Today’s Nuggets

Argentina’s Mining Strategy

South Koreans Pushing for Bitcoin!

More Hash, More Security, and More Trust

Revealing the Bitcoin Cycle MidPoint Map

How Long it Takes for Your Fiat to Halve

“Good in May”?

Discovering the Average Bitcoin Purchase Price

We know that post-halving things can be quiet for about 30 days, but things are happening behind the scenes. We are now nearly halfway through this 30-day post-halving period. We might have another two weeks of this non-action in the Bitcoin market.

In this lesson, I will spend some time on what I believe is the mid-cycle theory: When will we reach the halfway point and what will that all look like?

As a reminder for those interested in Bitcoin-only content then, the playlist can be found here:

https://www.youtube.com/playlist?list=PLWTRLGkkf1kTTbIDdv-P6ykul7a8iUXYf

*Some browsers do not show their YouTube playlists, so make sure you are using the Chrome browser.

🇦🇷 Argentina to mine Bitcoin using stranded gas with 1,200 BTC mining machines, according to Forbes.

Game theory is on!

We have seen a lot of change in Argentina since Javier Milei took office, including squishing inflation, which people that he could never do.

Sometimes, a different approach is needed in politics, so here is a shout-out to Javier.

Mark Moss recently discussed how nuclear power stations can create too much power. Now, you can solve the problem of stranded energy by leveraging Bitcoin mining.

Nation by nation, this opportunity will be realized over time, making the network more secure while making Bitcoin more pronounced worldwide.

Given Bitcoin's current price of $62,000, a half-coiner may be the new status of a whole-coiner!

I am proud of MechaStuzilla, who had a plan and stuck with it over their six-year journey.

Keep adding slice by slice and keep your security tight.

This 13f filing reveals all of the top holders of IBIT.

Highlighted in pink is Hong Kong, the top holder and number six holder of IBIT. The rest of the list is Americans, with a little bit of Switzerland mixed in as well.

This shows that other nations besides the U.S. are stacking these BTC ETFs.

Rumor has it that after the victory of South Korea's left-leaning Democratic Party in the recent elections, efforts are underway to push regulators to approve a spot Bitcoin ETF, fulfilling a pre-election promise.

The Financial Services Commission (FSC) - South Korea's equivalent to the U.S. Securities and Exchange Commission - currently prohibits the issuance and trading of spot Bitcoin ETFs. This approval could happen before June as the Democratic Party has reaffirmed its commitment to honoring its pledge concerning the spot Bitcoin ETF.

The party intends to "seek a definitive interpretation of the Bitcoin spot ETF from financial authorities once more after the commencement of the 22nd National Assembly in June."

The 2020 halving was a combination of COVID-19 and a whole bunch of money printing. We experienced the big COVID-19 haircut in March; May was the halving, and things went bonkers. This time around, things are slower but that is OK as it gives more people time to stack.

Strap in tight, everybody, because it is coming as the following charts will reveal…

The generation that needs Bitcoin the most are the ones that least understand it, which is a big problem.

It is shocking to think about how uninformed people who attend university are and what they learn in school.

Irony not lost on me…

This chart displays a falling wedge structure and @TitanofCrypto believes the bounce back to $74,000 will be much sooner than many expect. A falling wedge that seems to be currently playing out for BTC could catapult the price action. $73,800 is the current all-time high, so this chart is forecasting a break of that price level soon.

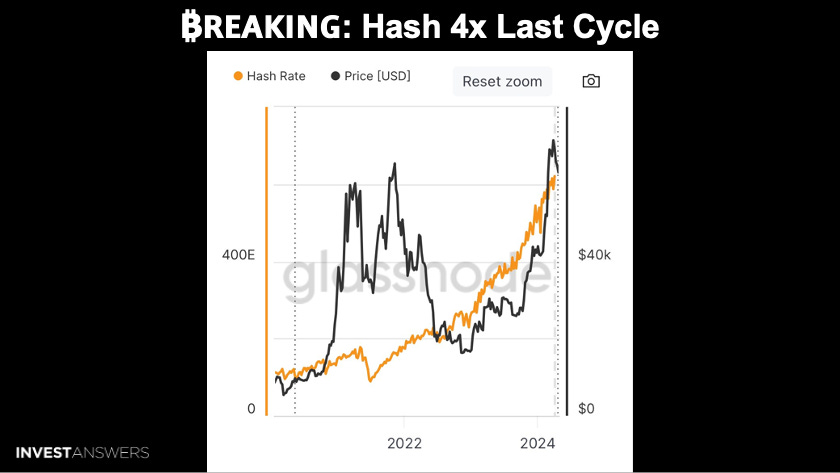

Vivek recently stated that the Bitcoin hash rate has improved 4x since the last all-time high; however, the price is still at $62K.

According to his math, the price should be at $250K instead if the price follows the hash.

This analyst is also looking at the market cap over the hash ratio.

Per Ki Young Ju, the Bitcoin network fundamentals could support a market cap three times its current size compared to the last cyclical top, potentially sustaining a price of $265K.

The Bitcoin price is currently really low compared to previous cycles when benchmarked against the hash rate.

The more hash, the more security. Therefore, the more trust there should be in the network.

This is Plan B's stock-to-flow price (S2F) targets on a table. In the last cycle, it missed the S2F target by 33%.

We do not know what it will do in this cycle but even if it is 50% wrong, it will take BTC to $239,000.

This is similar to the valuations from the hash rate, supplying further confluence in the $250,000 level, providing you with more confidence in the actual numbers.

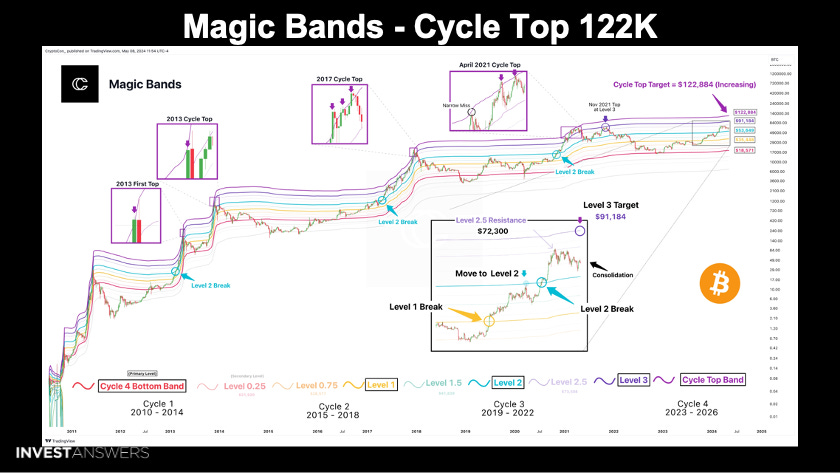

Level 3 of the Magic Bands looms as the next Bitcoin target is $91,184. It is normal for the BTC price to sometimes stop in between and consolidate before reaching a new all-time high. The cycle top band has also expanded to $122,884, which has been hit every single cycle since Bitcoin began. This band can keep increasing as the price rises, just like the 200-day moving average and the short-term holder cost basis.

I do not want to throw a wet blanket on things, but we have already made nearly 10x from the Bitcoin bottom.

Many people in the community want another 10x in Bitcoin this cycle.

It is very, very unlikely that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.