Today’s Nuggets

Dramatic Decline in BTC Short-Term Holder Cost Basis

Dell Calls Fink “Fascinating”

When Tether Mints, Buy!

BTC ETN French Pension Plans Launch

Hong Kong ETFs Return

ETH ETFs to Start Trading Soon

Raydium Continues to Dominate Uniswap

Tesla FSD is Coming Faster than Expected

The U.S. BEV Tipping Point

MSTR Beats NVDA

U.S. Rate Cuts at 100% Probability?

This story will be big because there is much to cover and the markets have been excellent. Things are rebounding nicely and many stars are aligning.

Crypto Market Update:

The market cap is over $2.4 trillion; and

the Fear & Greed Index rapidly returned to 65.

J-Man has been using the tools in the community for the last two years and is able to quit his day job.

I wish to remind everybody that these are special times and we have been in the right assets at the right time.

We must remain humble because the market can rip your face off in a heartbeat. So put stuff away, hedge, and take profits!

Every week, all the usual names seem to pop up. Refer to the unlock percentages for each of these tokens and be careful when investing.

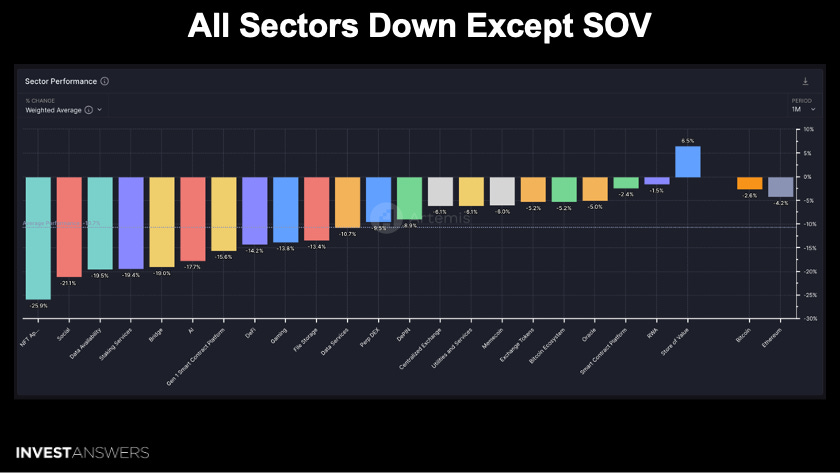

The last month of crypto performance has been rough but it has rebounded quickly.

All sectors are down for the month, except store of value, up 6.5%. Interestingly, Bitcoin (-2.6%) has outperformed Ethereum (-4.2%). Real-world assets are only down 1.5%, which will be bonkers this year.

Smart contract platforms are only down 2.4%, outperforming BTC and ETH.

This clown always made me laugh because if you go back to the origins of what Bitcoin is and cryptographers, they call them ‘cypherpunks’.

They are the type of people who wear t-shirts and shorts and would never dress like this complete fool, Faketoshi.

Craig Wright is discredited and faces perjury charges right now. He was found by the high court judge to falsely claim to be the Bitcoin inventor (Satoshi Nakamoto) and the crown is going after him hard now.

Beware of people like this.

This historical chart is due to Germany selling 50,000 Bitcoin in three weeks, which decreased Bitcoin's price and broke records.

Over the last 30 days, Short-Term Holders (STH) saw a significant drop in profitability, with over 66% of their supply moving into unrealized loss. This is one of the largest declines on record and indicates many "top buyers" now face challenges in their portfolio profitability.

In contrast, Long-Term Holders experienced minimal changes in their profitability because they bought when things were cheap. That said, things are rebounding fast despite the fears associated with Mt. Gox.

This was a stunning pop in Fear and Greed, back up to 65. Last week, we hit 25.

When the fear and greed are at 25, buy in a bull market, not a bear market. In a bear market, it can be down under 20 for a long time.

XRP is up, and people are so excited as they have been waiting eight years for things to pop. It is only up 8%.

Do not touch this token!

Everything else is green versus Bitcoin, except Toncoin. TON was down, but that had been popping for a lot of the period.

It was a big week for Bitcoin, up 14.72%. Again, risk happens fast!

There are 10 or 15 days every year when you want to be on the train. If you miss those days, you leave 80% of the gains in the garbage can. So, do not be fearful!

When others are fearful, you are greedy.

Digital asset investment products saw further buying on price weaknesses which was good to see.

The inflows were 1.44 billion last week, bringing year-to-date up to a record $18 billion. This is far surpassing 2021 inflows of only $10 billion. BlackRock has pulled in ~$18 billion alone year-to-date.

Bitcoin had the fifth largest weekly inflow on record, with $1.35 billion in dip buying.

Short Bitcoin saw the largest weekly outflow of $8.6 million since April, meaning people are not going short, which allows the market to move up. In addition, much of the price weakness was due to the German government selling, which left a lot of money on the table because of their stupidity.

A turnaround in sentiment occurred due to lower expected CPI in the US, prompting investors to add to positions.

A wide range of altcoins saw inflows - notably Ethereum - which saw $72M last week, the largest inflows since March. This is likely in anticipation of the imminent approval of the spot-based ETF in the US.

