RECAP: REAL # OF WHOLECOINERS

🚨📈 Unbelievable Revelation! # of Bitcoin WHOLECOINERS - Prepare to be SHOCKED!💥

NUGGETS OF ALPHA

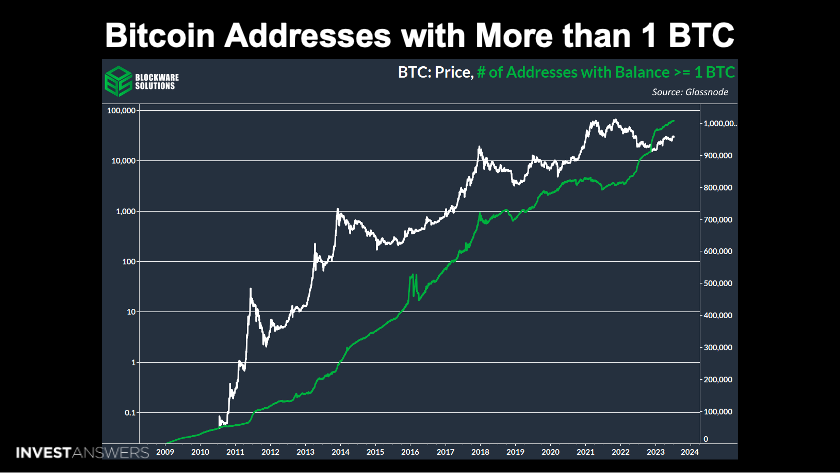

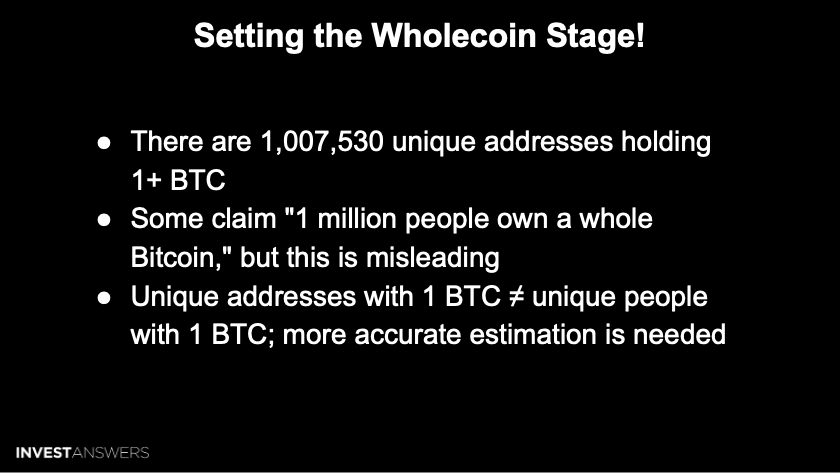

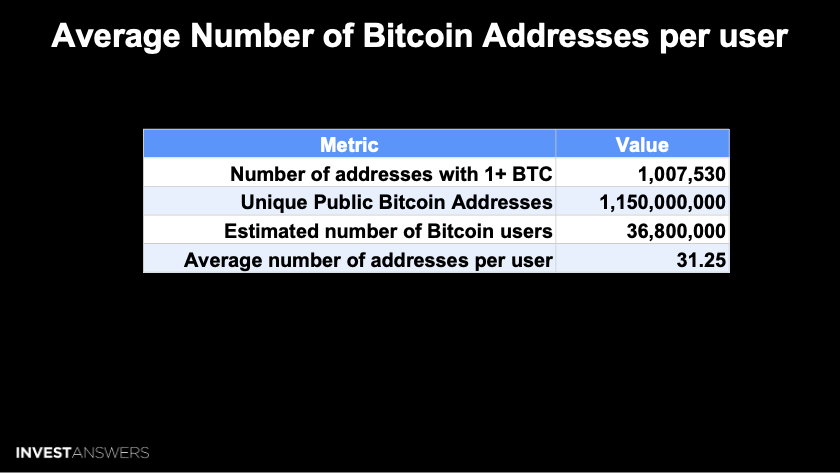

1,007,530 unique addresses are holding 1+ BTC

31.25 is the average number of addresses per BTC user

1.15 billion addresses only represent 36.8 thousand Bitcoin unique users

The maximum number of Wholecoiners that can be achieved is ~235,200

We have most definitely reached peak wholecoiner status already

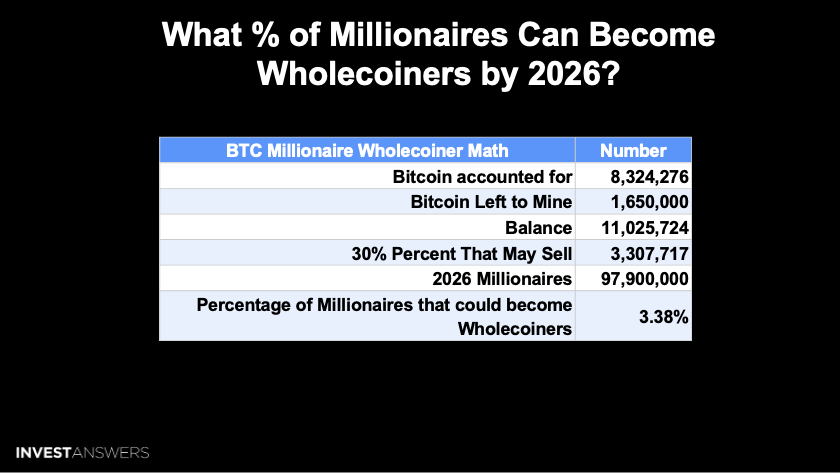

The max number of millionaires that can become Wholecoiners by 2026 is 3.38%

MSTR corporately owns ~152,333K BTC; Michael Saylor personally owns ~37K

0.0029% of the world population is the max number of Bitcoin Wholecoiners

~26.3% of the supply that is gone due to lost coins

July 18th, Cathie Wood predicted that Bitcoin could reach $1.5 million by 2030

Today 1,007,530 unique addresses are holding 1+ BTC. I have talked about the whole coin status since I started this channel, and I have incentivized many people to make that their goal.

In this lesson, we will discover how few unique people own at least one BTC, which many will find very surprising.

