Today’s Nuggets

ETH:BTC Ratio Lowest since April 2021

Nvidia Surpasses the Crypto

U.S. PPI Accelerating to Fastest Rate

Biden Makes Solar Expensive

Crypto Valley of Death

Solana DEX Volume Exceeds $1.7 Billion!

The First L2 on Solana

Polymarket Raises $70M

Is Battery Storage Overtaking Hydro?

The Most Wanted Jobs in the Next Decade

Crypto Market Update:

The global crypto market cap is $2.24 trillion and has hovered around this level for six weeks, with a 24-hour volume of $76 billion.

The price of Bitcoin is still $61,300 and BTC market dominance is 53.9%.

The price of Ethereum is $2,890.

The best-performing sector is DuckSTARTER, which gained 3%.

The Crypto Fear & Greed Index is currently Greed (66).

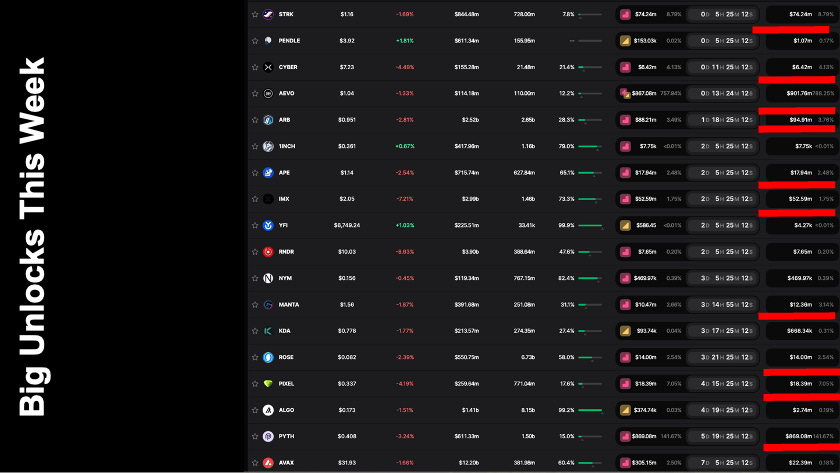

Here is the biggest unlock dumpage I have ever seen by far in all the years I have been reporting unlocks on OCTA every Tuesday:

STRK = 9%

CYBER = 4%

AEVO = 800%

ARB = 4%

APE = Always dumping

IMX = 1.75%

MANTA = 3%

ROSE = 2.5%

PIXEL = 7%

PYTH = 142%; we covered this one a couple of times already so people would know

You can be in a position and you can change your thesis. This is when you need to swap trains.

I hope that is very clear and worth mentioning again.

The ETH:BTC chart has fallen 30% year-over-year.

What is ugly about this is that the orange continues to have that girth and stay strong.

The trend is nasty.

Per James Van Straten, "The Ethereum to Bitcoin ratio recently hit 0.046, a low not seen since April 2021, briefly revisiting levels from April 2024. This downward trajectory highlights Ethereum's ongoing struggle against Bitcoin's dominance in the digital assets market. Ethereum's inflationary trends and pending ETF decision exacerbate market challenges."

In full disclosure, I had a 0.5% allocation towards Ethereum and it is now gone, so I am out of the position choosing to get on a different train.

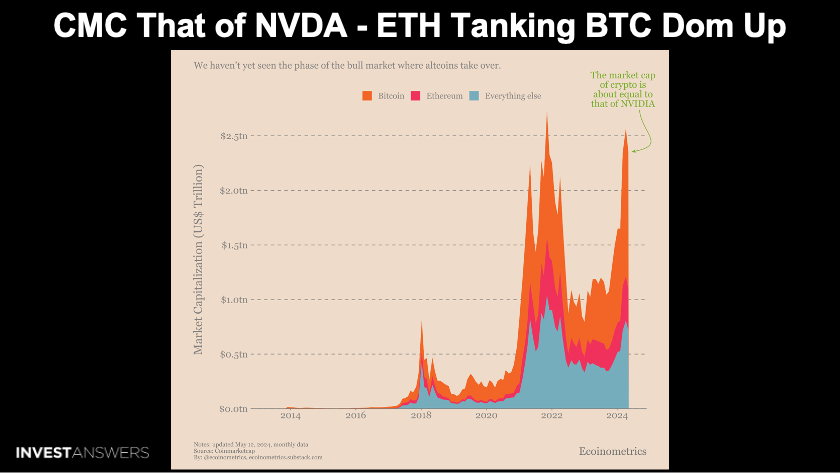

The entire crypto market cap is the same size as the market cap of NVIDIA.

