NUGGETS OF ALPHA

Grayscale outflows are less intense than they were over the previous three days

The ETFs consumed an additional 21,100 Bitcoins above the Grayscale dumpage

The new U.S. ETFs bought 120,000 BTC in eight days—the crunch is coming

Since the FTX Collapse in November 2022, the BTC dominance has moved from 38.9% to 49.8%

The SOL/BTC ratio has increased by 290% since October 2023

When entering a stock investment, you want the growth to outpace the P/E ratio

NVIDIA's market cap increased by $320 billion in three weeks, up 27% in 2024

The bottom 50% of Americans own 5.8% of the wealth but over 62% of the debt

In this lesson, we will examine trillions and how small they are today. We will also discuss why certain things do not move and why others do.

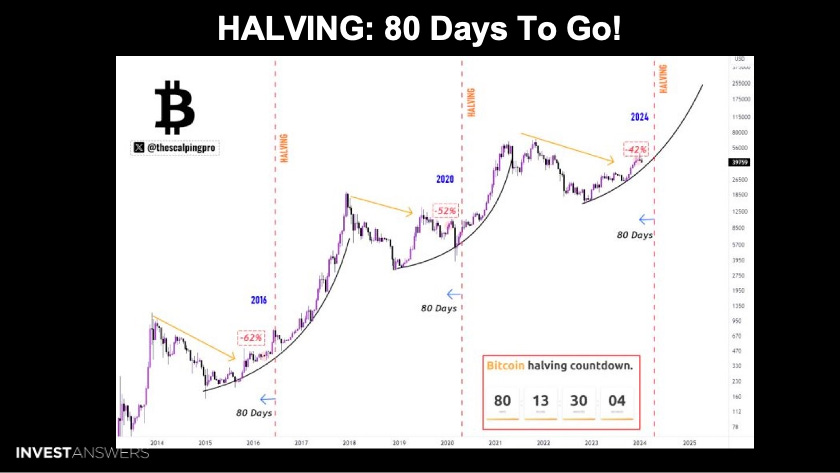

If you look at these relative curves over the last cycles, you can see how Bitcoin has performed after it is within 80 days of the halving. Bitcoin typically goes up from this exact point in the cycle, but the difference this time is that we have the spot ETFs combined with the GBTC FTX effects.

Will this future curve for this fourth run be more vertical? I believe so.

These are the 1,000-plus Bitcoin holders. The count has grown from about 1,480 to 1,513, nearly a two-year high. Notably, the whale withdrawals have been outstripping deposits for six consecutive days.

This is day eight of tracking the BTC movement and money flow in the spot ETFs. The green line at the bottom means the Grayscale outflows are less intense than they were over the previous three days. It is letting up slowly but surely. The Bitcoin price rebound also indicates that the Grayscale dumpage is slowing.

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.