Today’s Nuggets

Saylor Forecasts 24% CAGR for Next 10 Years

MicroStrategy Raising $700M & Buying More Bitcoin

Ethereum is Becoming Institutionalized

Solana 1.18 Performing 2,000 True Transactions Per Second

Jito Explodes

Jupiter Dominating Aggregators

Raydium Becomes #1

Tesla Approves Pay Package and Reincorporation

Elon Forecasts FSD & BOT Impact

Shocking Stats on Unprofitable US Small-Cap Companies

Bank Run on Roubles and Suspended Russian Stock Market

In today's story, we will cover all the important news that you may have missed this week, including:

Talk about crypto and all the changes;

Price targets for certain assets we care about; and

Some macro.

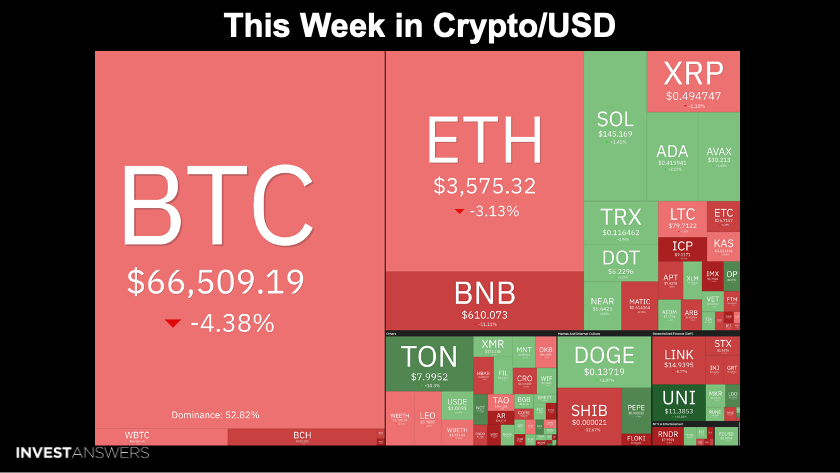

Binance is mean-reverting after hitting a new all-time high last week.

ETH, SOL, and XRP beat BTC for the week.

BTC -4.38%

ETH -3.13%

SOL +1.45%

BNB -11.11% to $610 - still way higher than it was at the beginning of the year

TON +15.29%; I will cover this in the weekly Q&A

This sounds exciting, but it is not—at least not the way I invest.

A conservative 24% CAGR means Bitcoin could do 8.5x by 2034 or $575,000.

However, we have another asset that could do more, that we will review…

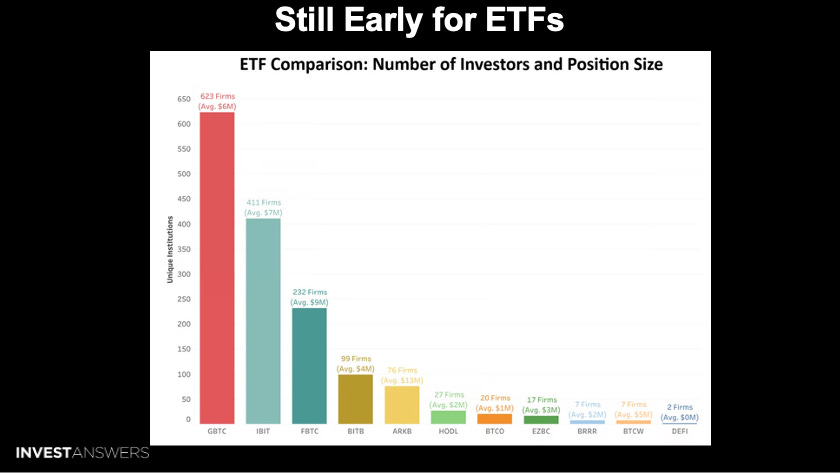

This data was mind-blowing for me…

BlackRock only has 411 firms invested and their average buy is $7 million. Fidelity has fewer firms but a higher average buy of $9 million. We would need a huge number of retail investors to match these buyers. I calculated that the weekly ETF buys would equal 80 million retail investors.

