Today’s Take

BTC (32%) and ETH (36%) are both up big since January 1st

Solana made the biggest move to date in ‘23, breaking back into the top 10

Technology stocks bounced back, with Tesla, Google, and Apple leading the way

If history repeats, the S&P 500 could hit US$4,448 by year-end

Markets bottom way in advance of an economic recession in the U.S.

Piper Sandler released a promising outlook on Tesla this week

All four big banks have come out with statements to brace for a recession

Markets are now pricing in a 91% chance of a 25-basis point increase

In December, the U.S. CPI printed its sixth consecutive month of decline

The EU’s MiCA proposed crypto regulation has been delayed until April

U.S. home sales are now down 34% year-over-year

The breadth and reach of the World Economic Forum are concerning

The U.S. Federal government’s deficit continues to explode

This recap will review what transpired in the markets and what happened in Davos this week.

The bears had their field day in 2022, fueled by black swan events. For many, this has become the “most hated crypto rally,” as many in the space are missing this run-up.

BTC and ETH are coming off their bottoms and quickly reclaiming their high-performing asset status.

Amnous’ remarks are in response to a published BBC article explaining why inflation is good for the working class. I am left wondering who the BBC works for today.

I tend to focus my investment selections on a few assets but go a mile deep in my analysis. For example, I focus on Bitcoin and the Layer 1 chains in crypto.

Solana made the biggest move in 2023, again breaking it to the top 10, surpassing Polygon MATIC’s market cap. However, Solana remains the best upside opportunity in crypto based on fundamentals like daily active users and network activity.

Technology stocks bounced back, with Tesla, Google, and Apple leading the way.

The big banks were hit hard this week and face uncertain times ahead.

If history repeats, the S&P 500 could hit US$4,448 by year-end.

Overall, investor sentiment is beginning to shift bullish despite the following:

Macroeconomic headwinds

Federal Reserve future tightening

Looming recession

Remember, markets bottom way in advance of the declaration of an economic recession in the U.S.

The names we will be watching for Monday’s report:

Microsoft - interest in AI & ChatGPT?

Tesla - can they pull out an earnings surprise?

Mastercard & VISA - state of credit card delinquency?

Piper Sandler is known to be a very conservative analyst. However, they made a bold statement with their recent report, “Tesla will easily achieve more than 50% delivery growth in 2023.” Despite lowering their vehicle prices, Piper Sandler believes the margin profile of new capacity in Shanghai, Austin, and Berlin is higher than many expect. Piper Sandler stated, “we don't think most investors appreciate the extent to which lower pricing could support Tesla's market share.”

Piper Sandler highlighted Tesla's Full Self-Driving software, which they see as “a 'free' call option” at this valuation.

Due to the price cuts, Tesla stands apart from the competition when you consider features, reliability, and safety. Even the Chinese market is recognizing this and will not remain loyal to their local market’s E.V. manufacturer.

This data from the U.S. Central Bank is alarming for most Americans. The rich own almost everything and call the shots.

All four big banks have come out with statements to brace for a recession.

I believe traditional banks are set up for disruption with the advance of crypto.

The forecast beyond February is now down to only one more 25-basis point increase.

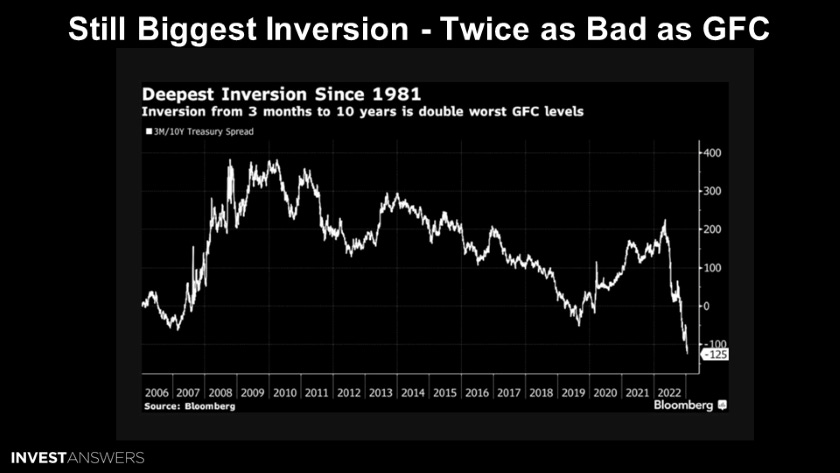

The key takeaway from this chart is that it is twice as bad as when the Great Financial Crisis occurred.

The deflation is happening fast, which is good.

The European Union’s MiCA is the first regulation on crypto wallets and reserve requirements for stablecoin users. The E.U. wants this to become the regulatory standard for the entire world. The delay is because the bill must be translated into twenty-four different languages.

U.S. home sales are now down 34% year-over-year.