That is bonkers to think about!

Due to the amount of liquidity that the meme is sucking in, they are now almost at levels that were near previous all-time highs. In addition, BTC dominance is up, ETH is down, and the other alts are up.

This time, it is a very different market!

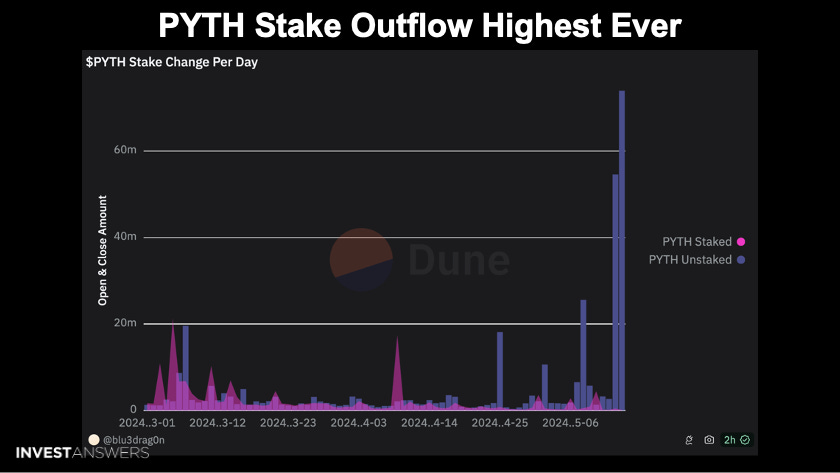

Yesterday was the highest staking outflow of PYTH ever recorded.

While today is not over yet, yesterday's $54 million of unstaking has already been dwarfed by today's $73 million. Everybody is getting out because they fear the monstrous unlock we covered previously.

This is the danger of crypto and it is still the Wild West.

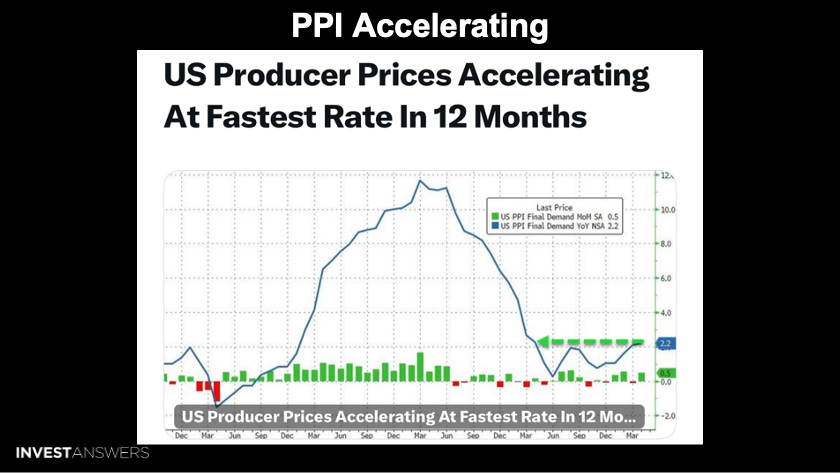

This is the PPI chart that rattled the markets this morning.

However, three hours later, the markets forgot and rebounded. The U.S. producer price index is accelerating at the fastest rate in 12 months.

The Produce Prices Index drives the Consumer Price Index. Increasing PPI raises businesses' costs, meaning they must raise prices, fuelling broader inflation and eroding purchasing power.

If the Fed wants to achieve its magical 2% rate, it must raise interest rates. This is why the FOMC is so perplexed and boxed in and it rattles the markets.

