Today’s Nuggets

Government Corruption is Widespread

Bitcoin Sharpe Ratio Lower Than Previous Runs

Dead Chain Throws Shade at ETH

BTC Alignment with Global Liquidity

Bitcoin’s New Chief Marketing Officer

MSTR Rip Continues

In this lesson, we will examine a wide range of on-chain data.

We have run a lot over the last week and this story will build upon last week's OCTA entitled Pre-Fed Run.

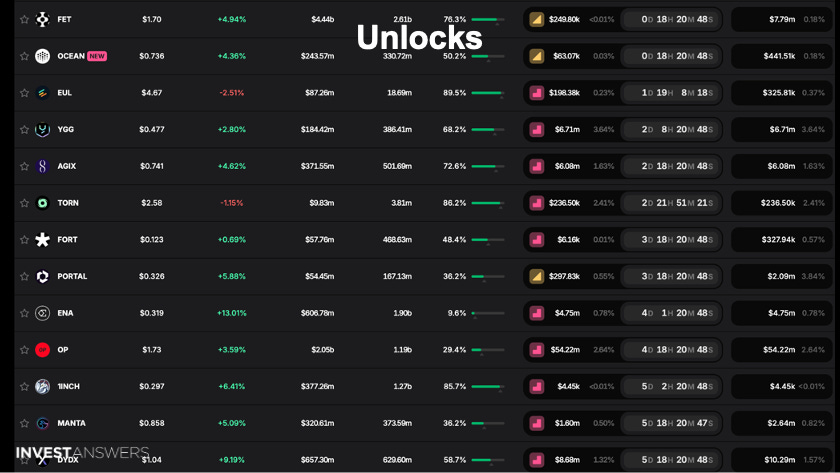

Yield Guild Games returns to the list and the gaming tokens are always raining down tokens.

Ajax, Torn, Portal, and ENA are always raining.

Nancy Pelosi sold nearly $1 million worth of Visa stock on July 1st.

Right after that, the U.S. Department of Justice sues Visa. Again, having insider information matters. Government workers get an edge and I think it is just criminal.

The FCC just fast-tracked George Soros' purchase of basically all the radio stations in the United States so they are able to control the narrative.

It is like a cheap way of buying Twitter (X.com). I have seen the damage that George Soros has done to a place like California.

I hope him having control of the whole radio waves will not create another one true narrative. It is always good to have a diverse set of views from different sides and all sides.

The government tells Gary Gensler that we could not have had a more historically destructive or lawless chairman of the SEC.

If you do not believe that the government is corrupt and lawless, why do you not believe a government official who runs part of Congress?

I hate corruption, lies, and all that stuff…

If you look at the history here, focus on the peak sharp, and normally we run around the 27-22% range.

This is technically still an incredibly good return based on historical assets. We are up over 4x off of the bottom, not bad from $15.5 to $64k right now. But at the same time, we have a long way to go.

I do believe we are still

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.