DISCLAIMER: Remember, before we delve deeper, my suggestion involves having several strategies—about five or so—and dedicating resources to each. This approach I'm sharing, which I refer to as Solana, is just one among many. It demonstrates how a straightforward plan, initiated early and pursued aggressively, can theoretically yield significant success, especially when you start at a low entry price. In simple terms the idea is to have multiple bags across assets like TSLA MSTR BTC SOL etc REM ALSO THAT ANY ASSET CAN GO TO ZERO IN A HEARTBEAT!

ALPHA NUGGETS

Diverse Investment Strategies

SOL's Remarkable Growth

Rising Market Dominance

Solana's User Engagement

Market Cap per Daily Active User

Solana's Developer Ecosystem

Fee Generation and Performance

My NEW 2025 SOL SUPER BULL Price Prediction

Since I started doing this three years ago, many of you in the community have built positions to fulfill your retirement goals. The fundamentals of this chain that people mocked me for years have changed radically. The SOL token show above $200 today. A year ago, it was $20! 15 months ago it was $8.

Our analysis today will revisit the fundamentals to establish fresh price targets based on updated models. To wrap up, we'll integrate all our findings and explore various retirement lifestyles influenced by geography.

When I first started doing these in June of 2021, the price of Solana was $22. Then, I did another second lesson in May of 2023, and the price of Solana was $20. Today, the price is $200! Yes we know it was manipulated by FTX but let’s move past that.

Recently, I ran an X.com poll to gauge interest in this topic. 92.2 percent of the respondents, with 3,116 votes, said yes to this topic. So here we go.

A rising tide floats all boats, and the tide as it relates to Solana is the crypto market cap that hit $2.75T today. This model allows you to input your crypto market cap forecasts per year and your SOL dominance assumptions in order to supply you with a credible future price target.

In October 2023, I presented my bear case in this bull run as follows:

If Solana hits 3% of crypto market cap dominance (CMC) and the market cap reaches $5T, then it would take the price target to $363. SOL is already halfway there only twenty weeks into this cycle.

Now remember that is an old chart

This is where we are now

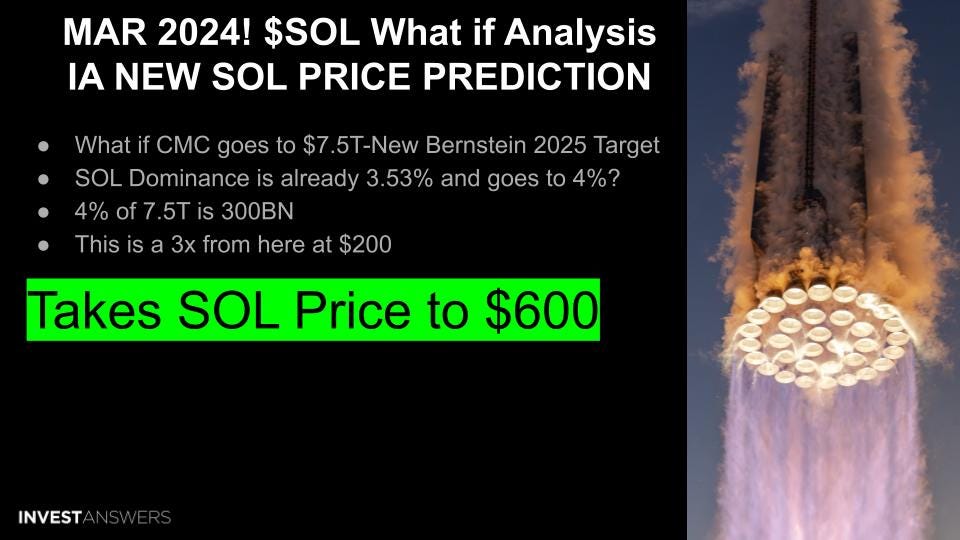

Bernstein think the CMC will go to 7.5T

And in other news - Solana just hit 3.54% completely destroying my bull market prediction of 3%. And we are a month away from the bitcoin halving. This is unbelievable!

Solana crossed through the 2.4% of CMC dominance on September 6, 2021, at $181. It crossed 2.4% of CMC at $190 on October 19, 2021, and again on March 30, 2022, at $131. on March 15, 2024, we are at 3.23%, with the high today of $189. March 17th Today CMC is 3.53!

My new Target is 4% of CMC

4% of 7.5T is 300BN

That would take SOLANA to $600

IA NEW MARCH 2024 SOL PRICE PREDICTION for 2025

So Solana is off to the races, demonstrating that it is the black hole. Solana is the consensus trade for this cycle, and I will back that up with data throughout the remainder of this post.