We are still early with only 400 firms for a company like BlackRock in a world with hundreds of thousands.

Michael Saylor will be buying again next week.

He issues stock at the speed of light and they convert that to Bitcoin within 24 hours! I expect him to announce that MicroStrategy bought $700 million worth of Bitcoin sometime this week.

Expect Bitcoin to be positive this week…

In addition, we have new institutions like Metaplex in Japan and Sembler in Santa Clara.

All Layer 1s and Layer 2s were down for total value locked.

Stablecoin Volume = Optimism

Developer Commits = Cosmos

Weekly Active Developers = Cosmos

Daily Active Users = Ethereum up 10%

Daily Transactions = Solana up 18%

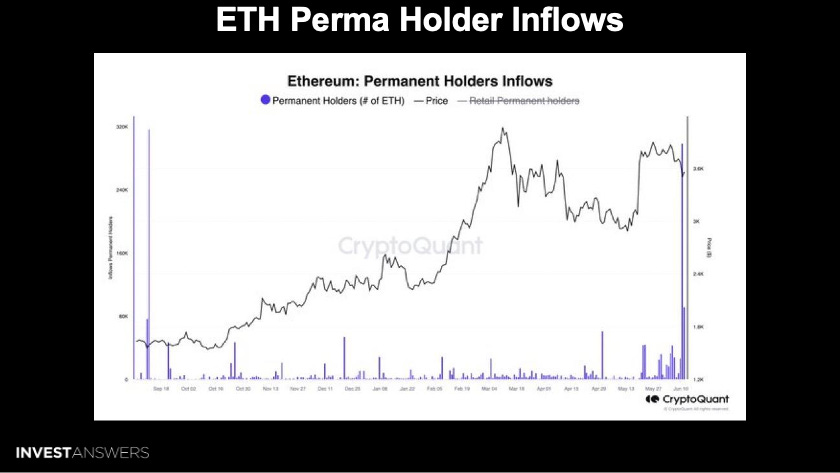

Ethereum is quickly becoming an institutional game.

Yesterday was the second-highest day of buying from institutions in history, with 298,000 ETH. The record daily buying was 317,000 ETH on September 11th. Somebody is stacking Ethereum ahead of the ETH ETF.

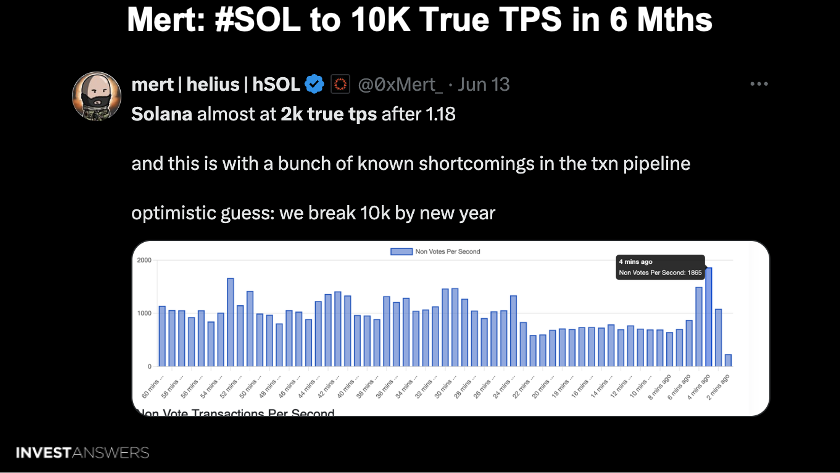

Solana released version 1.18, which is twice as fast as the previous version, allowing more people to complete more transactions.

Mert stated that Solana can perform almost 2,000 true TPS now!

