NUGGETS OF ALPHA

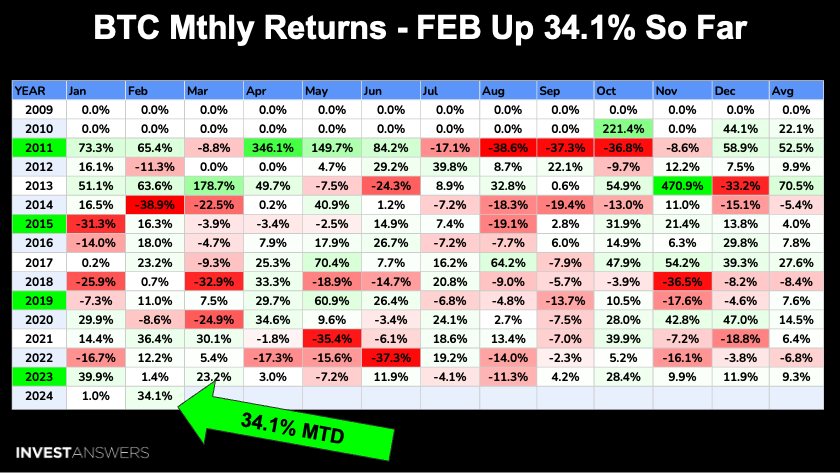

Bitcoin is up 46.41% in February so far (real time)

Bitcoin's Remarkable Performance

IA Crypto Compendium Dashboards

Ethereum's Upcoming Developments

ETF Influence and IA Price Predictions

Crypto Market Resilience

Impact of High Interest Rates

Technological and Financial Innovations

Market Sentiments and Behavioral Insights

Comparative Analysis of Investments

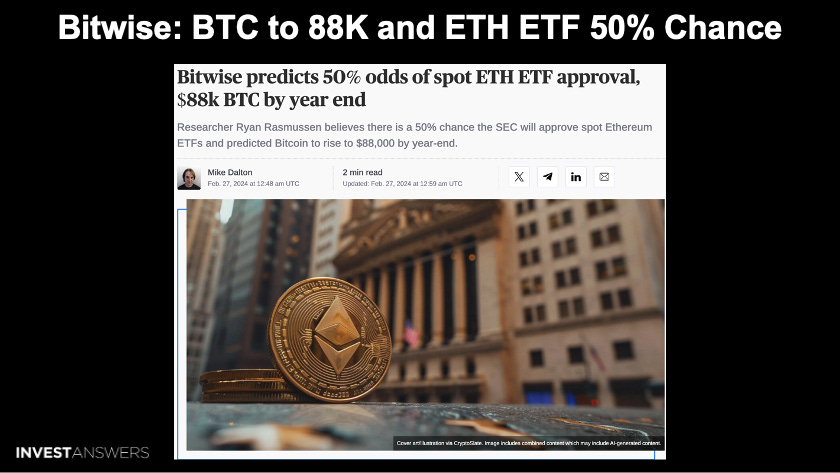

Bitwise predictions

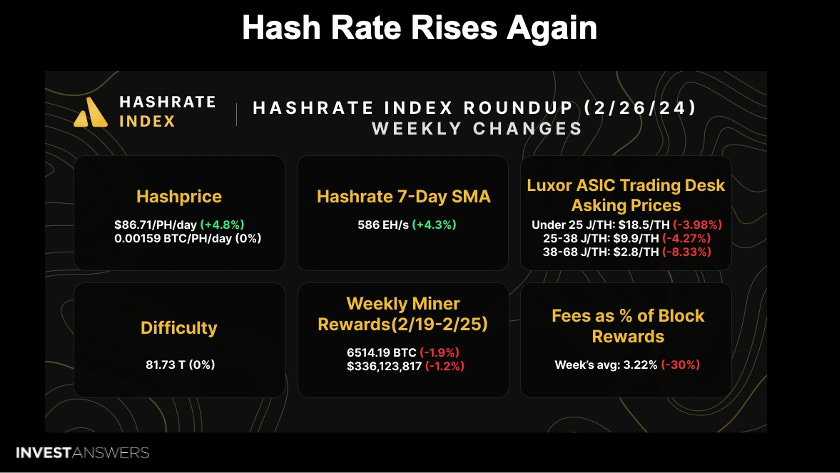

After a dip last week, the hash rate rose again, and now it is up 4.3% or 586 EH/s. The more the hash increases, the more pressure it puts on the miners.

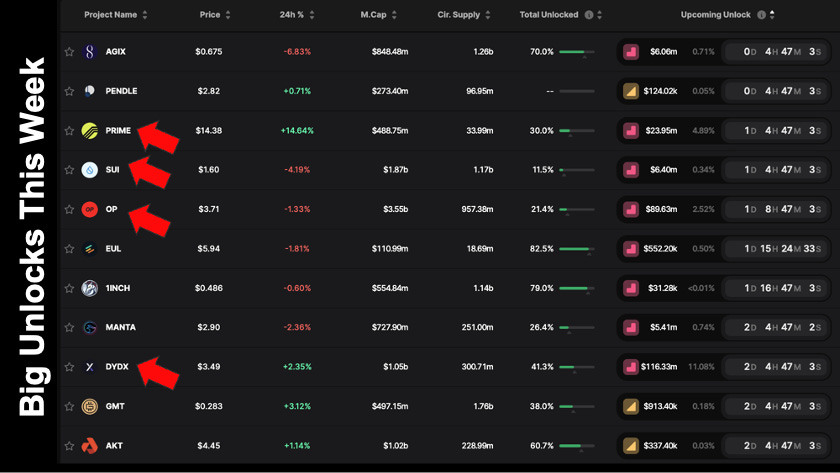

Ugly Unlocks this Week:

