA, AVAX, BNB, LTC, DOGE, and TAO beat Bitcoin.

ETH is still lagging behind Bitcoin, which has been a trend all year.

We are flat for the week despite many positive feelings.

There is a lot of positive sentiment in the market now.

Everything is positive, whether it is crypto Twitter or magazines like Crypto Slate.

The rally comes amid optimism driven by the Fed's rate cut, economic stimulus, China, sustained demand for institutional players, etc.

Looking back to 2012, we can see that the return was 15.1%. The return so far this September is 11.4%. It is not the best September ever. Considering September is Bitcoin's worst month, it is doing pretty well.

As I have said multiple times this year, everything is shifted left a month.

Rektember is supposed to be bad but we had the carry trade happen for Japan on August 5th, which wrecked the market.

What happens after this is interesting…

November is the best month for Bitcoin, with October being the second best. December is always good despite people being on holiday.

The question is, what will happen this time around? Could we have three positive monthly returns for Bitcoin?

Considering the money flow lately, global liquidity, historic trends, and everything has shifted left,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.