Ten months ago, the Solana dominance was 0.73%. Now, it is 3.53% at a $2.75 trillion CMC. The rising tide is floating all boats while the Solana dominance is going through the roof.

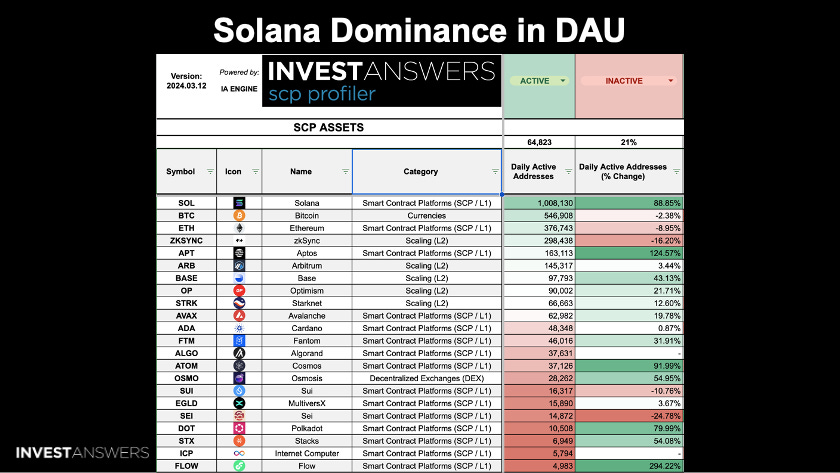

Per the SCP profiler, daily active addresses compilation:

Solana has 1.008 million daily active users

Next is Bitcoin at 540,000.

ZK-Sync has 286,000.

Aptos is at 163,000.

Arbitrum, which is a Layer 2, is at 145,000.

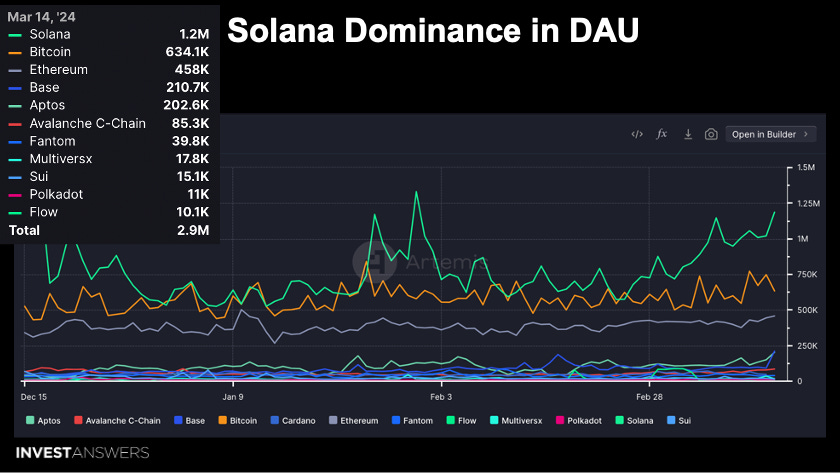

This graph from Artimus reflects that Solana has 1.2M daily active users. The green line is what you want to focus on, and it's up and away. Solana has become the consensus chain with many dApps across a broad spectrum of use cases.

At the bottom, you find the so-called Solana killer Sui at 15,000 daily active users.

A very important metric is the amount of market cap per daily active user:

ETH = $1 million

Solana = $74,000

Polkadot = $1.3 million

Stacks = $850,000

You must be careful in terms of understanding relative value!

My original thesis was that if there is an Ethereum killer, it is Solana. According to this chart, this is proving to be correct as wins: the Nakamoto coefficient, block time, max TPS, daily transactions, daily active users, etc. Even though SOL has been on a rampage, it has a long way to go to be the size of Ethereum (~640%).

This chart displays what I commonly refer to as the Zombie coefficient. This helps to identify dead chains. If you are 15 months into a bull run and the token's performance is still languishing at the bottom, away from all-time highs, then the token is probably dead. Old stuff withers away and dies. The Winners take most.

I have real numbers and narratives and ETH has still not scaleth!

Solana is second only to Ethereum for developer repositories, which shows the breadth of the dApps. Again, Solana is very new compared to Ethereum.

Solana is now crypto's fourth largest fee generator despite charging .00002 center per transaction (an old joke from the 90s). The Solana Network makes up its cost leadership fees with volume.

Ethereum makes a ton of fees, but that will all change. Nobody can pay for 25 transactions a day and spend $30 per transaction.

Ethereum has had a great year. It tripled over the last year, but what beat it by an additional 360% over the same period? This should give you a good perspective of just how much better Solana's performance has been.

This project is construing a way of using Bitcoin liquidity on the Solana chain akin to what Stacks does. These two might provide an interesting face-off comparison pair.