PRIME = 4.89%

SUI = 0.34%

OP = 2.52%

DYDX = 11.08%

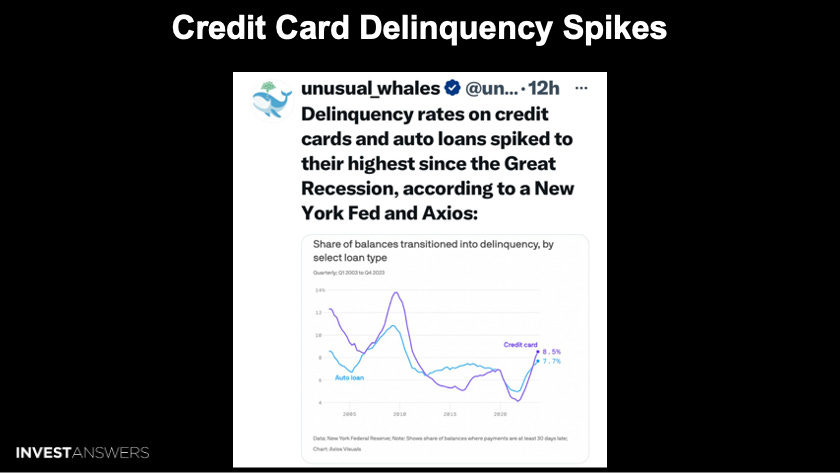

This is what high interest rates do, and we have yet to see the damage. People might lose their cars, so it is a very sad time. Watch your credit!

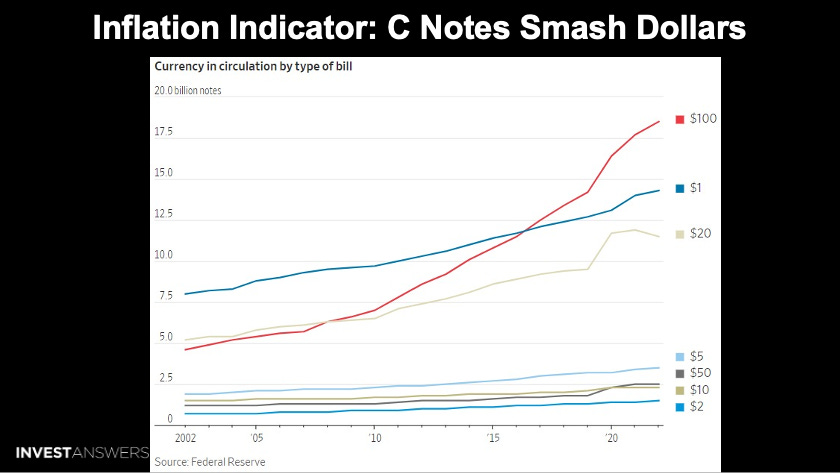

This chart displays the historical supply of U.S. dollar bills. What stood out is that one-hundred dollar bills are far more common than one-dollar bills. You can not buy much with a single dollar anymore.

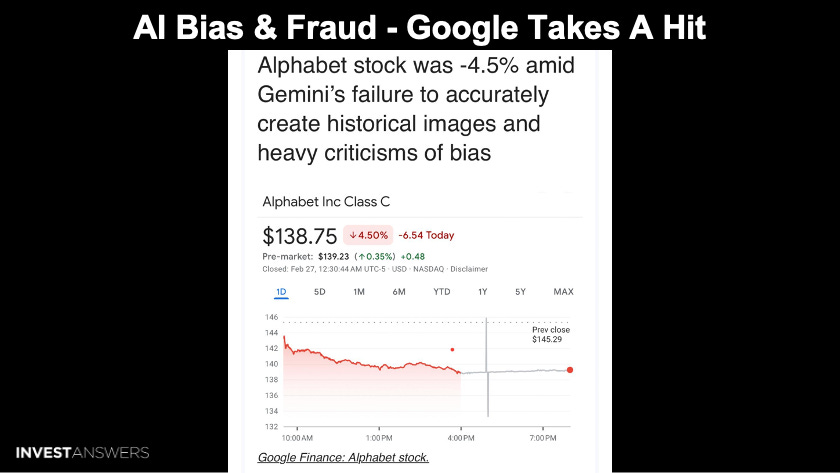

Google took a hit, dropping 4.5%, likely due to its AI’s failure to create historical images accurately, and the company is under heavy criticism for bias. In my opinion,

this is a good thing–I hope big tech will become less biased and more honest.

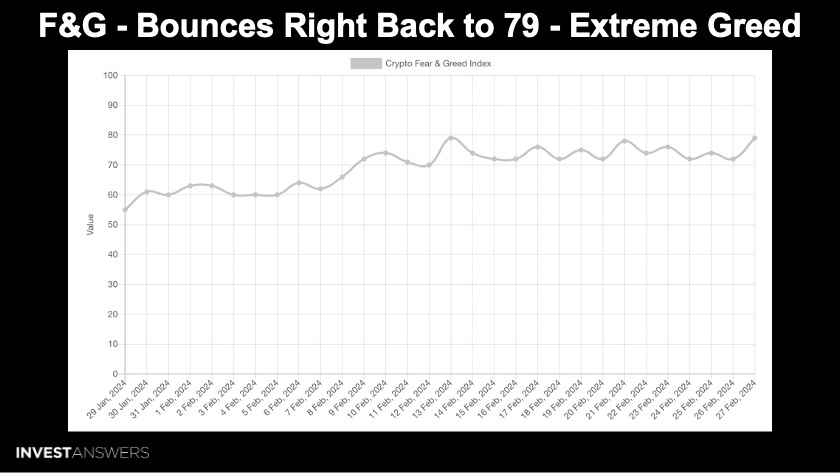

The Fear & Greed is back up to 79, rising from the 76 level last week. This is more of a sentiment or FOMO indicator, and it does not mean things will crash.