Solana had an inflow of $4.4M.

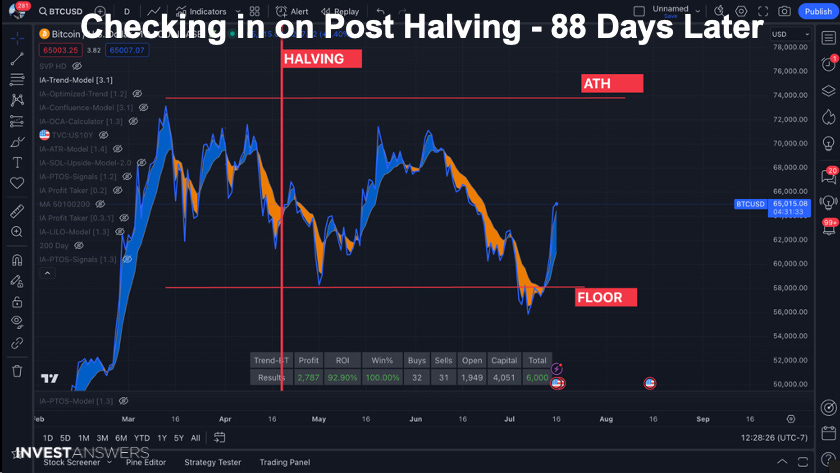

This is day 88 since the halving and I track this carefully.

We are in the middle of the box. Thanks to Germany, we did break through the floor but the rebound was nothing short of spectacular. We are now back halfway up to the all-time highs and get there very quickly.

Bitcoin can add $4,500 in a day and to return to all-time highs from where we are right now would only take two good days.

The Alt Season Index is up to 33. It did shoot to nearly 50 and rebounded a little bit. However, the alts are moving pretty nicely.

Here is a look at the last 90 days.

Remember, you will see different things pop up at various times, which can create varying perspectives. This is why we review this regularly.

Bitcoin has now been up 3.3% over the last 90 days. Solana had a big rebound, up 18%. Tron is up there as well, alongside FLOKI and BONK. TON is still up 233% over the last 90 days but is taking a breather.

Perhaps it is good that some of the meme coin excitement is leaving the market and people are beginning to focus on better projects.

The market depth is significant because it displays how much the market can absorb if there is a dump. This is why I care about this chart.

Given the market depth, the average daily volume of around $15 billion alone for Bitcoin for the distribution of about 65,000 Bitcoins worth approximately $2 billion.

At current prices, it could be absorbed by the market over a week or a little bit more without causing any severe disruptions, assuming liquidations are done gradually across multiple exchanges. However, these findings are only suggestive of the depth and maturity of the BTC market but should calm fears of liquidity shortage in the near term. This indicates that the market is mature and can absorb the dumps. This was probably the most significant silver lining of the German dumpage.

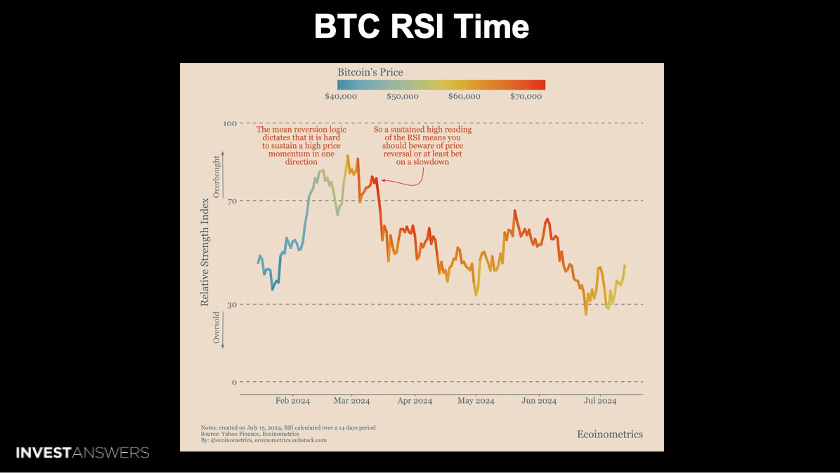

Traditionally, if you see an RSI above 70, that is in overbought territory. We saw this at the beginning of the year when the ETFs started buying lots of Bitcoin from the liquidity pool.

The oversold territory is 30. We saw a dip below 30 over the past couple of weeks at the end of June, which took us right down.

This is another foolproof signal. We have the top and bottom indicator, which takes in 22 different signals and creates a composite score.

You buy when the indicator is under 30 or when Feer and Greed is 25 in a bull market. It is that simple!

Suddenly, Michael Dell has been talking a lot about Bitcoin and conducting many surveys, combined with posts of Cookie Monster eating Bitcoin.

Many believe he could be Mr. 100 because he has the money. I calculated that about 1.7% of his total net worth is the size of the actual spend from Mr. 100 and he keeps buying 100 Bitcoin every single day.

Michael Dell saw BlackRock CEO Larry Fink's video, which he said was fascinating. Larry Fink said that his doubts about Bitcoin five years ago were wrong. These are strong words from the biggest money runner on the planet alongside a top 10 billionaire saying it is fascinating.

What does that tell you? Yeah,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.