NUGGETS OF ALPHA

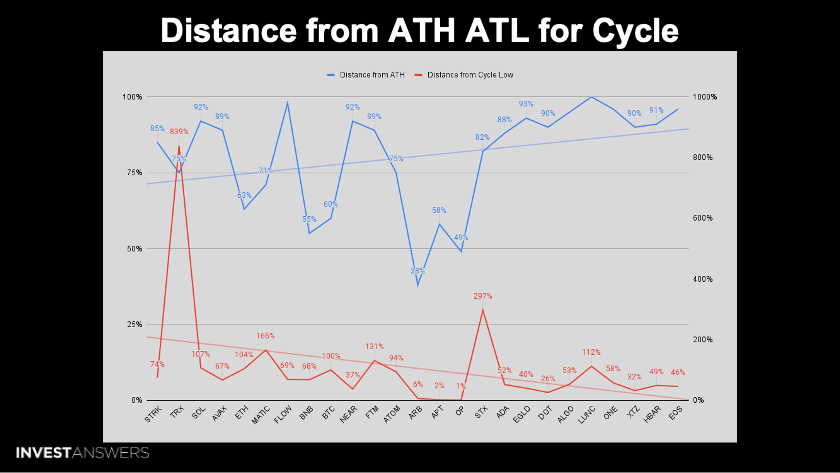

Solana’s price is ~107% off of the cycle low and ~92% off of the cycle high

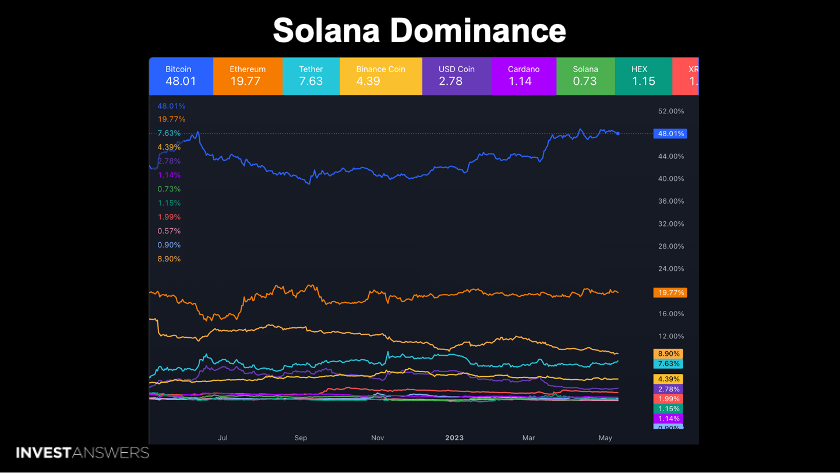

Solana is 1/28th the market cap of Ethereum

Since March 2021, Solana is up over ~40% over ETH

Solana is inexpensive when you factor in all of the metrics

Raoul Pal forecasts ~$1,000 SOL and that it is the Ethereum of this cycle

IA forecasts SOL to be worth 20%+ of Ethereum’s market cap in the coming years

The DePIN strategy is going to make SOL even more widely adopted

SOL’s Nakamoto Coefficient is third of all cryptos behind BTC and DOT

The pace of growth of the Solana ecosystem is second to none

Based on fundamentals, everything in crypto looks overvalued compared to SOL

There is also talk of Jump Crypto thru Wormhole becoming a defacto L2 on BTC

Fundamentally nothing has changed since I first began talking about Solana on this channel in March 2021. This project has far surpassed my wildest dreams in terms of adoption and integration over the past two years. Per my analysis, Solana is the best, cheapest, and fastest chain. Therefore, I believe all roads in crypto will lead to the Solana network unless it is disrupted.

It is challenging to analyze where you are going unless you know where you have come from in crypto. SOL’s price is ~107% off of the cycle low and ~92% below the all-time high price of $206.06. We are working on a new model that helps make decisions based on our new ATR algo!

Presently, Solana is 1/28th the market cap of Ethereum. Fundamentally, this metric indicates that Solana is inexpensive when you factor in all the metrics we will cover in this lesson.

Since early 2022, Solana has been bleeding against Ethereum. However, since March 2021, Solana is still up ~40% against ETH. I mention March 2021 because that is the first time I started becoming very interested in the chain.

Since March 2021, SOL has been up ~531% over ADA. These two battle each other daily, but remember, ADA has more than 150% of the market cap of SOL, and SOL has more than 12x the DAUs.