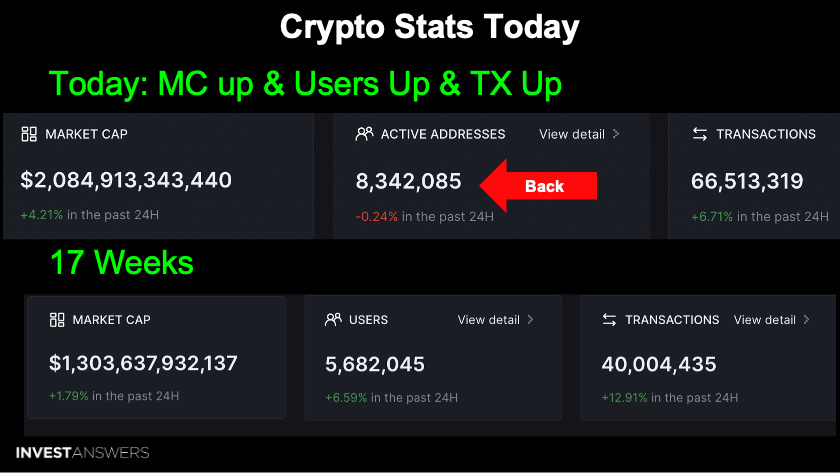

Last week, we observed a dip in active addresses in crypto. Well, it is back now, sitting at approximately 8.3M.

The crypto market cap went from 1.3 trillion to 2.084 trillion in 17 weeks.

The transactions rose from 40M up to 66M.

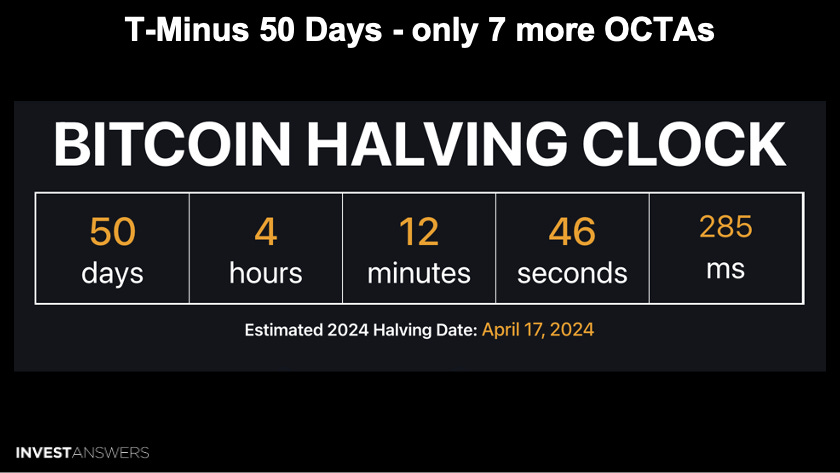

Only have seven more OCTAs (my weekly Tuesday YouTube series) until the halving.

This was yesterday. Today it is up 46.1% for FEB so far. February is now up 34.1%, and as I promised in January, this month would be great. The ETFs have changed everything.

Most of the market was up slightly last week. BTC & ETH are the two names in the sun right now. Bitcoin has its pre-halving, and the ETFs serve as a catalyst to light things on fire. ETH has the Dencoin upgrade alongside a potential ETH ETF coming.

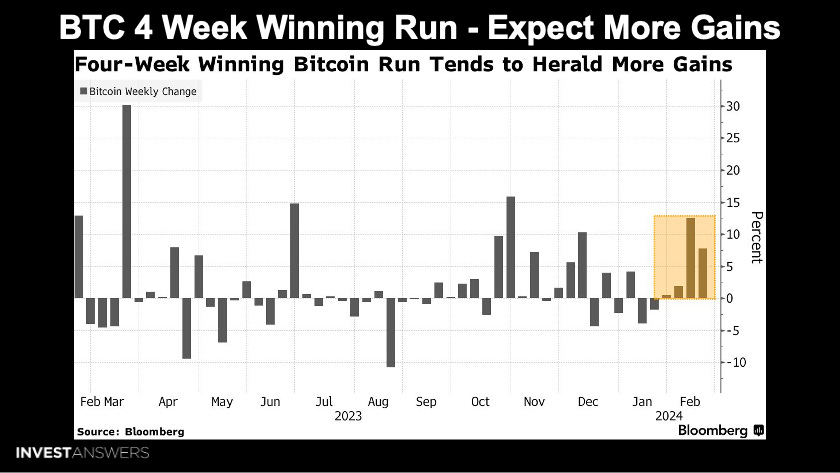

A few weeks ago, I warned that when you have four weeks running in a row, you can expect more gains in week five. This was bang-on and an example of perfect pattern recognition. The returns were insane, particularly over the last 24 hours.

This chart displays how far we have come in this cycle so fast. You will notice we had the first and second high due to a fake-out squeeze that nefarious actors manipulated. The current trend is going vertically higher and faster than many in previous cycles, bringing us within 18% of the all-time high, not adjusting for dollar debasement.