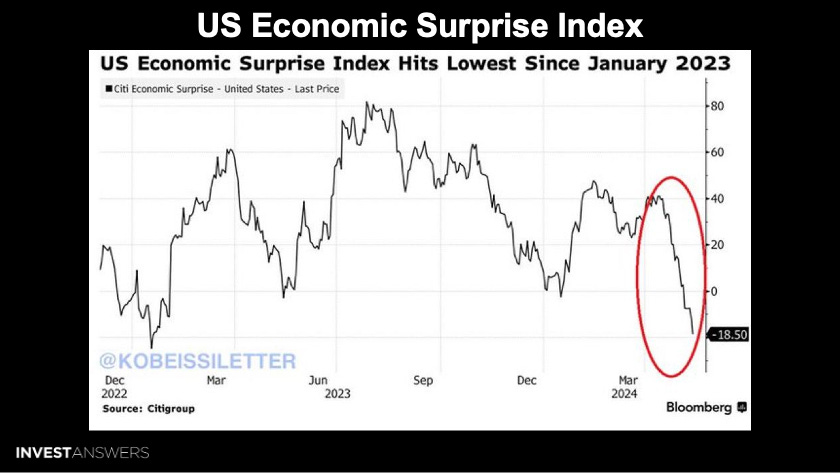

This is the U.S. Economic Surprise Index, which has dropped to its lowest level since January 2023.

This measures the data relative to expectations, and we have not seen such nasty surprises in a long time. The index hit minus 18.5 in May, meaning most data has been below expectations in recent weeks. The gauge has declined by nearly 60 points in one month, marking the steepest decline since early 2022.

But if you ask government officials anything, they will tell you everything is fine and rosy. The economy is smoking hot; everybody has a job, and everything is fine.

No, it's not!

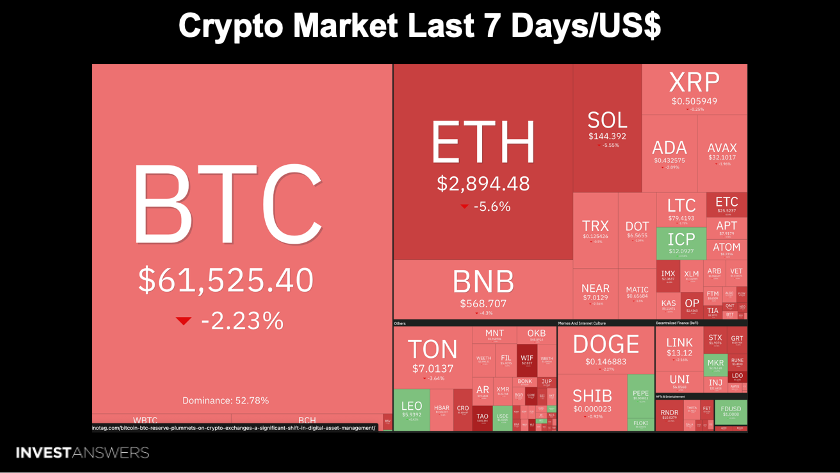

Not an exciting week for crypto:

ETH is down 5.6%;

SOL is down 5.57%;

ICP is a little bit up;

MKR is a little bit up; and

LEO is up.

In dollar terms, Bitcoin has been down two percent since I did this a week ago, alongside everything else in crypto.

We thought it would be 70 days of chop with maybe up to 90 days post-halving. We are on day 77 of this downdraft but sometimes things are quiet before the storm.

We will see if a storm is coming…

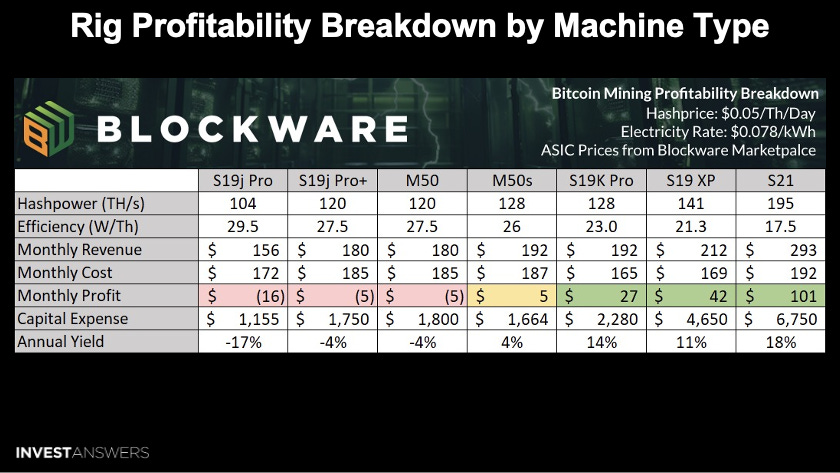

Let us look at miner rig profitability…

Many people think mining is easy but

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.