This could be a game changer

Killer Bears is apparently a top game, and this is what I call the black hole.

Big money runners, such as Pantera Capital, buying up $250 million of Solana as it breaks $150. They will be holding it for four-plus years, so they are not buying it to dump.

I have made my case for why I call Solana the black hole and know I will turn focus how to properly value it for the next 10 years.

This model looks at Solana's dominance through 2027. I highlighted one just so you all know how to read it. For example, with 3% Solana dominance and a crypto market cap of $2.75 trillion, you get $186, which is exactly where we are today.

Now, if SOL achieves a 5% market cap dominance and the crypto markup goes to $5 trillion, then the price would be $482.

You can take this and run your scenarios based on what you are comfortable with.

My previous model, which I referenced earlier, only assumed 3% dominance. This is now old and irrelevant. The new model assumes 5% dominance.

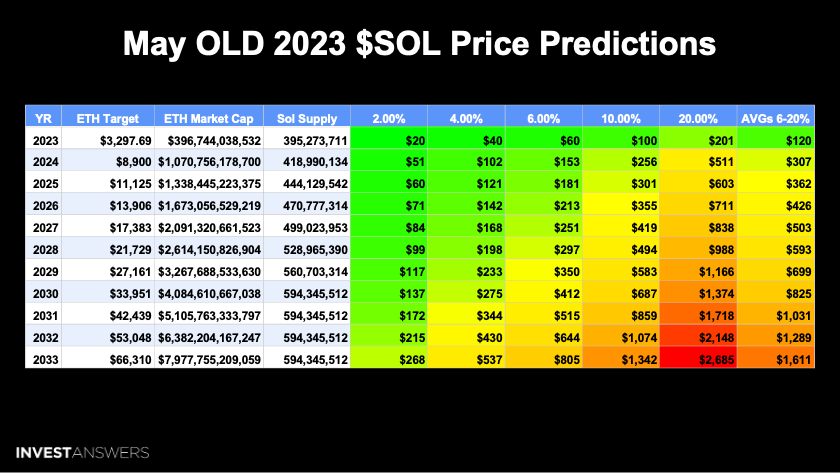

Here are my updated price targets in table form. I used to compare Solana to Ethereum, but that is no longer a valid analysis because I believe Ethereum will shrink and Solana will continue to grow as it has done. Therefore, I changed the model completely, which produced the following results:

Bear Scenario = $228 in 2024

Expected scenario = $380 in 2024

Bull Scenario = $481 in 2024

2025 = $269, $449, and $898 for the three scenarios

The bull target for 2032 is $3,200

VanEck has a target of $3,222 for 2030

For perspective, I have had to up all of my price predictions this cycle because they were too conservative for most of the crypto that I have been bullish on going into this cycle.

This is a visual of what the various Solana price predictions look like over time:

Yellow = Bull

Red = Expected

Blue = Bear

These assumptions are what is going to drive our retirement model.

Here is the Solana retirement in 13 destinations. We added a new destination because Sanjay wanted it. I will share this model in a Patreon exclusive, explaining how you all use it.