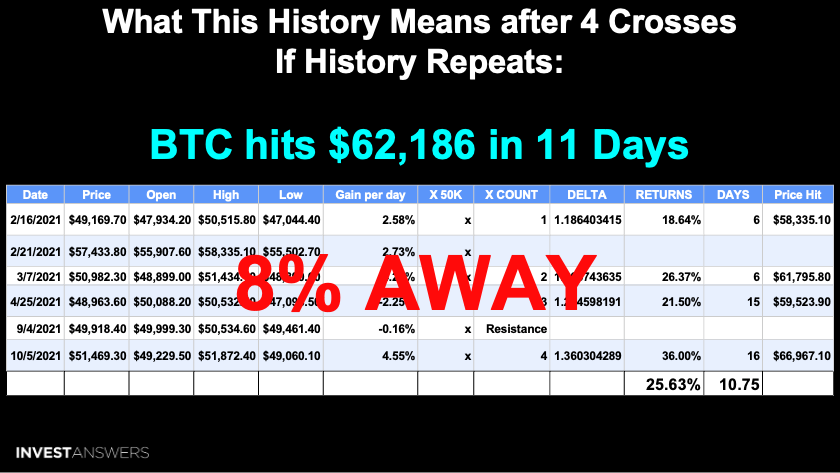

In a previous video I stated that Bitcoin will hit $62,000 in 11 days if history repeats. This was simply a breakdown of the actual deltas experienced in pre-halving runs at the exact period of time in the previous cycles. The good news is that I was pretty close, as we are only 8% away from hitting the model's price prediction. It ended up hitting 64K after 13 days…. so I was off - it took 2 days longer and went up $2,000 higher!!!

$88,000 at this rate is an easy target, considering we are at nearly $60,000 right now. We shall see.

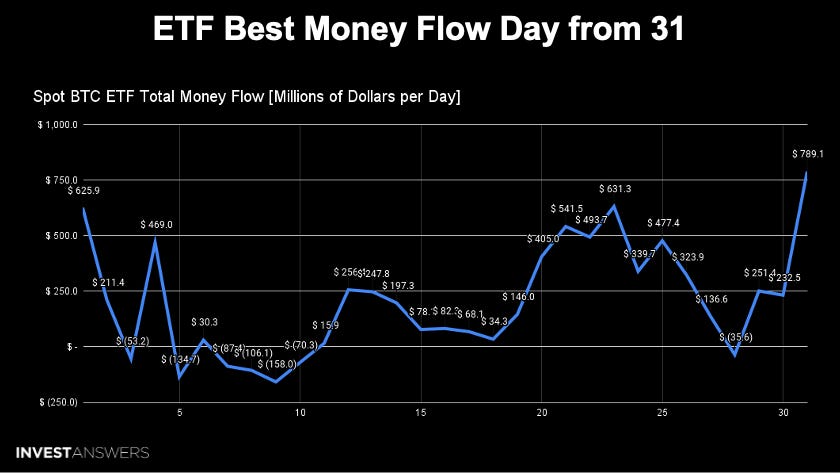

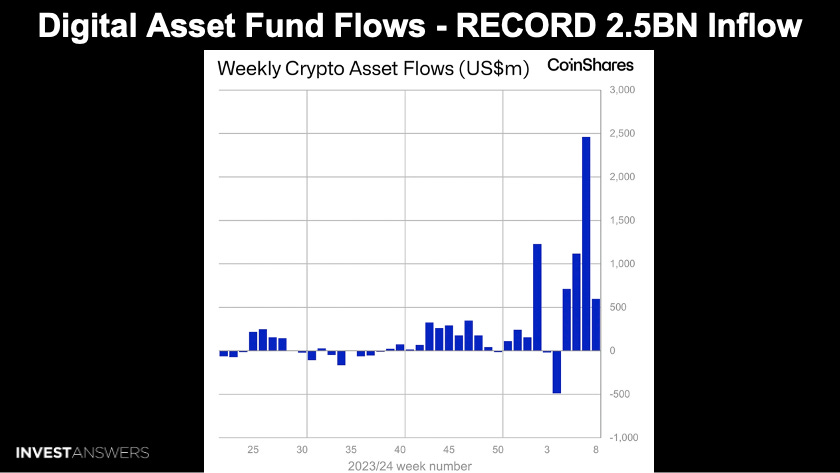

This chart summarizes the ETF flows. With 31 trading days, approximately 252 trading days equate to about eight days a year, we still have a long way to go to realize this year's ETF impact on BTC supply. The ETFs have smashed my expectations.