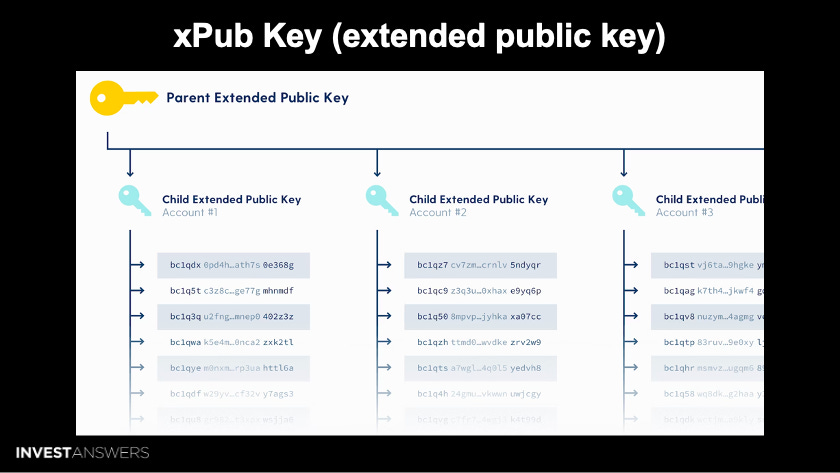

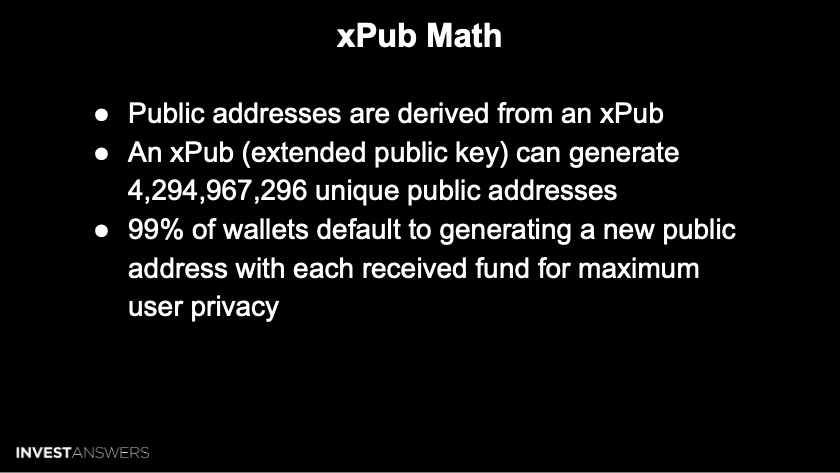

First, let’s examine wallets. A Bitcoin wallet consists of a private key and an extended public key (xPub). The public addresses used to receive BTC are derived from the xPub, which has so far created over 4 billion unique addresses.

Most wallets generate a new address each time you receive funds to enhance privacy. There is no way to know that any two addresses derive from the same xPub (wallet) unless someone shares their xPub. This is part of what allows Bitcoin to be simultaneously 100% transparent but also pseudonymous (i.e., private).

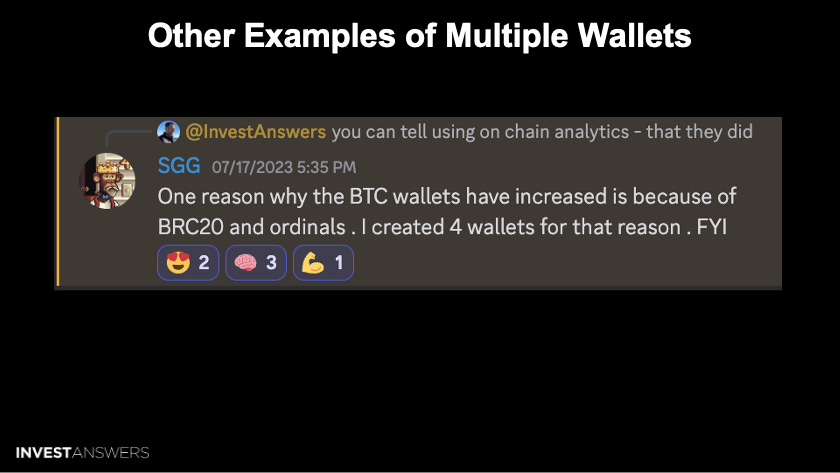

In the case above, you can see SGG created 4 wallets in the space of a few days for BRC20 Ordinals. So again, it is not one wallet per user, as a user might have multiple use cases for BTC.

So almost all BTC protocol participants receive this automatically for their wallets each time they use it for a tranfer.

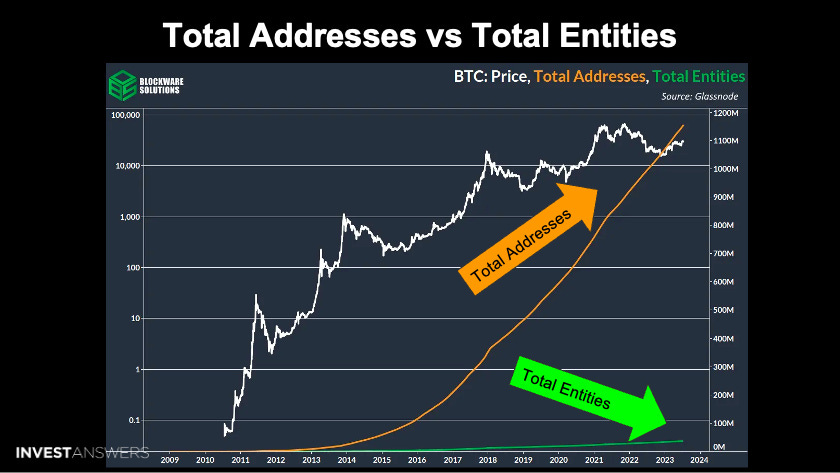

According to the model above, there are 1.15 billion unique public Bitcoin addresses that hold over 1 Bitcoin. However, there are only an estimated 36.8 million users who control these addresses. This means that the average number of addresses per user is 31.25. This is a key part of this paper.

