Today’s Nuggets

Investors Load Bitcoin Ahead of Election

Fink Bullish on BTC

Confidence in FIAT and Bonds Tumbling

Every Day, New BTC Corporate Treasury

Tether Update, MSTR Playbook

Sellers Out of Coins

Coinbase Down 40% Since IPO

DEXs Killing CEXS

AMZN Crush Earnings up 55% & $15.3B Net Income

1 Million U.S. Job Vanishing in Revision

In this story, we will break down the week and analyze where we have come from as we perform a postmortem of October.

We will look at some on-chain data to see if that is true and what happened over the last few days.

As I have said before, anybody buying bonds needs their head examined.

The debt is going up so high and everyone knows fiat is going to zero, so they cannot sell all their bonds.

Bonds are not selling and CNBS is staying true to its name.

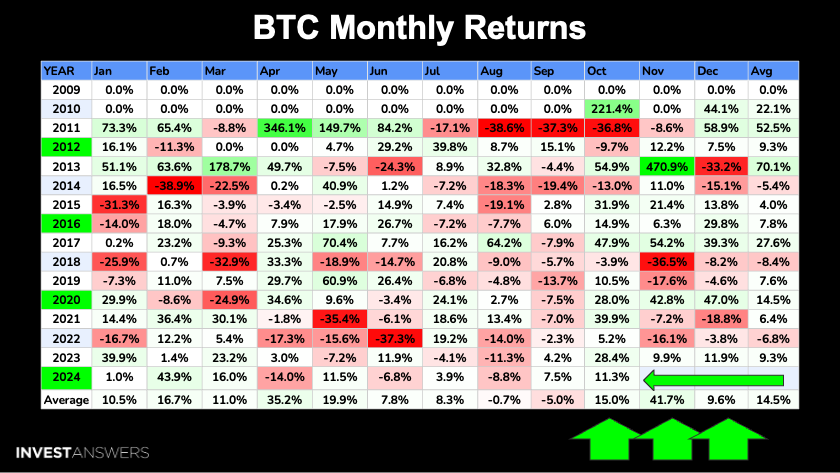

Bitcoin was up 11.3% in October, on top of 7.5% in September.

Remember, the first half of the month is always bumpy but BTC ended October well. The biggest month for Bitcoin is Moon-vember!

The ETFs experienced a monster October.

BlackRock dropped nearly $5 billion alone into the ETFs in just 21 trading days. This is a crazy huge amount.

Larry cannot get off of the television…

He was on Fox Business News, stating, "I am very bullish on the long-term viability of Bitcoin." Larry is kind of serving as the chief marketing officer of Bitcoin. Well done, Larry.

BlackRock owning 2% of the total BTC supply in just 10 months is kind of stunning.

Phase three of accumulation is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.