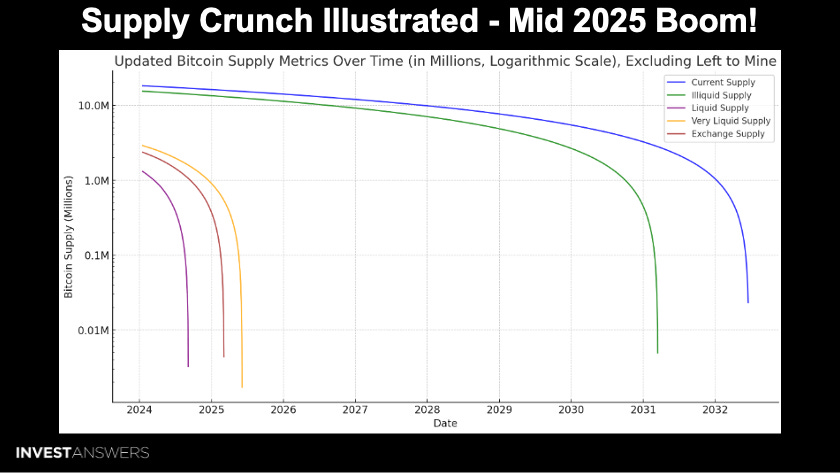

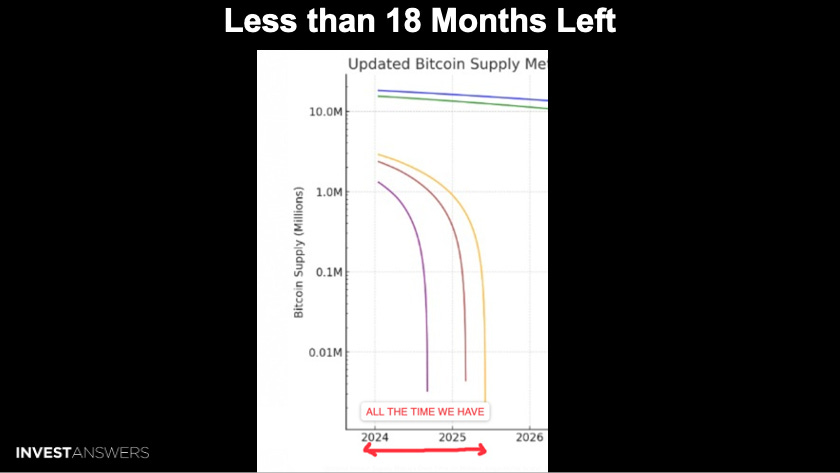

In 30 trading days, Bitcoin ETFs have amassed over 300K BTC under management, showcasing significant pressure on Bitcoin's supply dynamics. This creates the context for a potential supply crunch. If the inflow rates like BlackRock's initial daily average of 6,266 BTC continue, the liquid supply of Bitcoin could be fully absorbed by the year's end. The very liquid supplies will be potentially exhausted by mid-2025. This underscores the looming threat of a supply crunch due to ETF activities.

Should the current pace of Bitcoin acquisition by the newborn nine ETFs persist, it is projected that 1 million BTC could be under management by June. The entire current liquid supply of Bitcoin (approximately 1.3 million BTC) will potentially be absorbed by September. This aggressive acquisition rate indicates a significant tightening of available Bitcoin supply, potentially leading to the 'Mother of all Supply Squeezes.' This is why I have been obsessed with Bitcoin since 2017!

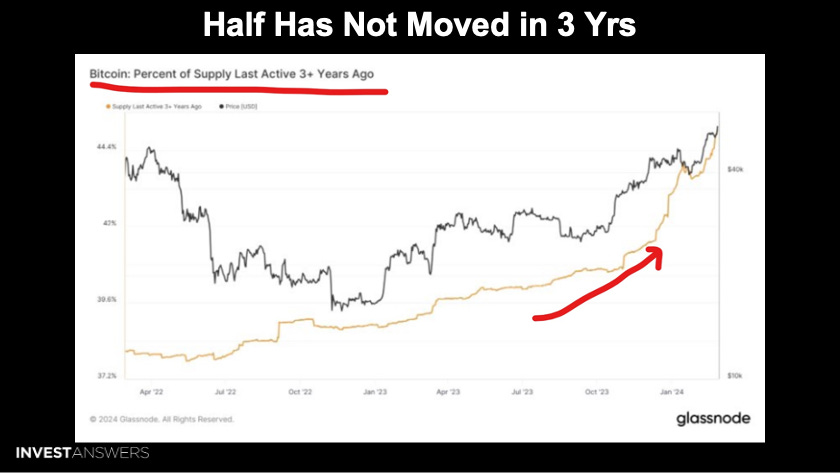

We know 70% of the supply has not moved in one year. The fact that almost half of the circulating supply has stayed the same for at least three years is even more impressive. These buyers bought Q1 2021 at the top of the mania and held a 75% unrealized loss. The same buyers continued to DCA in the bear market and dropped their cost basis from $47K to $35K.

Following a weekend of relatively flat price action, trading volume throughout the industry is up significantly:

Bitcoin +30.9%

Tether +35.7%

BNB Chain +48.6%

Solana +45.7%

Staked ETH +29.1%

Ethereum was up a more modest 15.4%

Volumes breaking out is always a good sign for future price action.

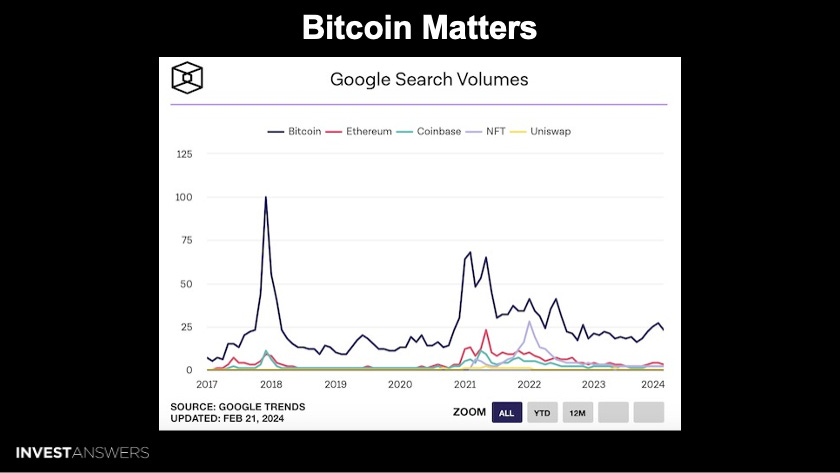

These are Google search volumes from into the block, and you can see that Bitcoin is towering over everything. Bitcoin is in black at the top, then Ethereum in pink at the bottom. Coinbase sn blue and less than Ethereum. Uniswap is pretty much non-existent. This is a Bitcoin story, and it is getting all the attention.

