Today’s Nuggets

Everyone Sold But BlackRock

Fundstrat’s $115,000 December Prediction

ETH ETF is Lackluster

DeFi Mindshare is Up and to the Right

Cardano’s Chang Hard Fork Set to Deploy

Pyth Network Market Share Surging Up 120% YTD

SPX is Raging

The Demise of ICE & BEV Flipping

Meta Warns of Quantum Apocalypse

Not much has happened lately… however, there are things bubbling up under the scenes I want to bring to your attention.

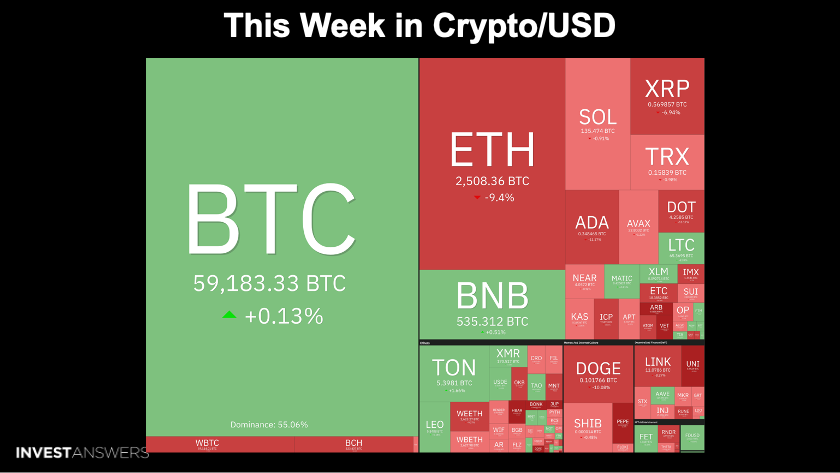

Crypto Market Cap:

CryptoMarketCap is a bit higher than it was yesterday - at about $30 billion - while the volume is very low;

Bitcoin is back at $59K;

Ethereum is at $2,500; and

The Fear and Greed is at 29.

Bitcoin is right at breakeven on the week.

Ethereum was down 9.4%.

Cardano was down nearly 11%.

Solana was down 0.9%.

XRP was down 7%.

TON, despite the outages and arrests, is still up 1%.

All of the ETFs were in the red this week except for BlackRock, who are still there buying.

It was a good, strong start to the month in August but then it really petered out towards the end. Maybe it is because there is a thing in the U.S. called Labor Day weekend.

Everybody is out and away, having fun at the beach or going to concerts.

Yesterday, Bitcoin ETFs dumped $175.6 million and the day before, $72 million. It dumped $153 million and $127 million in the previous days. It was a brutal week… but BlackRock still made it happen as they pulled in over $210 million for the week.

Despite the crazy dumpage and the buying by BlackRock, Bitcoin price was fast. It shows you the market makers are doing their thing.

This beautiful chart is Fundstrat's Sean Farrell, displaying how choppy Bitcoin's price action has been.

BTC has been sliding between $58K to $62K for ages right. That means there could be some exaggerated price movements when things kick off. If you look at the little red box painted on this chart, things can be sideways between the second week of August and the third week of September. That is the seasonal pattern of Bitcoin. It can also take a little bit of a dip in November but November is always the best month.

We are in that doldrum period, as I have been calling it for weeks. However, I do expect things to kick off in

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.