In the next six months, Mert forecasts 10,000 true transactions per second - very impressive!

I talk about the assets with the most activity and stuff going on.

In this case, it is all Solana because that is where all the transactions happen and all the users have migrated. Solana is looking to push out the middleman on payments.

In my opinion, the biggest use case in crypto is payments.

This can be huge to a retailer with thin margins, which is why many restaurants now charge extra if you use a credit card.

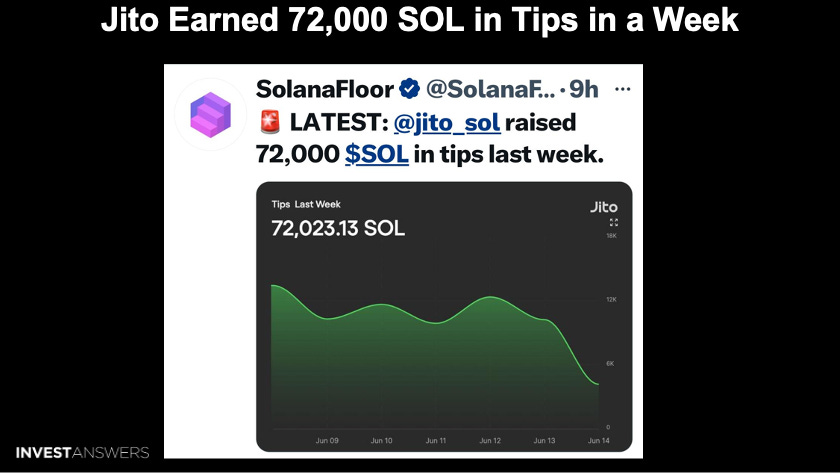

One dApp on the Solana network received 72,000 tips to accelerate transactions.

What is happening with Jito (JTO)?

Jito is listed in purple on this chart.

You can see it is exploding now to 11 million staked SOL out of nowhere. It is growing very fast, far faster than anything else - this is interesting!

Jupiter is now handling 72% of all the aggregator volume across all chains.

This trend was clear to me as I was looking for such a solution from my early days in crypto. However, it did not arrive until late last year.

Raydium protocol has become the number one DEX protocol.

Uniswap has been around for a long time on Ethereum and this one DEX on Solana now beats it. We were excited a few months back when Jupiter beat Uniswap for the first time.

Now, individual DEXs on Solana are beating Uniswap.

It was a big week for AI, and when you look at the top growing companies, they are all AI-based.

As I have been saying since 2022, AI and crypto are where it is at!

MSFT +4.42%

AAPL +7.92%, which is a monstrous amount

NVDA +9.09% post a 10/1 split on Monday

META +2.27%

The judge said the shareholders were misled and did not know what they were doing…

This is ridiculous and the judge has no leg to stand on. We have to eliminate corruption from the world as quickly as possible. The pendulum is swinging in the other direction, towards things that are proper and good.

I know lots of companies that are looking to leave Delaware as well.

New companies are considering where they incorporate and looking at states like Nevada and Texas instead of looking toward Delaware anymore. Companies that are in Delaware with executives that have stock-based compensation plans are heading out.

The newly refreshed Model 3 is by far the best band for the bucking vehicle on the planet, as voted by top vehicle analysts.

All the top people are blown away by how good this car is for the money. It is currently ranked number 10 in the world. I forecast it will join the Model Y as number one or top three within one or two years.

No, EVs are not dead. People say they are, but this is the last gasp of the ICE and the hybrid.

In three to five years… game over.

Now, this was the most mind-blowing thing from the actual shareholder meeting.

ARK's model is just vehicle autonomy, not megapacks or robots! Tesla has approximately 3 billion shares outstanding and at a $30 trillion market cap, it results in a $10,000 share price or 67x from where we are today. For Bitcoin to match this growth rate, it would have to go to $4.49 million per BTC.

The question is, which gets to that level first?

This is why I own

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.