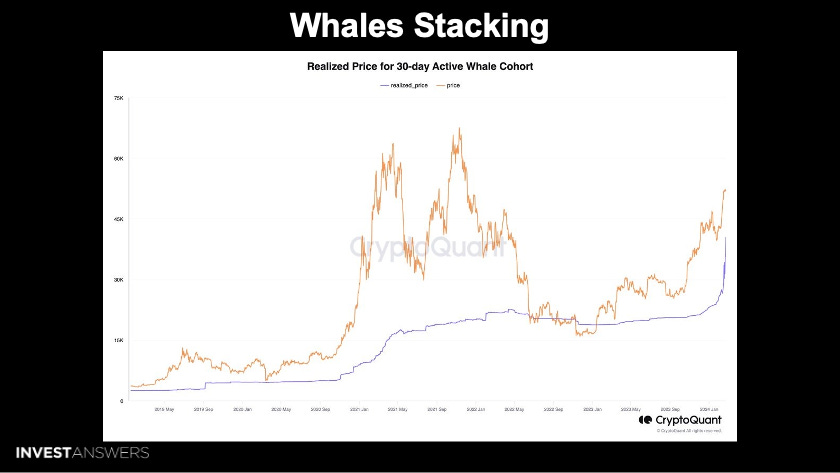

The on-chain data is screaming that new whales are accumulating Bitcoin. These new addresses are already sitting on a 38% unrealized profit after just 30 days.

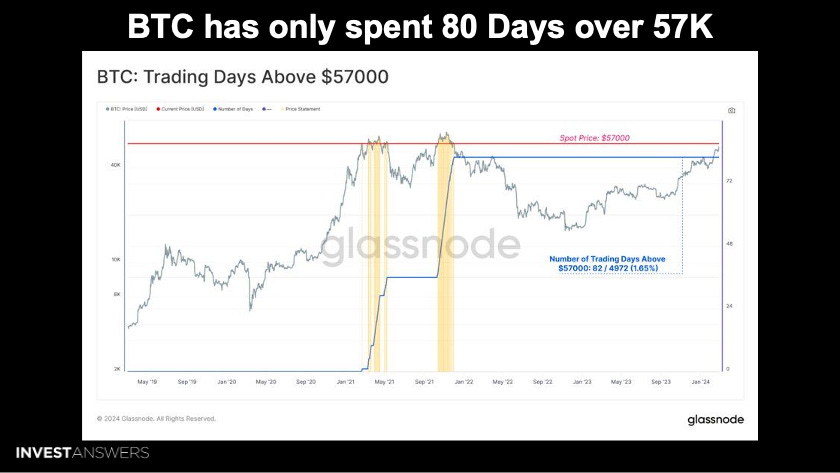

With the Bitcoin spot price reaching the $57,000 level, we noted that only 80 of 4,973 (1.65%) trading days had recorded a higher daily closing price. This tells me that a breakout is on the horizon because we are so high so early.

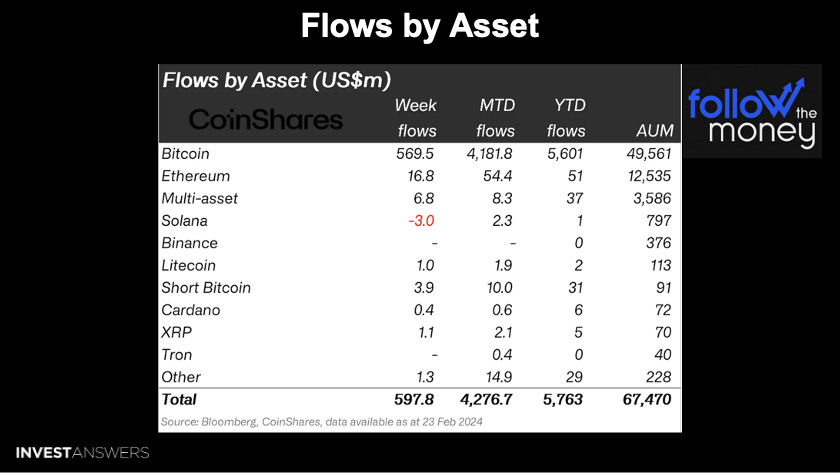

Last week, digital asset investment products saw weekly inflows totaling $598M, marking the fourth consecutive week of inflows. The year-to-date inflows have now surpassed the $5.7B mark.

This chart reiterates that right now, it is all about Bitcoin and Ethereum:

$569M flowed in Bitcoin

Ethereum got 16.8M of inflows

Solana was drained of about $3M

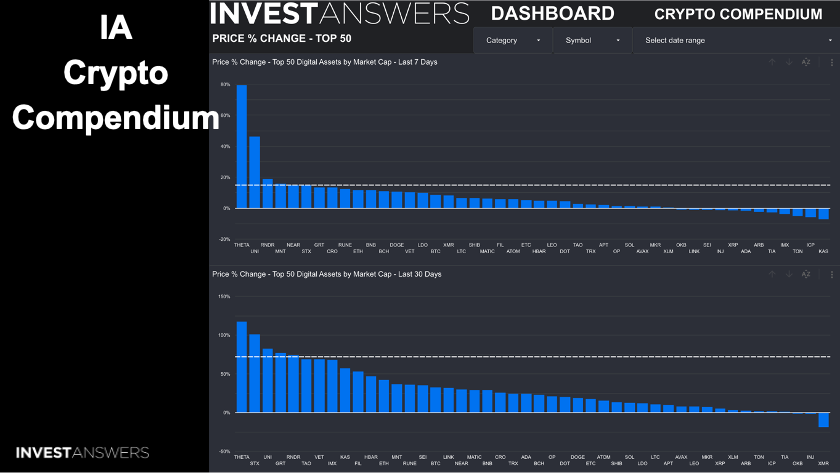

Winners of the last seven days:

THETA

UNI

RNDR

Losers of the last seven days:

TON

ICP

KAS

Winners of the last thirty days:

THETA

STX

UNI

Losers of the last thirty days:

