Today’s Nuggets

Risk of Explosive Short Squeeze Ahead

Funding Rates Ultra Bullish

ETF Adoption Fastest in History

100 Hours to Keep 82,000 Hours

BTC Optimized Trend Flipped

Bitcoin Undervalued Relative to QQQ

HODLers Outpace Spenders

Bitcoin has been moving in three to six-week cycles up and down. We will break that down in our lesson here. Many of you have been frustrated thus far in August as Bitcoin has experienced its first 33% correction of the bull run. We had two prior 20% approximate corrections. We had the 5Gs that forced sellers:

German government

U.S. government

Mt. Gox

Grayscale

Genesis

Crypto Market Update:

The crypto market cap is now over 2.1 trillion.

Bitcoin is at $61,164.

The Fear and Greed Index is low. When fear and greed hit 25, that is when you buy.

I had to share that image because it is hilarious and on point!

This is the way that many in our community are waking up every day. Every time Bitcoin costs $58K, people are upset. When people are most frustrated, when people are most fearful and when people are capitulating, that is the best sign in the whole world.

The Fear and Greed Index is at 26 and one point off my kill mark at 25.

Do not get too ‘chintzy’ on the Fear and Greed.

This post is titled Short Squeeze Incoming because - according to K33 Research - the funding rates for Bitcoin perp futures have reached their lowest level since March 2023.

The big story here is perpetual swap funding rates, averaged at negative levels over the past week, while open interest has sharply increased. This suggests aggressive shorting, structurally creating a setup for a ripe short squeeze.

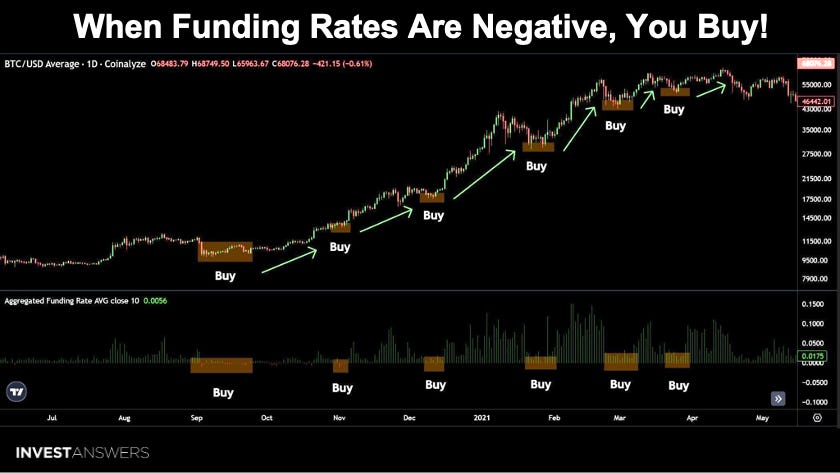

These are the funding rates and I encourage you to focus your eyes on the bottom with the red dips.

We had a nasty period way back in 2023 with a lot of negative funding rates. Of course, in April 2022 where, it was very negative, which is when certain things break in the markets.

Right now, Bitcoin funding rates are extremely low and negative.

This is historically the time to accumulate.

This chart shows you that you buy when you see negative funding rates on Bitcoin in a bull market! You buy whenever you see fear and greed below 25 in a bull market!

It is not hard, everybody!

The adoption of the Bitcoin ETF is at the fastest rate in history.

The institutions are coming and are coming in size. You cannot deny the fact that big players are here.

It will be a very good latter half of the year.

Things can go bonkers once all this stuff is swept away and there is gradual accumulation.

This thing is scarce!

A $700 million shift by Mt. Gox in Bitcoin went unnoticed.

Mt. Gox made a massive transfer and the market went up. This is a sign of not only liquidity but also maturity.

This is a very poignant point by Michael Saylor.

I calculated that there are about 1,820 working hours in a year. We work for 45 years on average, which results in 81,900 hours unless we can retire early. If you spend

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.