Today’s Nuggets

Global Liquidity’s Big Spike

The ‘Trump Trade’

Binance Pulls Shorts

Crypto Daily Active Users Exploding Upwards

Solana 83% Discount to Ethereum

The Dead Zone Update

Ellison Reveals the Most Valuable Company

The Blue Screen of Death

It has been one hell of a week. Let us break it all down.

Many things surged, a lot tanked, and a lot of things stopped working.

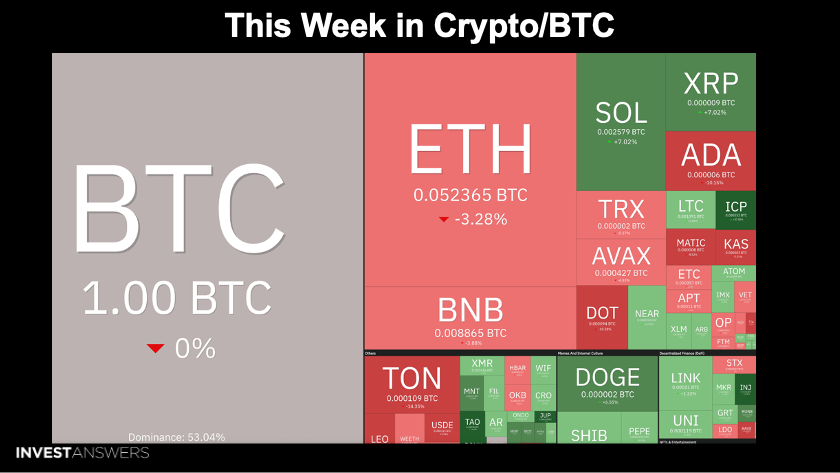

Crypto Market Update:

The crypto market cap is just shy of $2.5 trillion;

There is not much volume, but a lot of other stuff is happening behind the scenes; and

Fear and Greed is 74. It is incredible how fast this space moves.

It looks like we have this weird situation where certain things are going one way and other things are going another:

Solana and XRP both beat Bitcoin by 7%.

Cardano fell by 10%.

Toncoin down.

Polkadot down.

Bitcoin is up a whopping 16.23% for the week and another $800 today.

ETH is up 12%.

Solana is up over 24% for the week.

This is a beautiful graphic from Marty Party.

This is kind of the macro worldview of assets and I always believe the best charts are the simplest charts:

The first chart shows the BTC price and you see that massive rebound with a clear bounce off the 200-day period.

Gold got rejected off $2.5K.

NVIDIA also rejected off the top as it was a bad week for tech stocks.

The dollar yield is down.

The stock market is up because the small caps are doing really well.

Energy is up.

Telsa is kind of flat and choppy but down ~2%.

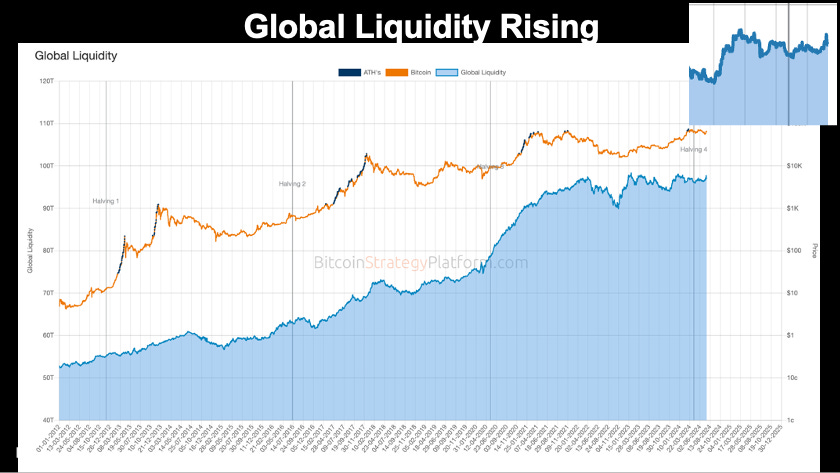

I have been expecting liquidity to rise hard in 2024 for a year and a half now. Well… it looks like we got our first big spike.

By the way, that vertical line is the BTC halving.

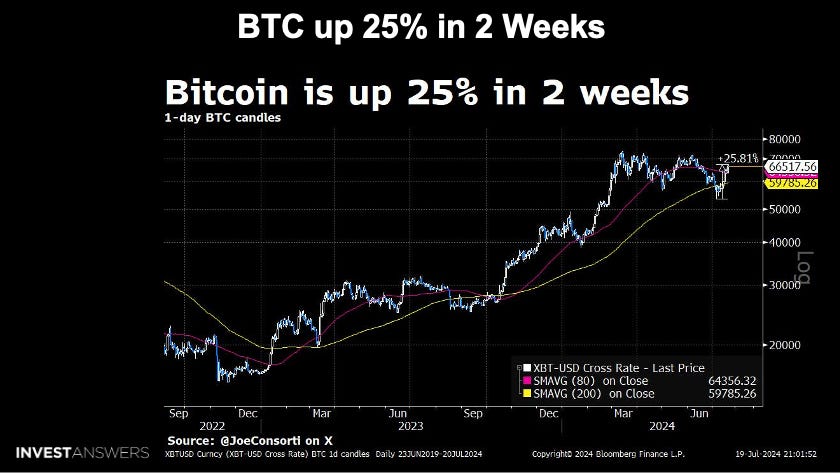

There is a new term out there on the market, called the ‘Trump trade’. The S&P rose 0.81%, NASDAQ fell 0.81%, and Bitcoin was up 8% in just five trading days.

Bitcoin has been up 25% in the last two weeks.

The Germans could not have sold at a worse time but they also broke the Bitcoin price down by dumping it so haphazardly on the market. The market took a little time to digest and then people swarmed in and bought the dip.

This is a thing I call spoofing, and it is a well-known term in the financial space. It occurs when traders or marketmakers place large buy or sell orders without intending to execute those trades. These orders are quickly canceled before being filled. The goal is to create an illusion of increased supply or demand to influence prices.

In this case, with Binance, they pulled their shorts in order to not get wrecked. The possibility of going to a new all-time high is much higher because it is down to $1.6 billion. So, the shorts crashed by over 90% in a short window of time, giving the illusion that the market looked bearish.

This is the result of a Reddit pool - who knows if you can trust it or not? How much of the Bitcoin would they sell? 88 out of the 467 voters said they would sell 100% of their Bitcoin. Mt. Gox continues to be a big cloud that people are worried about hanging over their heads.

Why is this interesting?

I estimated that between 30% and maybe 50% of the Mt. Gox Bitcoin to be distributed will be

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.