Today’s Nuggets

BlackRock Approaches 2% of Total BTC Supply

Gold Trading at 40-Year Extremes

IMF CBDCs are Terrifying

Revisiting the Zombie Zone

SOL Metric Du Jour

QQQ Needs MSTR

Tesla Got Its Mojo Back and Ramping into 10/10

Thiel Dumping Palantir

Chinese Stocks on Fire

Here Comes the Sidelined Cash

We will explore these 36 big nuggets, weaving a tapestry of all the stuff you need to know, and things are looking pretty darn bullish.

We have been bullish since the pre-fed rate cut run. Things are just running nonstop and I will share why they will continue. We are now 161 days after the halving and things are finally getting back to where they need to be as liquidity is rising, breaking the $100 trillion level.

The crypto community was so terrified a month ago that it had to change its pants.

A couple of days ago yesterday, we were neutral. Now, we are back to greed.

This is how fast things move.

Rektember did not happen.

I had a theory that because we had the huge cataclysmic event of the reverse carry trade on the 5th of August, we might dodge a Rektember… and we did so far. Bitcoin returns are up ~11.5% so far for September.

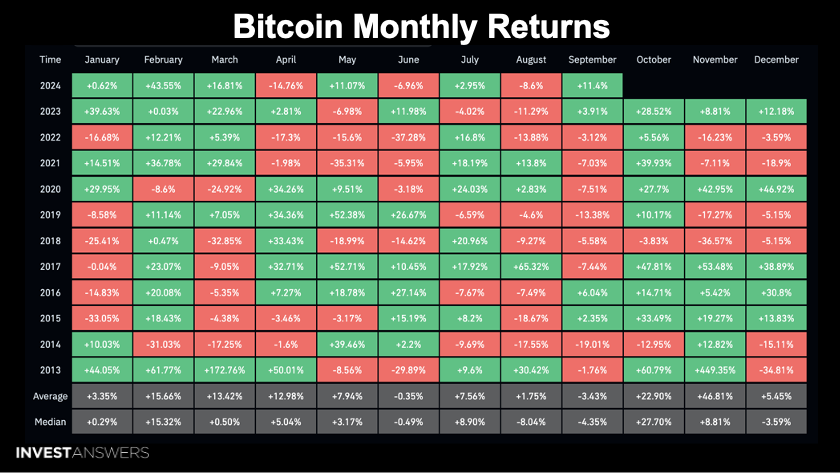

I always try to find patterns with charts. 2024 is like 2020, 2016, and 2012 in a BTC bull market. The average number of red months per year is about 4.75%. We have only had three negative months in three years. We had one year—I think we had eight negative months—but that is not going to happen in a bull run.

The question is, for those three years that I only had three negative months, could this be one? I think

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.