Today’s Nuggets

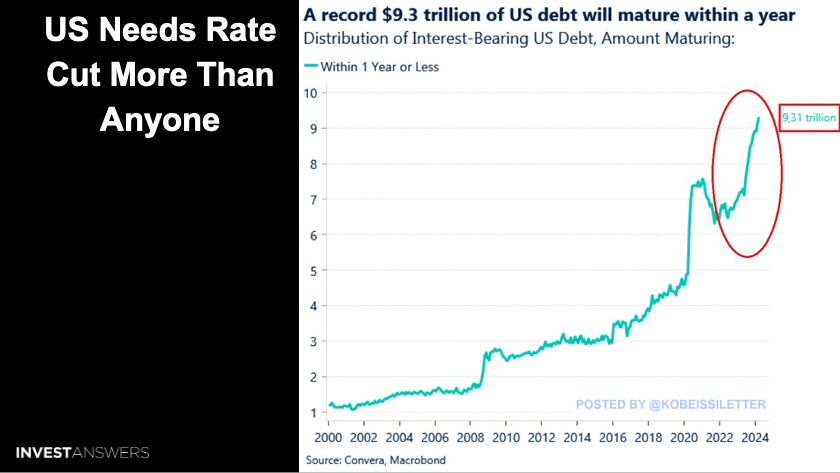

$9.3T of US Debt Maturing within a Year

Best Performing Asset

Helius Has More Developers than DOT

Real-World Assets Outperforming

SOL ETF Rumors

Global Liquidity Up $420B

Heavy Miner OTC Selling

Robinhood Buys Bitstamp

The Woke Death Star

Tesla Chinese EV Penetration Hits 47%

Today's lesson contains 50 nuggets covering a lot of stuff, including the PPI and CPI data coming out of China, Germany, and the U.S. leading up to the U.S. Fed rate decision.

Tesla's annual meeting is on Thursday, and the votes need to be in today or tomorrow, so I hope everybody voted properly for the biggest crime of the century!

People continue to ask me why I do not own Aptos, Sui, and Sei alongside the other new things. The reason is they rain down tokens. Watch out for the unlocks:

Render is on this week's list, but has a tiny unlock of 0.2%. When it is small, under half a percent, I do not care as it is insignificant.

Kadena is on this list; surprisingly, this chain is still alive.

Ape Coin is on this list every week.

Arbitrum shows up as well.

If you are out there looking out for yourself and your family, you have to understand how things work - this is why I share this news!

Over the past four years, the wealth of U.S. households has grown by $37 trillion, but 54% of that $37 trillion flowed directly to the top 0.1%. The other 46% was shared across the 99.9%.

The economy and the world are not fair.

The reason we do this and why we are in these disruptive assets is because it is the only hope some people have.

The Fed is looking for this miraculous 2% inflation number.

I always said that 40% of CPI is driven by the price of oil. The only way you can bring the price of oil down is to destroy the economy and everything else.

What is critical is that the record $9.3 trillion in U.S. federal debt will mature and must be refinanced at about a 4.5% or 5% rate in the next 12 months.

We are already spending nearly double the U.S. defense budget.

One of the biggest U.S. budget items is now on interest to service the debts. Therefore, they continue to explode deficits and the death spiral is out of control. This is ridiculous and is why you do not want to hold on to fiat!

The Fear and Greed index is still crazy high at 74, despite the dip in the actual market.

People were concerned with this last dip, but dips serve as opportunities. I wait for these moments and get excited. One of the reasons why I was a little bit delayed today was that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.