OKB

INJ

XMR

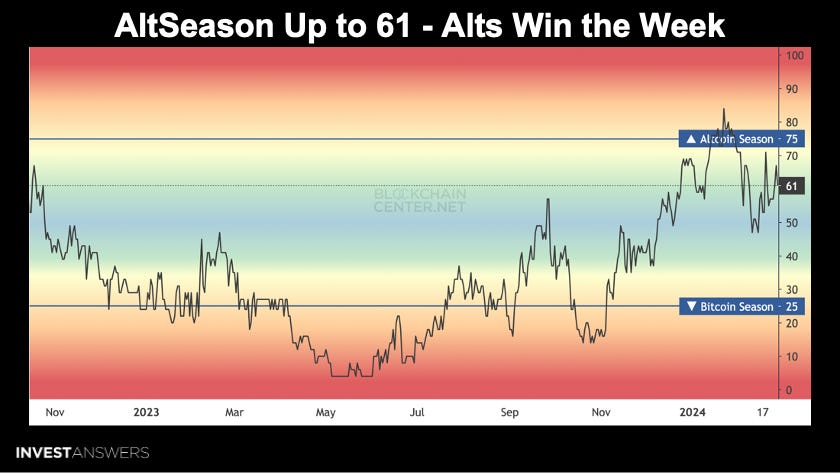

The AltSeason index is up from last week, reaching the 61 level. This means that the majority of the top alts are beating Bitcoin.

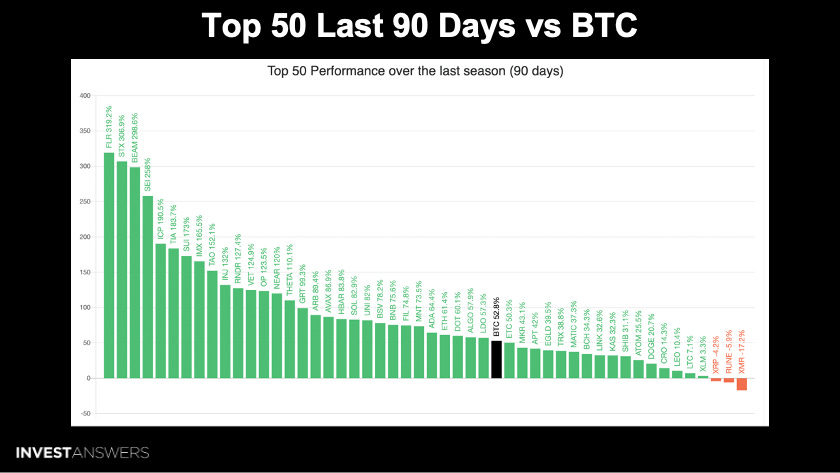

Bitcoin, depicted by the black bar in this chart, experienced a great return over the last 90 days. However, two-thirds of the listed altcoins outperformed. Remember, a floating tide raises all boats. If Bitcoin goes up along with the crypto market cap, the altcoins will rise and run much faster.

This release promises a scalability boost, which has my interest. Dencun introduces proto-danksharding, which will make Ethereum transactions faster and cheaper. It is akin to upgrading from dial-up to high-speed internet. In addition, data access will be more efficient as well. Dencun will significantly reduce gas fees for layer-2 blockchains.

This upgrade claims the network can go from 15 TPS TO 100,000 TPS. If this is the case, then a lot of the competing L1s are simply not going to make it. I hear you ask, what about Solana? Well $SOL is cheaper, faster and also has better PMF and UX.

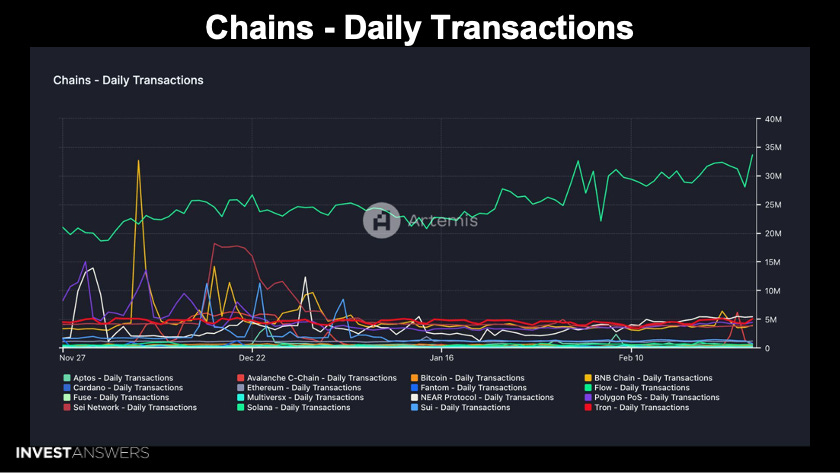

To provide some perspective, here are the top chains by daily transactions. Solana is at the top in green. The next highest chain is 1/7th the volume at 5M daily transactions.

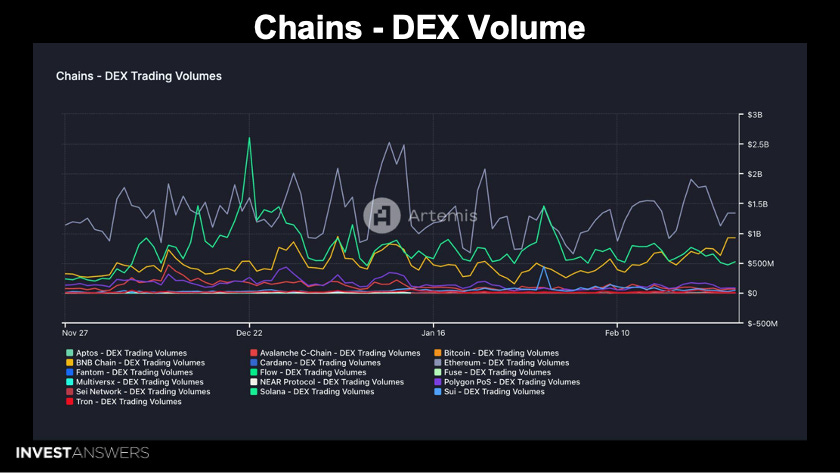

Here is a listing of the top decentralized exchanges:

BNB = #1

ETH = #2

SOL = #3 (was #1 back in early February)

The Dencun upgrade could help Ethereum in DEX volume as well.