This benchmark only accounts for smart contract platforms. Remember, the Crypto Compendium measures structure, tokenomics, whale bags, Nakamoto Coefficient and decentralization, and many other factors. Basically, it is the measure of the fairness of the protocol structure.

Solana is number one in this category against 40 smart contract platforms. This considers 69 different data drive metrics and benchmarks against peer groups.

Remember, this is based on market cap and not the dilution from hell coming in many projects such as ARB and OP.

From this perspective, SOL ranks #3, which varies as daily active users fluctuate. Had we measured this three days earlier, it would have been by far the lowest, as Solana had over 740,000 Daily Active users (more than twice any other L1 or L2).

This is a log chart because Ethereum is much larger than the other projects listed. The Fees on Ethereum are extraordinary due to the Meme Coin revolution #PEPE etc.

Another striking view of fees, Ethereum runs over $20M in fees per day. Quite impressive but also IMHO a bar to onboarding 1 Billion Crypto Users.

The section of the model that really matters is the 6% of ETH to 10% and the average of the 6-20%. Please do your own research.

In addition, we have a Model for this, which is available for Free on TradingView. Just Search for IA-SOL, and you will find it.

You can determine your own fair value for the Solana Chain from the model above. This is based on my Ethereum Valuation model, and I took a factor of that model modified for inflation.

If you want to be conservative, follow the 4% ETH column.

Assuming the mid-range of 10% of ETH value projected out to 2032, you arrive at a value of $1,067 per SOL.

So Raoul is stating that SOL could reach $1,000 before April 2024.

Assuming a steady inflation rate of 5% and a post-2032 to 2050 capital appreciation rate of 10%, previous models elicited criticism for overestimating monthly retirement amounts, especially in countries like Portugal. To address this issue, additional data was incorporated, and the portfolio was adjusted by up to 70% higher than government-recommended levels in specific regions, creating a more significant buffer against potential underestimations of inflation.

We must remember that we are entering an exponential era where much of the world’s commerce will move on to the blockchain. However, the percentage of humanity that uses these tools today is minuscule but is in the process of growing to a billion users. If Solana gets to a Billion Users, these numbers will be far underestimated.

Nothing is for sure in this world. So please do not take this to the bank but let it serve as a guide for your own personal planning. Nobody knows if ETH will exist in the future, Solana, or even crypto as a technology.

So let’s start with the USA first.

I added a specific multiplier for each country to add a buffer for lifestyle and, of course, inflation.

Model Average = ~515 Unstaked & ~373 Staking SOL to Retire in the United States

Suppose SOL achieves the expected case (12% ETH) of the IA models with a retirement of 2032 and an inflation rate of 5%. This chart forecasts SOL un-staked and SOL staked at 5% per year. This also assumes the static holding of SOL and that it survives over this period.