A visual of what we are talking about is explained above. Th stunning part here is there are 1.15 billion addresses but these addresses only represent 36.8 thousand Bitcoin unique users.

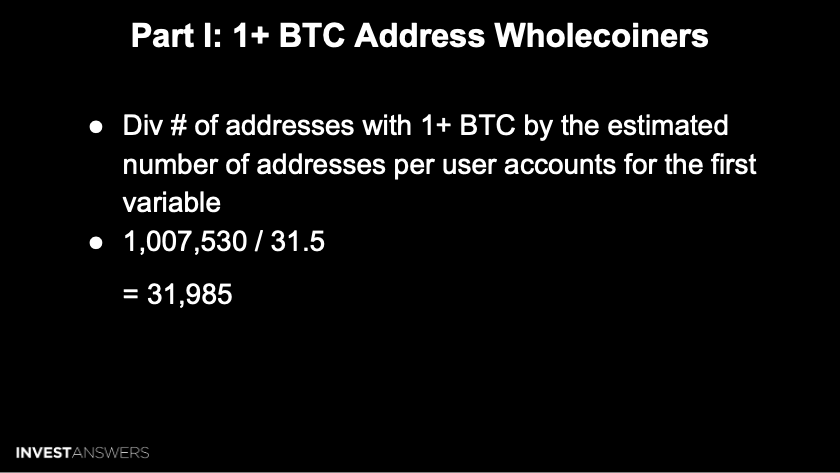

The number of addresses with 1+ BTC does not equate directly to the number of whole-coiners because most users have multiple addresses with 1+ BTC. We can account for this by dividing the number of addresses with 1+ BTC by the estimated number of addresses per user.

The estimated number of addresses per user is 31.5. So, if we divide the number of addresses with 1+ BTC by 31.5, we get ~31,985 whole coiners. This is part 1.

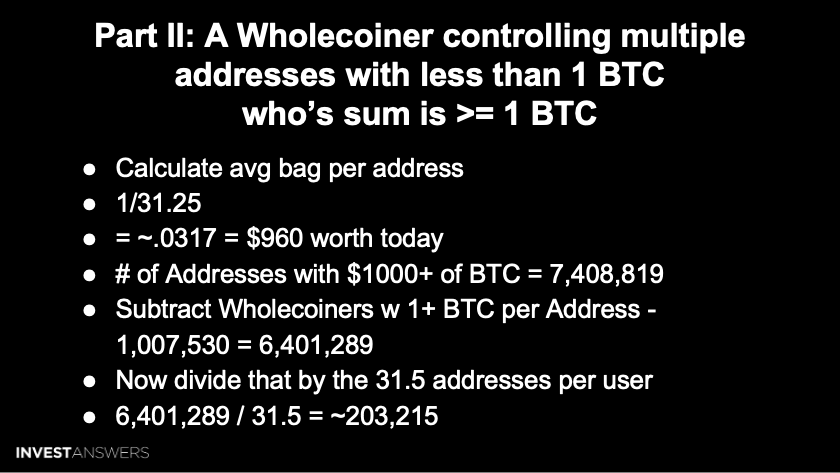

Now, Part II is critical. There are a small amt of Wholecoiners that have 1+ bitcoin in their wallets. But the larger number is for those how have small amounts of bitcoin across many wallets per unique entity. Per this math, we estimate the maximum number of Wholecoiners that can be achieved is ~203,215.

