Today’s Nuggets

BTC Like $42K Last Cycle?

CPI and PPI Came in Below Expectations

Greed Kills, Patience Pays

Saylor is Back with Millions

Miners Continue Post-Halving Selling

Fidelity Calls Bitcoin “Exponential Gold”

Bitcoin Adoption Exceeds Internet

Bitcoin Bear Trap is Set

Mining Industry is the Highest Renewal Energy Industry

This week, I took time to assess the entire situation of exactly where Bitcoin is right now - called SWOT analysis. We are at a juncture where there is mixed sentiment in the market. Good stuff is happening…

Some bad stuff is taking place that leads to some price suppression. Remember, when you have a $70,000 asset that goes up and down $500 bucks to $1,000 - that is nothing, especially in terms of Bitcoin.

Crypto Market Update:

The crypto market cap is $2.4 trillion;

The volume is $65 billion, down about $20 billion from yesterday;

The Fear and Greed Index is 74; and

Bitcoin dominance is still 55.4.

Let us check out the Bitcoin monthly returns before jumping into the charts. We are down 2.9% for June, which is unnerving many people in the crypto community.

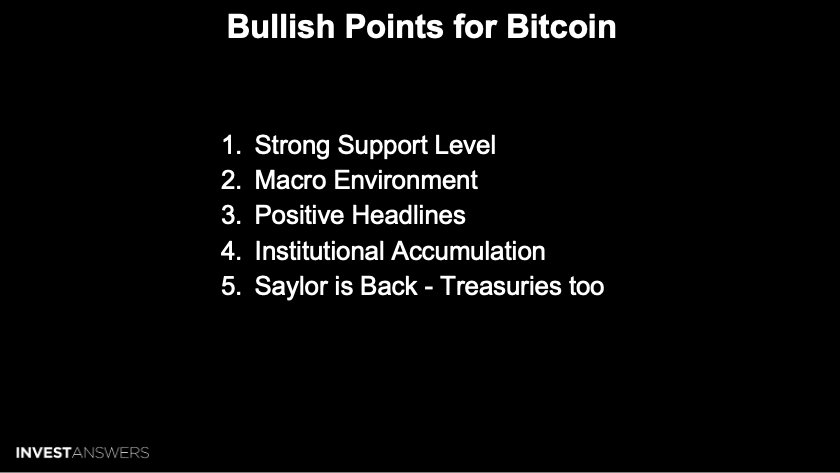

Now, I will explain how I view the current Bitcoin market at this juncture:

Strong Support Level: Bitcoin has been consistently supported around the $66-67K area (Level 7 on the LILO model) for weeks and months, indicating a solid floor. Therefore, I have referred to this as the $42K level in the last bull run.

Macro Environment: The CPI and PPI came in below expectations. If we believe government data is becoming more favorable for risky assets like Bitcoin, the overall economic environment is moving up. Most importantly, liquidity is moving up, and we are headed into a large expansion cycle that will lift all boats.

Positive Headlines: Despite recent struggles, news like ETF approvals and political support from prominent figures are fundamentally bullish.

Institutional Accumulation: Institutions and pensions have been accumulating Bitcoin, suggesting confidence in its long-term value. Whales are stacking per on-chain data. Saylor is back with the MicroStrategy corporate treasury, and other companies like Metaplex in Japan are joining them.

We have bad stuff that is counterbalancing the good stuff, making this part of the cycle tricky.

Range Bound Movement: Bitcoin has been unable to break the $71-73K level to make a new all-time high, so we are stuck at layer 7. This creates frustration and bearish sentiment among traders who want to get rich quickly. Greed kills and patience pays in markets.

Crypto Weakness: Ethereum and Solana have seen significant declines, with Bitcoin dominance hovering around 54%, indicating overall weakness in the crypto market. I believe the altcoin market follows Bitcoin.

Technical Selling Pressure: Selling pressure from GBTC, hedge funds are playing games, the Mt. Gox overhang, and profit-taking from the year's earlier run-up are suppressing prices.

Minor Selling: Bitcoin miners are selling their inventory post-halving, adding to the downward pressure on prices.

Lack of Immediate Catalysts: The market is missing a clear, immediate catalyst to drive prices higher, leading to stagnation and potential further declines. People want to know when is the next big Saylor coming in.

All of these factors are keeping a lid on things.

The most important thing is the timeframe right now. We are in the 90-day post-having shakeout.

Therefore, we have 34 days to go!

Think of this time frame as similar to a periscope when looking at the horizon.

We are in the middle of the range between the all-time high and the floor. The trend is still up (blue shaded line), but we are bang on that $65K level. We have 34 days to go to get through this period of the cycle. We are moving into the July/August summer period, which is also normally slow.

This puts a lid on things as people start spending their money in September.

Saylor stated that he will be buying Bitcoin when it is at $8 million and that he will be forever buying the top. Michael Saylor's 21 Rules for Bitcoin calls Bitcoin 'Chaos' and an 'economic virus' are as follows:

Those who understand Bitcoin buy Bitcoin. Those who do not criticize Bitcoin.

Everyone is against Bitcoin before they are for it.

You know you grasp Bitcoin when you know you'll never fully understand Bitcoin. You will never be done learning about Bitcoin.

Bitcoin is powered by chaos.

Bitcoin is the only game in the casino where we can all win.

Bitcoin will not protect you if you do not wear the armor.

Bitcoin is the one thing in the universe you can truly own.

Everyone gets Bitcoin at the price they deserve.

Only buy Bitcoin with the money you cannot afford to lose.

Tickets to escape the matrix are priced in Bitcoin.

Bitcoin insight is restricted to those who need to know.

All your models will be destroyed.

The cure for the economic ill is the orange pill.

Be for Bitcoin, not against fiat.

Bitcoin is for everybody.

Learn to think in Bitcoin.

You do not change Bitcoin; it changes you.

Laser eyes protect you from endless lies.

Respect Bitcoin or it will make a clown out of you.

Do not sell your Bitcoin.

Spread Bitcoin with love.

If Saylor says Bitcoin's going to $8 million, what would Bitcoin's market cap be?

Assuming it happens when there are 20 million Bitcoin, that would be a $160 trillion market cap - right now, the market cap is $1.6 trillion.

The question is, when will this occur? Is that 2045, 2040, 2030?

We know what happens with

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.