Today’s Nuggets

SEC Continues to Target Crypto

SCOTUS Ruling is Key to Future Regulations

BTC Hash Rate is Dropping

CleanSpark Acquires GRIID Infrastructure

Bitdeer Expands Power Capacity Pipeline

Ark Files for SOL ETF?

Half of the U.S. is in a Recession

BTC Active Addresses at Drastically Low Levels

Miners Selling Slows

This lesson will cover some interesting stuff, including a big breakthrough from the Supreme Court of the United States and its impact on the SEC, Bitcoin, and the crypto space.

It has been another quiet week…

Crypto Market Update:

The global crypto market cap is $2.27 trillion.

The price of Bitcoin is $60,250, and BTC market dominance is 53.0%. Bitcoin has been flat for a while now.

The Crypto Fear & Greed Index is bouncing nicely.

The Fear and Greed Index has been bouncing off of the lows for a couple of days now, back up to nearly 50, which is a good trend as people are not terrified anymore.

When things fall fast, people get really nervous, which leads to them pulling the plug and selling when they should be buying on the dips.

The SEC continues to go after crypto.

The SEC does not want crypto and they are stifling innovation. The agency is stifling companies that want to build and make things better, which impacts both Bitcoin and crypto adoption.

Here is a list of all the SEC lawsuits currently in play. They keep on suing without any proper basis.

By the way, Kraken, Coinbase, Robinhood all sell Bitcoin.

There is a thing called the Chevron Deference, and it can be explained in three simple ways:

Regulatory Overreach Ends: Previously, regulators like the FDA, EPA, and SEC could interpret vague laws to expand their authority in areas they should not expand into at all. This broad interpretation was known as Chevron deference.

Judicial Scrutiny: With the reversal of Chevron deference, courts now require regulators to point to clear and specific congressional authorization for their actions. This means regulators can no longer create rules without explicit legislative backing. Now, they will need to write a bunch of mini-laws that cater to digital assets.

Innovation Boost: This shift removes barriers to new technologies and startups by preventing regulatory bodies from imposing restrictive, arbitrary rules. In the past, this has impacted numerous industries outside of crypto, such as nuclear power.

The SEC claims regulatory authority over crypto assets despite cryptocurrencies not being mentioned in the original 1933 and 1934 securities laws. Thanks to the Chevron Difference, the SEC can no longer point to these past laws and claim that crypto falls under them, which is good for the space.

The basic net of what Caitlin is saying here is that they are now past peak power.

The Warrens and the anti-crypto army can no longer work.

It is downhill from here, and hopefully, they will be out of office soon. I like innovation and crypto, so I do not like things that oppose that.

Miners are very important because they keep the Bitcoin network secure. The difficulty will be adjusted downward by 7.64% within a couple of days.

Interestingly, the next Bitcoin halving is about 1,390 days away and is expected to occur on April 18th, 2028.

We are going to experience a lot of undulations in that time frame but let us get through this bull market first.

I am looking forward to the bear market because that is when you can stack and get good deals.

Bitcoin volatility recently has sent shockwaves through the derivatives market, particularly between June 23rd and June 27th.

This week has been bumpy, and of course, Bitcoin fell below the $60K mark. This level was below the short-term holder's realized price, which triggered a cascade of events - including open interest in Bitcoin futures - which has tanked significantly due to margin calls and forced liquidations. The funding rate is very close to being negative, which is why we saw the hedge funds pull out of the ETF trade.

Once all of this leverage, the manipulators and the carry traders are flushed, and the miners stop selling, then we get back to business and start moving up again.

It is also the summer and not a lot happens during this period.

CleanSpark bought GRIID Infrastructure in an all-stock deal worth $150 million. CLSK will expand its capacity significantly, with over 400 megawatts expected to be added in the state of Tennessee over the next two years.

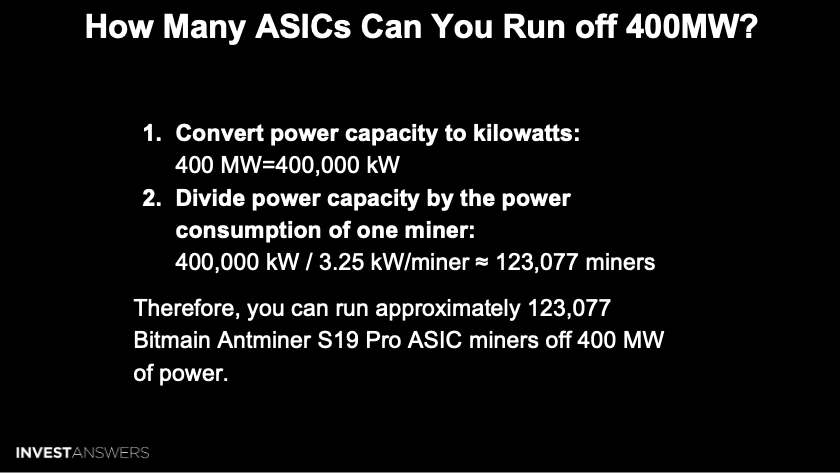

I calculated 400 megawatts is 400,000 kilowatts. If you take the amount of kilowatts used per miner, it is about 3.25.

So 400 should power about 123,077 miners, which will mint a lot of Bitcoin, even at a high hash rate.

This should also accelerate CleanSpark’s scaling plans to

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.