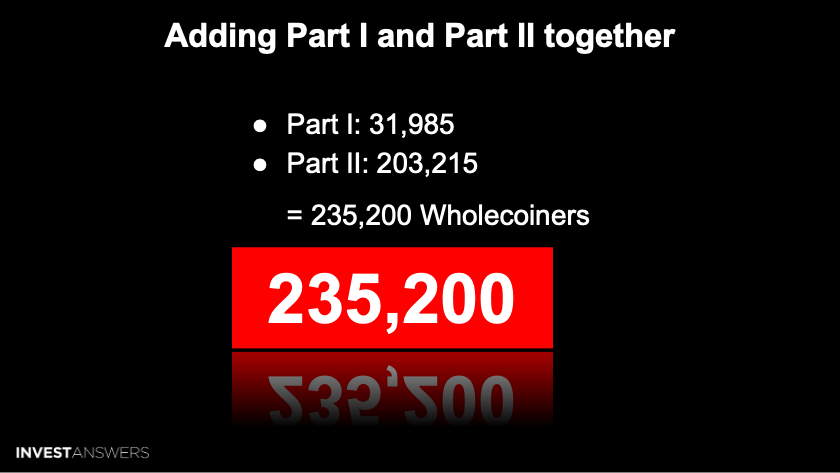

So based on this math, we can assume that there are at most 235,200 Wholecoiners on planet Earth.

Adam Back, a Bitcoin OG in the space, woke up to this realization recently. As Bitcoin's price soars, becoming a whole coiner (owning at least one BTC) might become unattainable for newbies. With 1M UTXOs holding 1 BTC, reaching 10M seems improbable due to rising prices. We most definitely are at peak wholecoiner status.

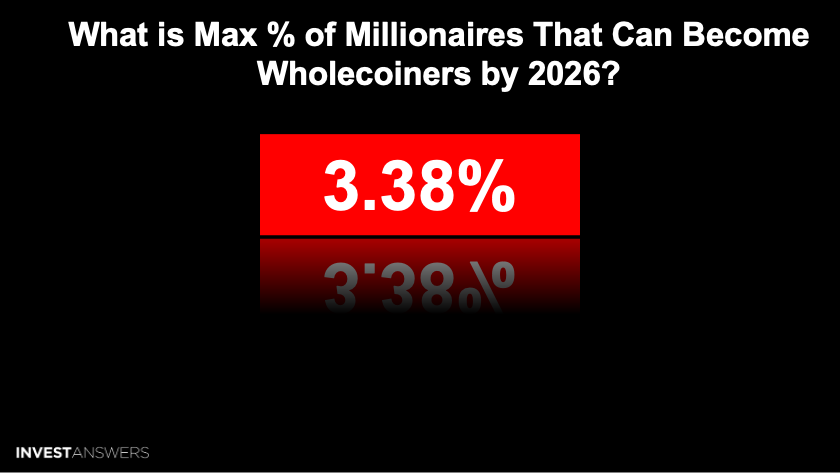

For this model above the maximum percentage of millionaires can become a whole corner by 2026 is limited to only 3.38% of all millionaires on earth in the year 2026. This number reflects the problem of being late. We are early!!!!

The problem is that any millionaire investing in Bitcoin will buy as many as possible. So the 3.38% will be much lower in actuality.

MSTR corporately owns ~152,333K BTC, and Michael Saylor personally owns ~37K BTC. The average BTC per human is 0.00175, so Saylor's buying denies 87M people the average BTC per person.

We are at Peak Wholecoiners. Sadly, this number is dwindling daily.