Another good week for stocks:

NVDA +14%

MSFT +1%

AMZN +4% (despite Bezos selling billions)

TSLA +3.2%

META +3%

GOOG -1.5% (due to biased AI)

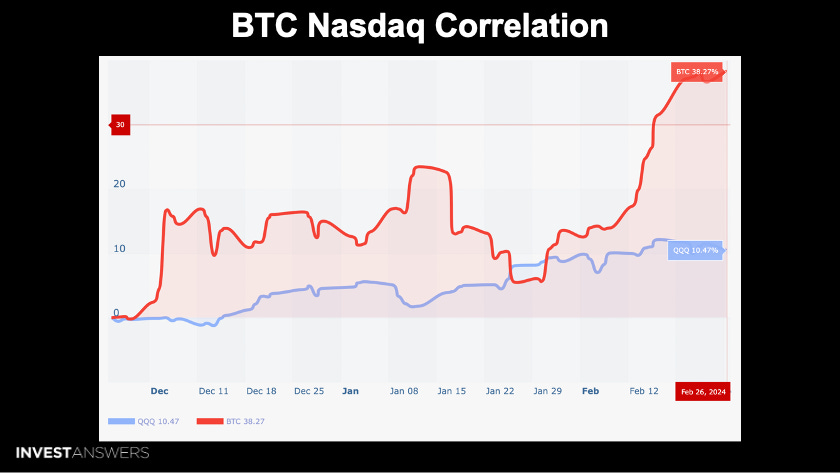

Bitcoin is off to the moon, up 36% over the last 90 days. Most of that action happened in the past two weeks. QQQ is up 16% during the period. Bitcoin's outperformance will catch the eyes of tech investors.

Apple's team of about 2,000 people worked on this project. Many people thought Apple would end up being the Tesla killer. Now, you can observe how hard it is to produce FSD electric vehicles.

This is the first "kind ink" I have seen from mainstream media related to Tesla in years. The Cybertruck blew them away, and they were honest about it.

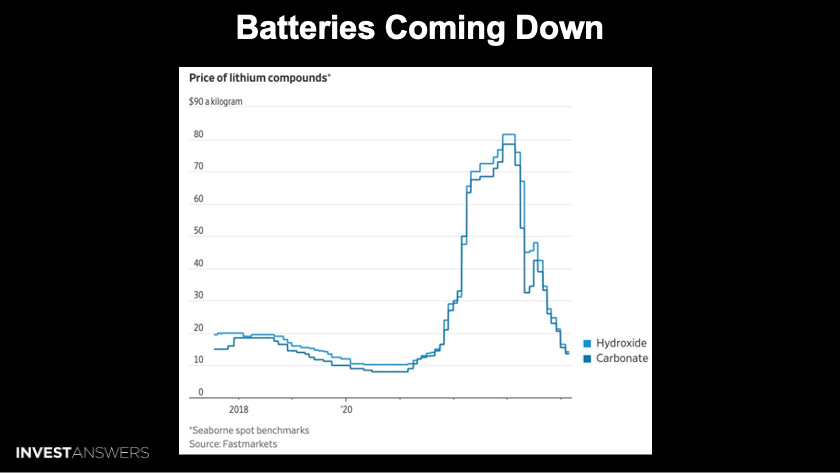

Raw materials and commodities continue to deflate. Here, you can see that the key ingredients for batteries - lithium hydroxide and lithium carbonate - are coming down to areas near five-year lows. The reason is that all of the EV makers have retreated and canceled their orders. This will help to reduce the cost of new Tesla vehicles moving forward.

Bitcoin would need to be worth $189,700 for Nakamoto to become richer than Musk.

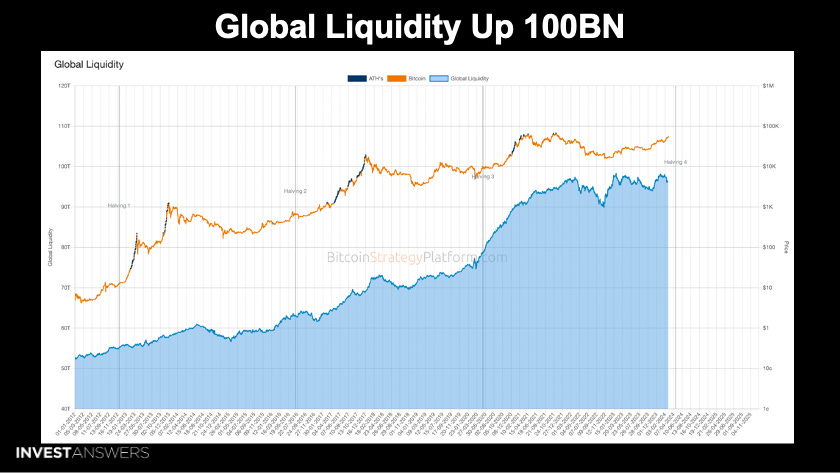

Global liquidity has been down all year. However, $100B was added this week, which is an encouraging break in the trend. M2 is already rising, so I expect the trend to continue.