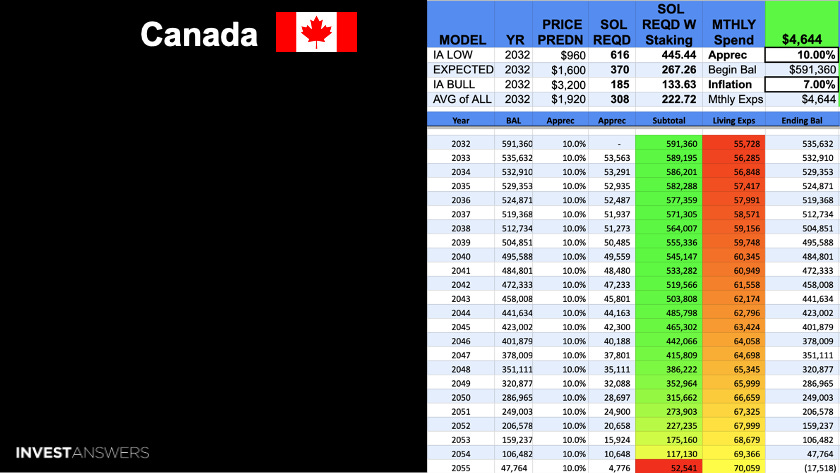

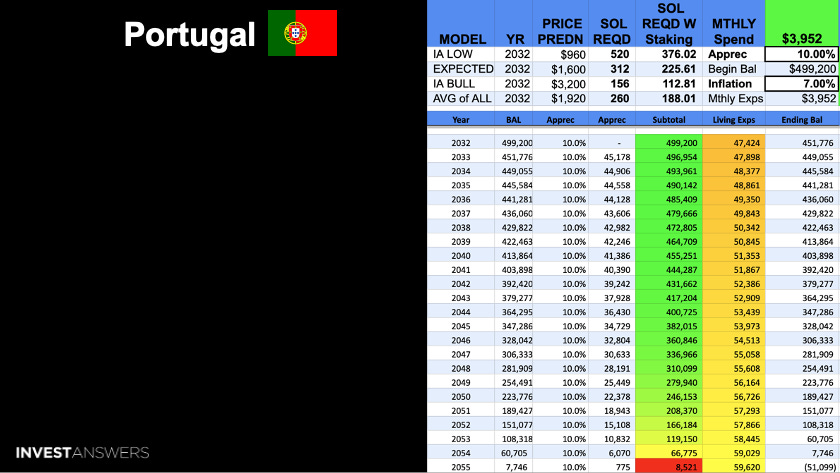

So, the retirement model breaks down the price prediction targets into the three scenarios discussed earlier: the bear, the expected, and the bull. Then I take an average of them all, and from this number, I take the top right number, which is how much you need per month alongside the appreciation assumptions of the underlying asset and the inflation rate.

Then, we put all of that together to give you exactly how much you need at a certain point in time. The point of time we are using in this example is 2032, so we can derive how many tokens you need to retire at that stage.

This is data from 2023 regarding how much a 65 year-old couple retiring in the U.S. needs. They need about $2,900 a month to maintain their pre-retirement standard of living. I always sandbag, so I added a 70% load to this number because I do not trust government statistics.

For the United States, adding 70% to the cost, you will need 361 SOL tokens to retire and spend $5,500 a month for 23 years. If you are staking in the U.S., you need 261 SOL.

Ten months ago, this bag would have cost $7,200, and it now costs $68,400.

This is a theoretical model with a single asset so that you can build a target. I will discuss later why you must always keep your tap dancing shoes on regarding asset allocations.

I converted the Euros to Dollars and then increased the government figure as I did in the first scenario, keeping everything in dollars for simplicity. You need 325 Solana to retire in Germany. If you are staking in Germany, you need 235 SOL.

To retire in India in a nice city, you need $1,951 a month. This would require 129 Solana, or if you are staking, it would only require 93.

You need about $3,000 in the United Kingdom, but with my 70% load, you need $4,538 a month to retire. This requires 298 SOL to retire and only 215 if they are staking. Most of the British do not stick around as they prefer the better weather in places like Portugal.

For Canadians, retiring requires 308 sol in order to spend $4,644 a month, which is much higher in Canadian dollars.

Ireland needs 285 SOl to retire, or if you are staking 206 to spend $4,311 monthly.

Thailand is a very popular place for retirees. People always ask me about it, so I broke at all of the costs, such as rent, food, transportation, healthcare, entertainment, and, of course, sandbagged everything. In Thailand, you need 145 SOL or 104 if you are staking to retire.

Portugal has become more expensive, costing $3,952 a month to retire. So, retiring requires 260 SOL or 188 if you are staking.

An Italian retiree needs 250 SOL or 181 if you are staking. Keep in mind that this assumes a city-centric lifestyle.

The Australians need $5,229 in retirement. This requires 345 SOL or 250 if you are staking.

Vietnam retirement costs $1,459 per month, which is one of the cheapest domiciles. So you only need 96 SOL in this model, which would have cost you $2,000 not too long ago. This illustrates how investing early and getting in hard can be so life-changing.

In Mexico, you need $2,848 a month. The SOL required is 188, but it is only 136 if you are staking.

Costa Rica is $2,801 a month, which has become a bit more expensive. This requires 186 SOL or 134 if staking.

I recommend having multiple bags for retirement: Tesla, MicroStrategy, Solana, or whatever you want. If one blows up, you have two left.

When I started the channel in 2021, I believed that Solana could be the Ethereum hedge. Then, I surmised it could become the ETH killer. Now, I think it could eat the world, especially if Firedancer floats. Solana is so performant that it enables entirely new classes of previously impossible applications.

I believe Solana will be worth 33% of Ethereum's market cap, which will take the price to $325. I prefer to be very conservative, and I would be happy if it hit my $1,600 estimate per token in 2032. Coincidentally, that is half of what VanEck has as their bull target for 2030.

I agree with Mert that Solana is the consensus trade of this cycle.

However, the world is changing very quickly with AI. So keep your tap dancing shoes on! If I identify a Solana killer, you will be the first to know about it.

The big question is, did you fill your bag?

Checkout my Retire On Series:

https://www.youtube.com/playlist?list=PLWTRLGkkf1kTc8STj14DdDjNq1_i8q7fH