Today’s Nuggets

Bad News is Bad News Again

JPMorgan Forecasts 1% Fed Rate Cut

Wag the Dog War Incoming

The Recession is Here?

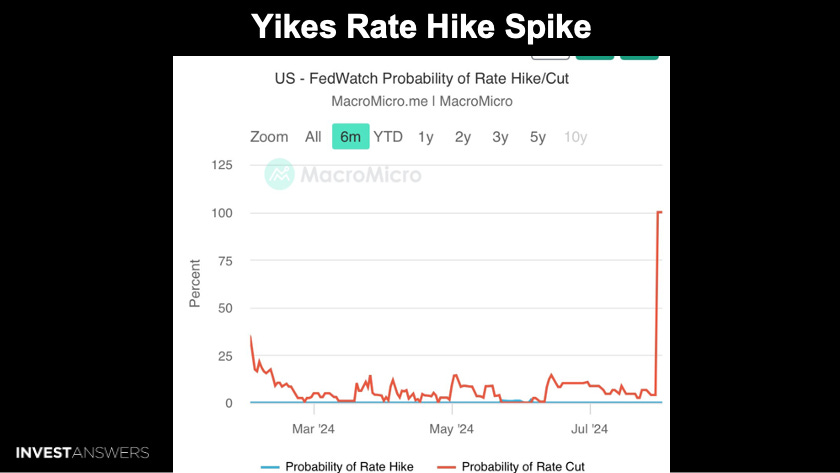

Rate Hike Change is Alarming

Job Market Tanks

Global Liquidity Hits All-Time High

MicroStrategy’s Outperformance Since BTC Adoption

This story is called Recession Signals and I will cover quite a bit of macro stuff, Bitcoin updates, and the relevant breaking news.

Crypto Market Update:

The crypto market cap is still at $2.24 trillion.

The Fear and Greed is still at 57, and we should be at 10, considering what's going on right now.

Bitcoin has just slipped $150 below that critical $63K support level.

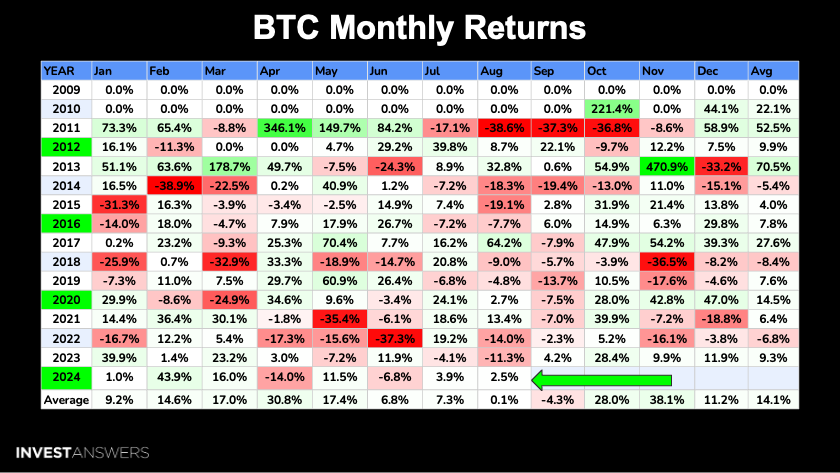

July was up 3.9%. August is now hovering around 2.5%, which is not cataclysmic.

However, if you look at the rest of the market, it is brutal.

For the longest time, we spoke about raising rates too late and then cutting them too late—too late in and too late out.

So much for the soft landing… as there are lots of signs that the economy has severely cracked and we are heading for a recession.

The Kobasi letter came out and said the same thing as I did yesterday: Bad news is bad news again.

This is how you know recession fears are rising.

The VanEck head says Bitcoin will hit $2.9 million per coin when central banks adopt it.

We know we could be on the cusp of some game theory here. We are unsure when, how, or which countries, but there is a lot of talk about this. Once it happens, it will be gradually and then suddenly, kind of like the pension funds coming into the space as well.

This is a 100 basis points forecast or four rate cuts all at once by November.

We are not sure exactly when, but this is alarming. I always say risk happens fast, and we are seeing a lot of things spike really fast.

Per Bitcoin Munger, So let me get this straight: we are on the precipice of both World War 3 and a recession, which will force the FED to cut rates and inject even more liquidity into the system, and you are not buying the dip with both hands? Bitcoin is poised to skyrocket under these conditions.

This is not a financial bias from Bitcoin Munger, as Bitcoin is poised to skyrocket under these conditions.

I always say Bitty loves a crisis.

Many people are so involved in crypto that they do not have an idea of what is happening around the rest of the world.

Right before an election, the powers that be tried to distract the populace.

U.S. President Joe Biden said that the U.S. military was redeploying forces in the Middle East in order to protect Israel from an expected future attack by Iran and its proxy forces while also urging for a de-escalation of regional tensions and a ceasefire for Gaza.

The comments came after a phone call with Israeli Prime Minister Benjamin Netanyahu amid growing concerns that Iran and other allied militant groups were set to retaliate for the killings this week of Hamas political leader Ismail Haniyeh in Tehran and Fuad Shukr, a senior military commander from Lebanon-based Hizbollah.

War is awful. War is bad. Instead of sending military, they should send diplomats, as in the old days, to talk and riddle out peace.

All fundamentals are moving towards a bullish outlook. Three or four of them were negative a week ago, and the market is slow to follow them.

However, these fundamental metrics show that the ecosystem's health and underlying ability to sustain price action going forward is very positive. The current price momentum sucks, but on-chain fundamentals are very bullish. The market is scared due to the macro recessionary outlook.

By the time you find out you are in a recession, you have actually been in it for quite some time.

We just triggered the Sahm Rule, an absolutely take-it-to-the-grave, reliable recession indicator.

Since 1950, the Sahm rule has indicated only one false positive, in 1959. We are in a recession, and Fed Chair Powell said it's not an economic rule but a statistical regularity.

The U.S. Fed watch probability of a rate hike cut is now guaranteed.

I actually said that recently. The question is, when? It will be September or

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.