Since 2022, there have been primarily two disruptive narratives in our world: Crypto and AI. We will be covering the AI narrative in depth.

There are many crazy things happening in the world of AI and compute and I will be doing this once a week from here on in because there is so much changing. AI compute is increasing at 10x every nine months and will exceed the sum of all human intelligence in less than five years.

Next year, AI will already be smarter than the smartest human, if not already.

Tesla currently has nearly 7 million vehicles on the road doing 2,000 miles a second, all being used to train AI at scale. Tesla now has three of the world's largest AI clusters.

This lesson will be heavy on Robotaxi, energy, valuations, price targets, TA, competition and a ton more.

This lesson is inspired by the Tesla AI roadmap that was unleashed.

Tesla also shot up nearly 6% this morning after a big gain yesterday. The stock was at $200 on Thursday last week, up more than 15% in less than a week.

Elon said in a conference call in July that Tesla will likely launch FSD overseas by the end of this year or early next. Well, it is happening. Yes, they may need some regulatory approval in certain countries but you cannot stop advancements in this area.

Tesla is an AI robotics company that aligns with its roadmap. The robots happen to have wheels - there is no difference. FSD v13 is coming with 6x improved miles between necessary interventions. I know some people who can drive 300 miles with zero intervention, which means with v13, you can go 1,800 miles without an intervention.

The biggest news is the target of Q1 2025 for FSD in Europe and FSD in China. There will be no problem with regulatory approval in China. It is going to happen and we are going to break down what that means for the stock price as well.

Tesla has about 2 million cars running around in China, about 2 million in Europe, 2 million in the United States, and another million in different parts of the world.

What does that mean for the stock?

If you have tried FSD and used it, you will not get behind the wheel of a car without it.

Here is a very crude, simple table related to FSD's impact on the Tesla stock. I assume a conservative 15% of Tesla vehicles will convert to FSD, leading to 900,000 vehicles in 2025. If the monthly subscription fee is $100, then annual revenue is $1.08 billion. If Tesla achieves a 20% conversion, that generates $1.44 billion in annual revenue, and at 25% conversion, it equals $1.8 billion.

It is not just how many people would convert and pay a hundred bucks a month. This company is selling a $40K product that turns into a recurring SaaS software model.

This is a really exciting thing that people have to get their heads around.

In addition, three OEMs are in talks with Tesla about licensing their FSD right now. In the next five to ten years, a car without FSD may not even be allowed on the road and will be completely obsolete as it will be a dumb car.

Volkswagen is to invest $5 billion in the EV startup Rivian for a software license so they can understand how to make software work on a car.

Rivian does not have any FSD, which is the crown jewel. Rivian has got something that plays music and Bluetooth, maybe the ability to do an over-the-air update.

Imagine three OEMs spending more than five billion to access FSD and creating a recurring revenue stream for Tesla.

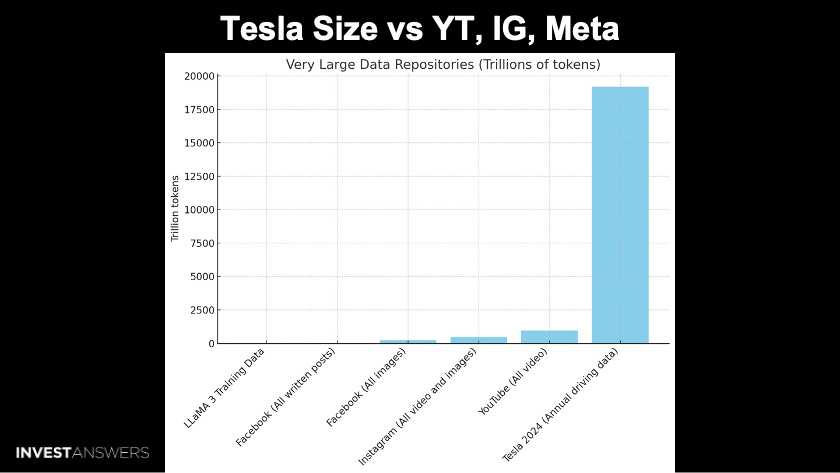

This chart is from Brett Winton from ARK Invest.

He stated that Facebook has 10x the proprietary language data on the database used to train the LLaMa models.

In images, Meta has 20x more data than that. Instagram and YouTube have 2x more data in uploaded videos.

However, Tesla's data capture-ability dwarfs that with at least 20x more data than that.

Here is another chart to give you some perspective on how much data Tesla has versus YouTube, Instagram, Meta, etc. YouTube is a spit in the bucket compared to the data that Tesla has on hand.

Tesla has been mining data for over eight years.

Every vehicle records and uploads its history to a massive number of data centers. Nobody uses data for real-world AGI or baby AGI applications except for Tesla. A few investors are beginning to wake up to this fact.

We know investing has fallen down but it is all AI or nothing.

AI companies captured 35% of U.S. startup investment, up 169% since 2022. $106 million was raised by non-AI in the US this year.

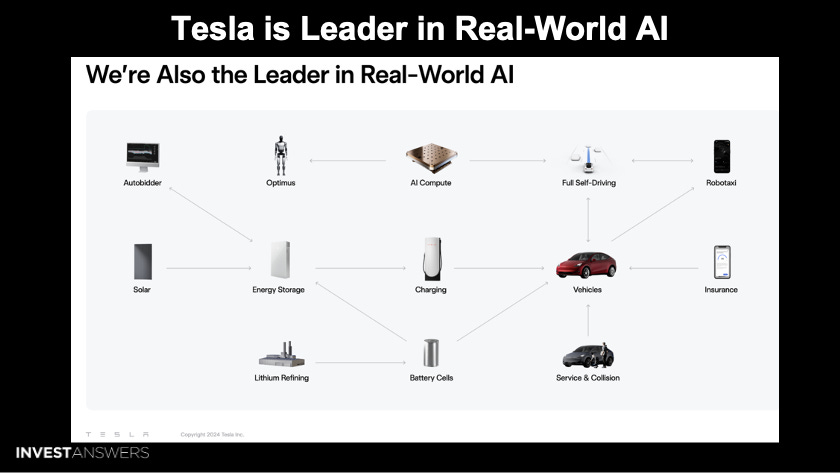

This graphic supplies proof of how Tesla is the leader in real-world AI.

I do not know if lithium refining is AI-driven or not but the rest certainly are. It is an incredible company.

Elon co-founded and provided the initial seed capital for OpenAI. Then he got shafted and stabbed in the back.

Elon's new startup, xAI, has built a 100K GPU cluster.

Tesla in Texas has another 100K cluster and another 35K cluster of H100s in California. Dojo is now live, up and running, and being used for training FSD and robotics that ultimately will be used by millions of people.

The player with the most compute will

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.