Technical Analysis: The Key to Alpha

Our new TA Masterclass on YouTube will teach you how to use technical analysis to beat the market. We're not just another investment support group; we're building a team of alpha-winning investors with a set of tools that will set you apart from the rest.

Technical analysis is a powerful tool that can help you identify trading opportunities and make more informed investment decisions. We build tools to support decision-making. Investing is all about being in the right assets at the right time. Our tools are built to help you determine that.

If you're serious about investing, then you will enjoy this!

The market is full of fluctuations as no asset goes straight up or down, and it is because of four foundational factors that bring about DCA on Steroids Possibilities:

Supply and demand: The price of any asset is determined by the balance of supply and demand. If there are more buyers than sellers, the price will go up. If there are more sellers than buyers, the price will go down. This is true for indices, stocks, commodities, Bitcoin, etc.

Investor sentiment: The mood of investors can significantly impact stock and Bitcoin prices. If investors feel bullish, they are more likely to buy assets, pushing prices up. If investors are feeling bearish, they are more likely to sell assets, which can push prices down.

Economic factors: The overall state of the economy can also affect stock and bitcoin prices. If the economy is doing well, investors are more likely to be optimistic about the future and invest in assets. Investors are more likely to be pessimistic and sell assets if the economy is doing poorly.

News and events: The current news and events can also have a short-term impact on stock and bitcoin prices. For example, if a company reports strong earnings, its stock price will likely increase. If a company reports weak earnings, its stock price will likely decrease. Similarly, if there is a negative news event related to Bitcoin, such as a hack or a regulatory crackdown, the price of Bitcoin is likely to go down.

These four factors influence price and is exactly what allows us to beat the market.

Our lesson will be a refresher to answer many of our community's commonly asked questions about one of the IA Indicators we’ve built called DCA On Steroids.

DCA vs. Lump Sum Investing: Which is Better?

The debate over whether dollar-cost averaging (DCA) or lump-sum investing is better is a heated one. But the truth is, it depends on your circumstances and risk tolerance.

DCA is a strategy of investing a fixed amount of money at regular intervals, regardless of the price of the asset. This can help to reduce risk and volatility over time, as you will buy more shares when prices are low and fewer shares when prices are high.

Lump-sum investing, on the other hand, is a strategy of investing all of your money at once. This can be a more risky strategy, but it also has the potential to generate higher returns if the market is on an upward trend.

DCA on Steroids - the IA way is the smarter choice.

SUMMARY

DCA: Invest small amounts regularly.

Lump Sum: Invest all your money at once.

DCAS: Time your buys, Load your buys and jump harder into growth and avoid weak assets.

Overall, DCA tends to outperform over more extended periods. But what happens if you can do better than DCA? We call that DCA on Steroids.

My job is to prove everybody wrong. Our brilliant development team has made it possible for the entire IA Community to prove Nick wrong.

We have pulled a comprehensive list of diverse assets for this research listed on the right and used all neutral settings in our TradingView indicator tools.

The DCAS Indicator tells you when you can and cannot buy as well as the most important thing: how much to buy.

This chart demonstrates an asset fluctuating in price over time. When DCAS is above the line and green, you nibble. You amplify your purchase if the chart is below the line and green. There is no buy when it is red and above or below the line.

For example, if you are committed to investing $100 per week, and DCAS signals a green buy indicator with a "load" of x3.19, then you would buy $319 of the asset.

DCAS: A Subscription Service to Optimize Your DCA Strategy

DCAS is a subscription service that helps you optimize your dollar-cost averaging (DCA) strategy. It helps you save and make money, and most importantly, it helps you avoid investing in crap assets.

For a modest subscription fee of $19/month, DCAS can help you:

Choose the right assets to invest in

Determine the right investment amounts

Determine the right time to invest

Set up a regular investment schedule

Track your progress using the back-test model

Tweak your settings based on your investment goals eg build a bag fast, or be very conservative and wait for pico moments.

DCAS is available for a modest subscription ($19/mo) to help us cover development costs and customer support on Discourse.

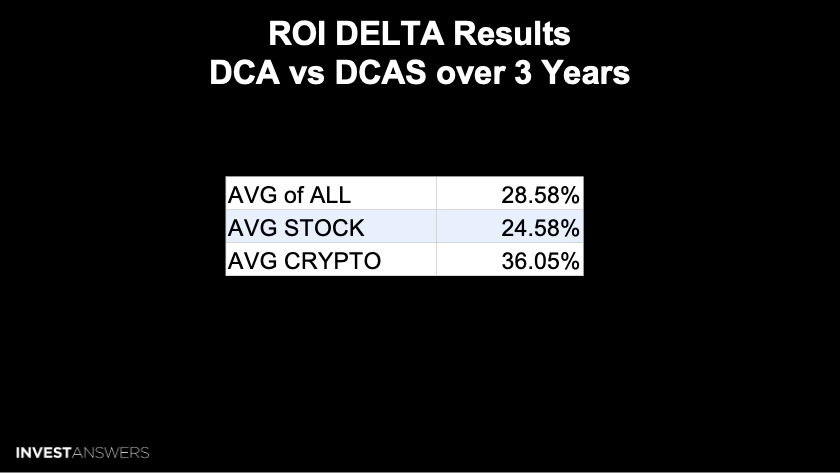

You can see the ROI of DCAS vs DCA over 3 years, all neutral settings across a mix of 35 different assets - good and bad from Crypto to Scamcoins to Mag 7 stocks to Commodities like Gold and Indices.

Note: The more volatile the asset, the better the tool performs. It works in all 3 market scenarios: Bear, Bull and Neutral.

One of our DCAS subscribers and Patreon members, Mike, who has to travel a lot for work, has set up to receive the trade alerts on his Apple watch. So he knows when and how much to buy in real-time, wherever life takes him.

Below are the DCA vs DCAS Results across a smattering of assets. The results speak for themselves, and this is not even taken into account using setting modifiers.

A visual of the ROI on the Delta between DCA and DCAS is even more striking. Blue is regular ROI from DCA over 3 years and Red is DCAS ROI. Names like NVDA, META, Bitcoin etc make a huge difference to implement this strategy - no matter what the market conditions.

Try for yourself, the best $19 you will ever spend.