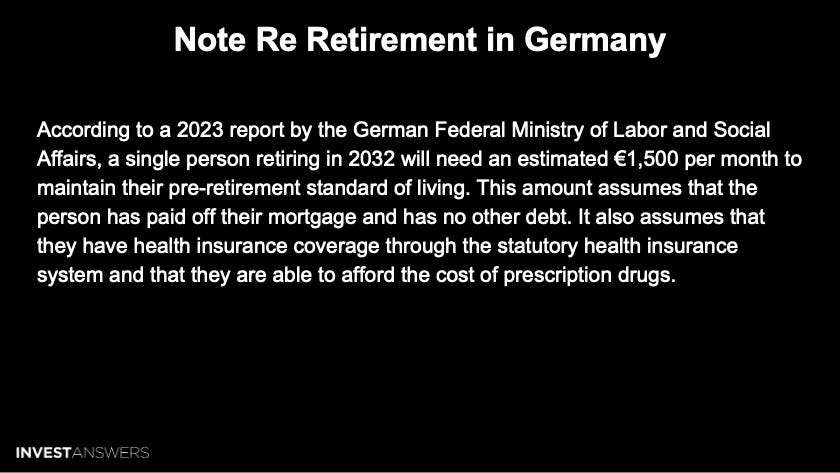

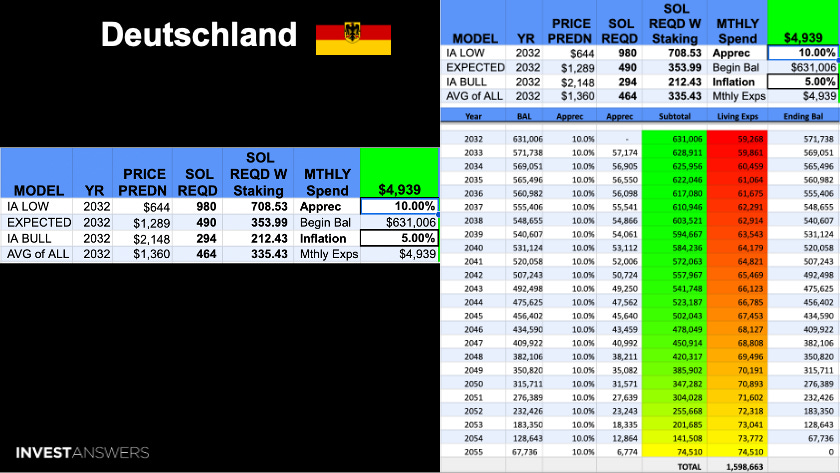

Germany has a good pension scheme, but I still padded these numbers.

Model Average = ~464 Unstaked & ~335 Staked SOL to Retire in Germany by 2032

We have a lot of people watching who are from India, and many also want to retire in India.

Model Average = ~183 Unstaked & ~133 Staked SOL to Retire in India. I modified the govt estimated number by a lot as I know how much it costs to retire well in places like Mumbai and Delhi.

A key point to make is that I do not know where the currencies are headed in the future relative to one another, so I am translating back to dollars to be safe.

Model Average = ~426 Unstaked & ~308 Staked SOL to Retire in the United Kingdom

Canada also has a generous pension scheme.

Model Average = ~436 Unstaked & ~315 Staked SOL to Retire in Canada

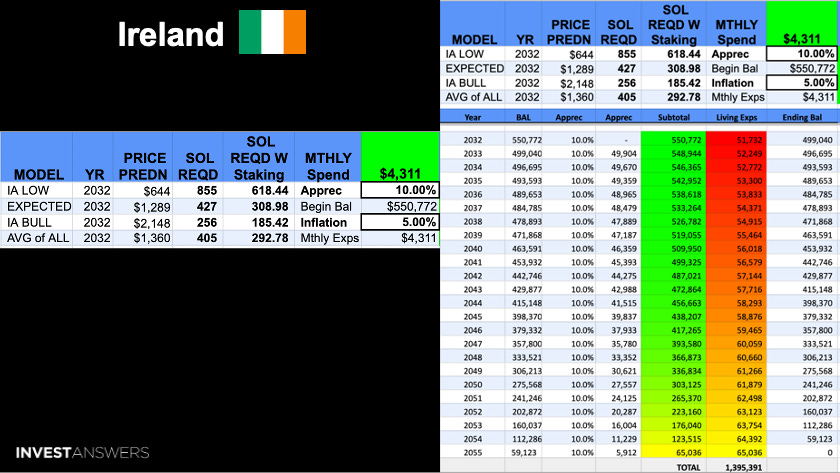

If you can leverage the free medical and the pension plan, you can likely live quite well based on these figures. I modified this number by an additional 58%.

Model Average = ~405 Unstaked & ~292 Staked SOL to Retire in Ireland

I do not have many viewers from Thailand, but this is where many people indicate that they want to retire.

Model Average = ~205 Unstaked & ~148 Staked SOL to Retire in Thailand

Model Average = ~371 Unstaked & ~268 Staking SOL to Retire in Portugal

Model Average = ~491 Unstaked & ~355 Staked SOL to Retire in Australia

Model Average = ~137 Unstaked & ~99 Staked SOL to Retire in Vietnam

Model Average = ~267 Unstaked & ~193 Staking SOL to Retire in Mexico

Model Average = ~263 Unstaked & ~190 Staked SOL to Retire in Costa Rica

At SOL’s current price, everything else in crypto looks overvalued compared to it based on fundamentals. Remember, in the short term, fundamentals do not matter in crypto.

Final Note re Wormhole

Solana could potentially become the de facto L2 on Bitcoin. Bitcoin scaling has been the main concern I have had since 2017. That could all change.

Wormhole is a SOLANA decentralized bridge that allows users to transfer assets between Solana and other blockchains. It is built on Solana and uses its high throughput and low fees to make cross-chain transfers more efficient and affordable.

Trading bitcoin on Solana is [I rather say COULD BE]

1️⃣ Fast - 400ms

2️⃣ Cheap - $~0.00025 if you're doing $0.10 or $100,000,000 of Bitcoin

3️⃣ Green - trading Bitcoin on Solana uses as much energy as ~2 Google searches

A GAME CHANGER for both BTC and SOL. Bringing BTC Defi at Scale to the masses. Think about that!!!!