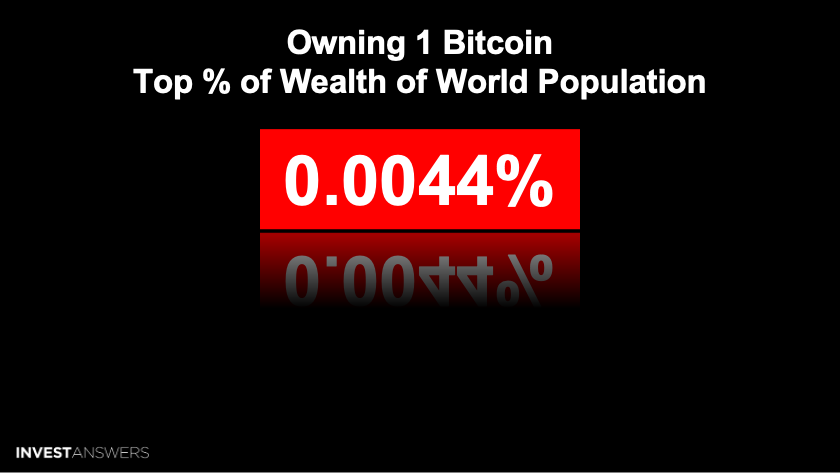

With a max of 14 million BTC and a world population of 7.75 billion that will grow, owning one Bitcoin will put you at the top 0.0044%.

This is what I call rarified air. Enjoy it if you are in the club.

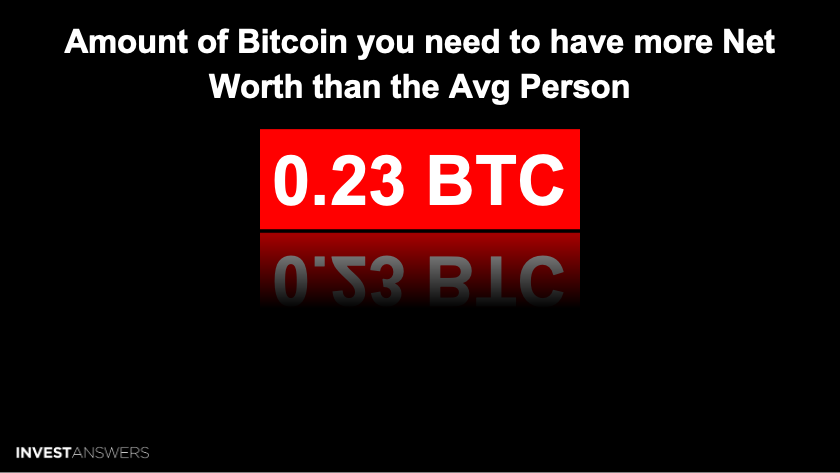

This is the average net worth of 8 billion people on Earth divided by the world's wealth. We know there is a massive concentration of wealth in the top 1%.

This one is another crazy statistic re Bitcoin's Scarcity!

If we assume that only millionaires distribute Bitcoin amongst themselves in 2026, the amount of Bitcoin per millionaire would be capped at 0.141 Bitcoin per millionaire. This is an impossible number to achieve for all millionaires, as many people got in early and are never selling. This demonstrates just how scarce this asset is.

This is why all of the scammers are out looking for Bitcoin holders. Do not trust anyone, and be careful with your security.

Bitcoin is a limited-supply asset. Unlike gold, which can be mined, there will only ever be 21 million Bitcoin created. In addition, some Bitcoin is lost or forgotten every year, which further reduces the available supply. This scarcity is one of the factors that drives Bitcoin's value.

The math we walked through in our lesson does not even consider the ~5M lost Bitcoins. This accounts for ~26.3% of the supply that is gone forever. So I estimate that less than 200,000 Wholecoiners will exist on the Earth going forward.

July 18th, 2023, Cathie Wood predicted that Bitcoin could reach $1.5 million by 2030. Wood's bull case for Bitcoin is based on its role as a safe haven asset. She points to the March 2023 regional bank crisis, when Bitcoin rallied from $19,000 to $30,000 as investors sought a safe place to store their wealth.

Wood also believes that Bitcoin is a hedge against inflation and counterparty risk. She argues that Bitcoin's decentralized nature makes it immune to the financial crisis that happened in 2008.

Wood's prediction is based on the assumption that Bitcoin will continue to gain adoption as a store of value. If this prediction is correct, Bitcoin could significantly impact the global financial system.

Get some today. It is important to your future well-being.