TODAY’S TAKE

Disruption and technology continue to outperform all other assets this year

The banking index has performed the worse year-to-date, down 21%

Bitcoin has been profitable for 89% of its total trading history (12.6 Years)

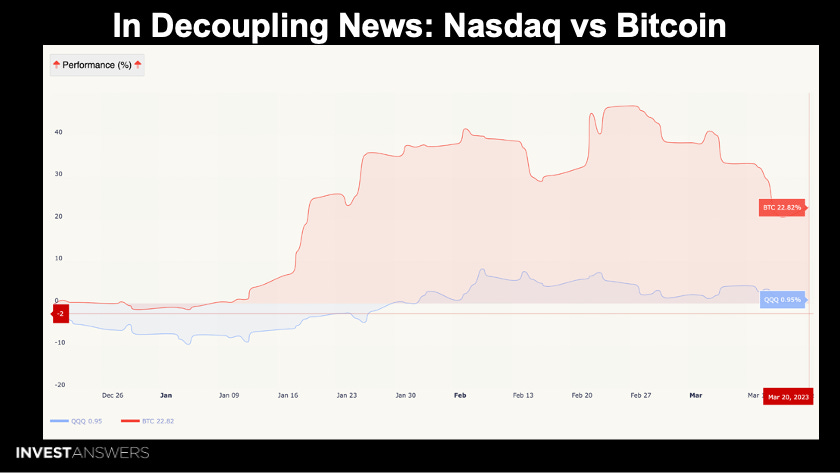

BTC is up 23%, while QQQ has been flat over the last 90 days

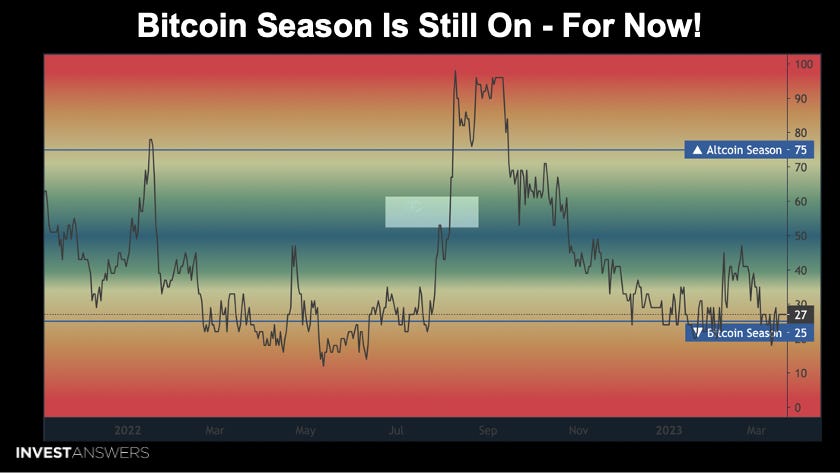

This week money appears to be moving from Bitcoin back into altcoins

Bitcoin, before the next halving, targets a price level of $45K

The top 50 altcoins had a positive last 90 days except for LEO

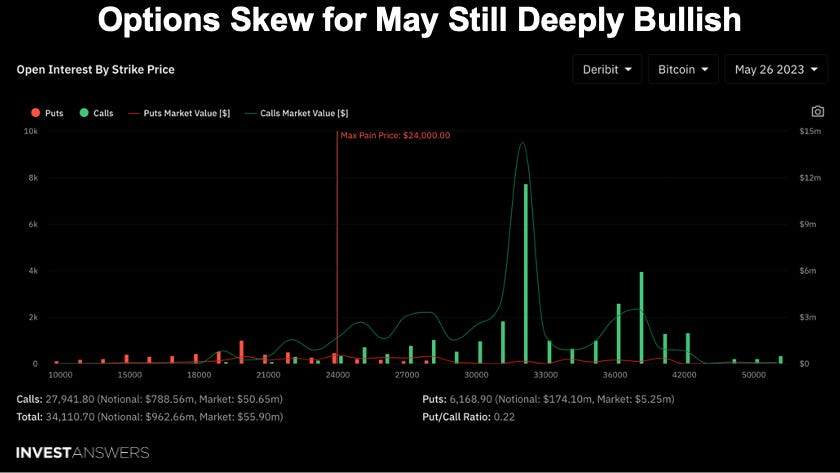

The open interest put/call ratio of Bitcoin is 0.22 through May 26th

Bitcoin miner revenues recently hit $22.6M/day, the highest level since June 2022

Ethereum's price eclipses $1,840 for the first time since August 18th

The Render Network eyes a migration from Polygon to Solana

Bitcoin is receiving a much higher sentiment of confidence over ETH

Overall a greek week for stocks, with big tech leading the way

Year-over-year internet search metrics still reflect 93% of users prefer Google

The Coinbase Premium Index signals high demand for spot BTC

BTFP erased 50% of the Fed’s work to decrease its balance sheet in a single day

U.S. households lost US$4.1T last year

The reason for sharing this is to emphasize how important it is to be in disruption and technology. It far outperforms everything else.

The banking index has performed the worse year-to-date, down 21%. Technology continues to outpace Gold. Bitcoin is the apparent growth outlier at 68% year to date.

Bitcoin has been profitable for 89% of 4,065 of 4,593 days during its entire trading history (12.6 Years), according to data from Blockchain.com.

XRP has been moving over the last week.

Another great week overall for crypto.

Bitcoin just began to turn around at the 48% dominance level because certain altcoins are strengthening, like XRP.

The money has started flowing to other cryptos that have not moved yet.

The Best Bitcoin Chart of the Week (#BBC) is a new section for OCTA. This chart illustrates Bitcoin from 2012 to today in reverse. This helps you see the channel of maturity as Bitcoin moves through its previous halving cycles.

Reverse charts are very elucidative.

This chart points toward a $45-46K price level for Bitcoin before the next halving by April 14, 2024.

LEO is the only project in the top 50 altcoins that has been down over the last 90 days.

The options continue to demonstrate bullish sentiment for the next two months. The put call ratio is 0.22, meaning four calls are bought for every put purchased.

The amount of Bitcoin's supply held by entities with less than 10 BTC continues to reach new highs. As a result, supply will continue to become more distributed over time, putting to rest any arguments against Bitcoin regarding supply concentration.

Since December 20th, BTC has been up 23%, while QQQ has been flat over the last 90 days.

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.