Over the last year, this is a 66% drop in commercial real estate sales.

Google laid off 6% of its staff, the largest in its history.

I hope the Fed realizes that the workforce's structure has changed soon.

Google’s MedPalm solution will directly compete with ChatGPT. MedPalm can handle questions on medical licensing exams with great accuracy than any other AI, as well as most human doctors.

Google is not dead and will bring its AI stack to market at some point. This makes me much more bullish on Google than Microsoft in the coming years.

This report aims to remove all of the noise from Covid and new food delivery options. Losing 16 percent of customers will sadly put a lot of restaurants out of business soon.

This AI art represents querying “who we can trust,” which I am using to transition into my review of the World Economic Forum news from Davos.

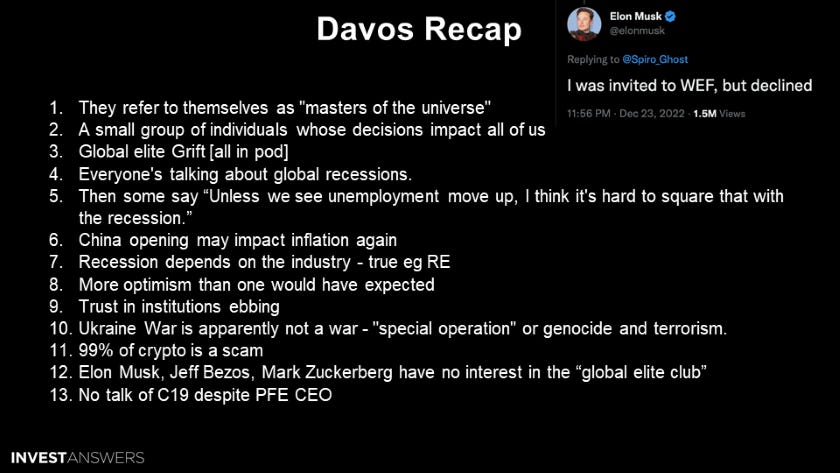

Davos Recap

Davos convenes some of the most powerful and wealthiest people on earth, representing the heads of big pharma, banks, and governments.

They refer to themselves as "masters of the universe"

A small group of individuals whose decisions impact all of us

Global elite Grift per the “all in” podcast

Everyone's talking about global recessions

Then some say, “Unless we see unemployment move up, I think it's hard to square that with the recession,” which is straight out of the U.S. Fed’s playbook

China opening may impact inflation again

Recession depends on the industry; true, i.e., real estate

More optimism than one would have expected

Trust in institutions ebbing

Ukraine War is apparently not a war; "special operation" or genocide and terrorism is the spin WEF put on the subject

99% of crypto is a scam; I agree

Elon Musk, Jeff Bezos, and Mark Zuckerberg have no interest in the “global elite club”

No talk of C19 despite the Pfizer CEO’s attendance

The breadth and reach of the World Economic Forum’s leaders are concerning.

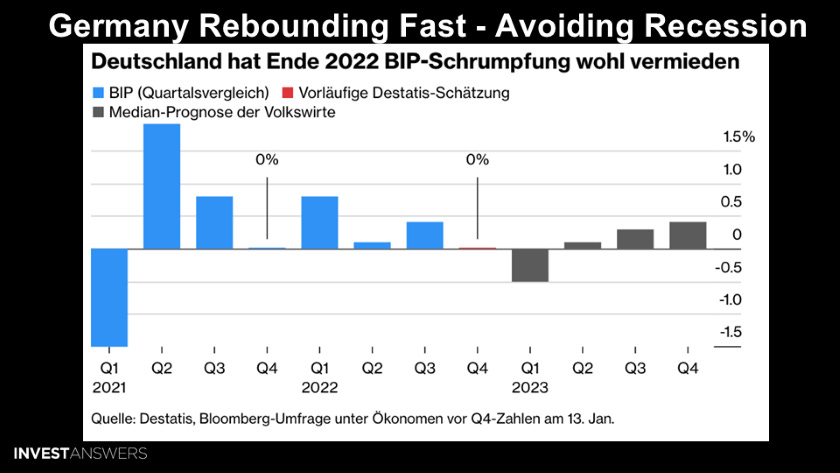

It appears Germany has solved their Russian gas problem for this winter and will hopefully bounce back well, avoiding a deep recession.

Big pharma desired to control the market with their expensive products.

Kids 12 and Under Covid Vaccination Math

Fewer than 1M kids have been jabbed, which equates to less than 2% of the population in the U.S. I am not anti-vax, but I believe it is not warranted for this segment of the population.

U.S. Government Deficit Exploding

US$85B worth of red ink in Dec 2022 compared to US$21B in 2021

Expenditures increased by US$540B

Receipts totaling US$455B

Receipts in 2023 will decline due to a lack of capital gains tax revenue