Today’s Nuggets

The Best Day in Over 2 Months

Coinbase Writing Bitcoin IOUs for BlackRock?

Energy Storage is Ripping Higher

ORCL Integrates OPS into Cybertrucks w/ Starlink

X Grows 22% Year-over-Year

The Roadster is Real

South Africa is Getting Starlink

CME Now 50/50 on 50 BPs Hike

The USA is Becoming the New Zimbabwe

Cheapest Commodities since the 70s

In this edition of What Happened, we have about 45 nuggets to unpack.

The market cap is $2.09 trillion; last week, around this time, it was $1.9 trillion, so we added $20 billion.

Bitcoin is hovering just under $60K, and BTC's dominance is 56.5%. ETH's dominance has fallen to 13.9%, which I think is a record low.

Fear and Greed is back up to 50, so everything is changing fast.

September certainly started off bumpy, similar to August. But perhaps the V-recovery I expected in September will happen a little earlier than expected.

ETH beat Bitcoin by 8%.

SOL beat Bitcoin by 10%.

AVAX and NEAR beat Bitcoin by over 10%.

Bitcoin is just shy of $60,000.

Ethereum is at $2,400.

Solana is still down off the highs at $137, but at the end of the year is going to be a great run.

James Van Straten sees a pretty dramatic divergence between the liquid and illiquid supply.

The Bitcoin circulating supply is about 19.8 million BTC. Of course, 5 million are lost. As you know from me, the illiquid supply is more like 14.6 million.

Look at the blue line (liquid supply) tanking and the black line (illiquid supply) going to the moon. We are currently observing a massive divergence. As the illiquid supply rises, more coins are being held, reducing market liquidity. This trend contrasts sharply with early 2024 when Grayscale Bitcoin Trust sold off a ton of Bitcoin, which increased the liquid supply.

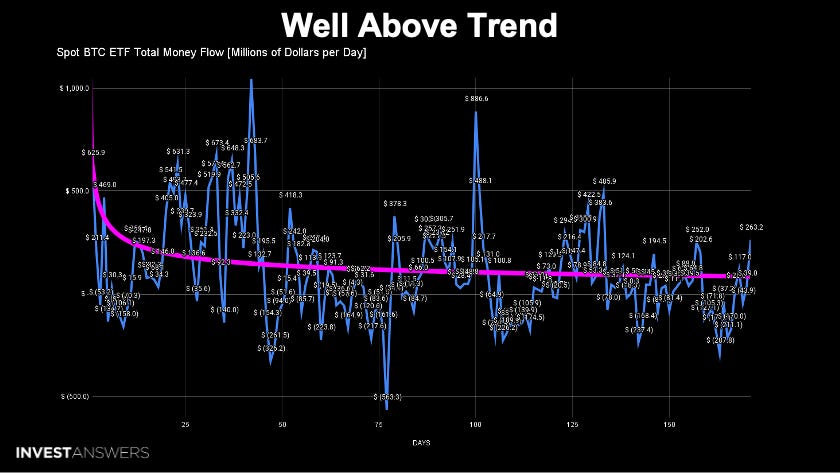

Yesterday was the best day in over two months.

The Bitcoin ETF saw 263 million in inflows yesterday, the highest in two months. The tides are indeed turning and it all happens fast.

We had the big green day yesterday and have had a $400 million week so far.

This week was a bit of a turnaround and September was not as bad as people expected.

It is hard to see gains here because ARK and Fidelity are kind of covering each other.

BlackRock has had slight dumpage for the last two days and dumpage and zero buys, which means that market manipulation games are happening. You cannot do a billion in volume and not move at least one Bitcoin. It is getting to be a little bit egregious.

This shows yesterday's big spike above the trend.

Yesterday, 4,400 Bitcoin were absorbed, ten times the daily issuance.

Now, everybody is suddenly up in arms about BlackRock's IBIT.

I have been talking about this since January 2024, so if you watch the channel, you know about it.

Is this possible?

I wish they would all

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.