NUGGETS OF ALPHA

Bitcoin Hash Rate & ETFs summary so far

China enters the Bitcoin ETF space, signaling a global race for ETFs

Neuralink's Milestone: Elon Musk's Neuralink has implanted a chip in a human brain, marking a significant advancement in neuroscience.

Tech Layoffs: PayPal and UPS announce significant layoffs, signaling cost-cutting measures amid economic pressures.

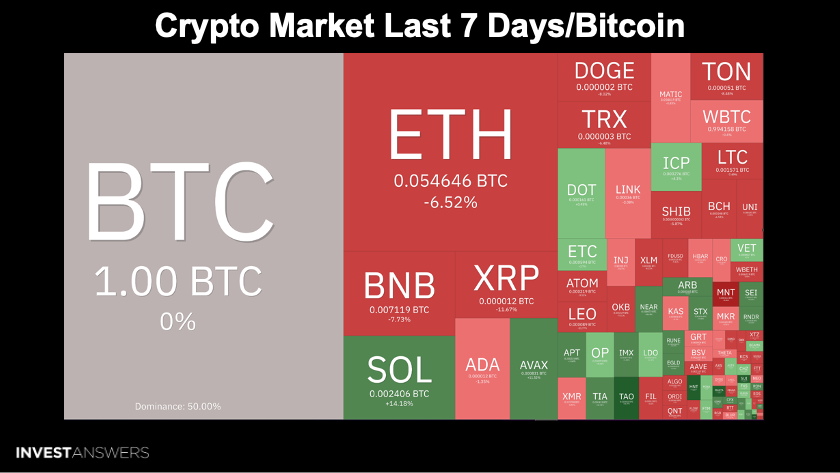

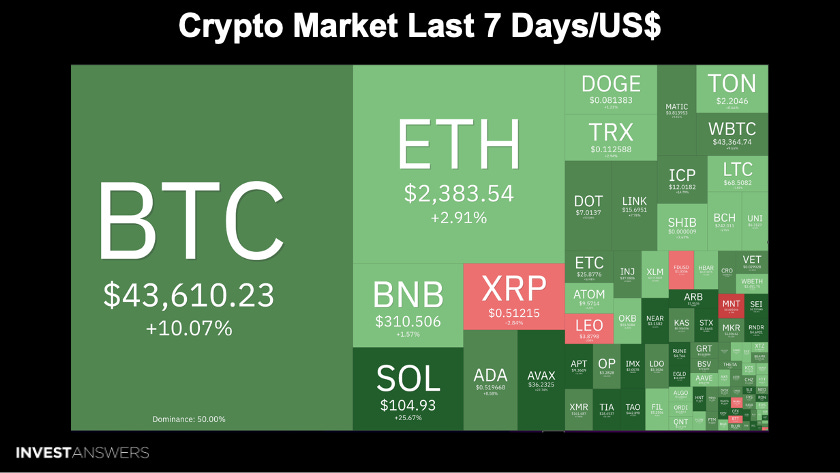

Crypto Market Movements: Mixed week for cryptocurrencies

Crypto Adoption & Growth

Market Sentiment: The Fear & Greed Index rebounds

Future Predictions: Bitcoin's long-term outlook remains bullish

Altcoin Trends: AltSeason continues with notable performances

Economic Indicators & Layoffs

Overall, it was a mixed week:

ETH -7%

SOL +15%

AVAX +10%

DOT and ICP have some light green gains on BTC

BTC +10.07%

ETH +2.91%

SOL +25.67%

XRP -3%

AVAX +22.74%

Fourteen weeks ago, I started tracking these stats when things started going up in Crypto.

$450B increase in just over three months

2.1M more users

13M more transactions per day

78 days is not a lot of time!

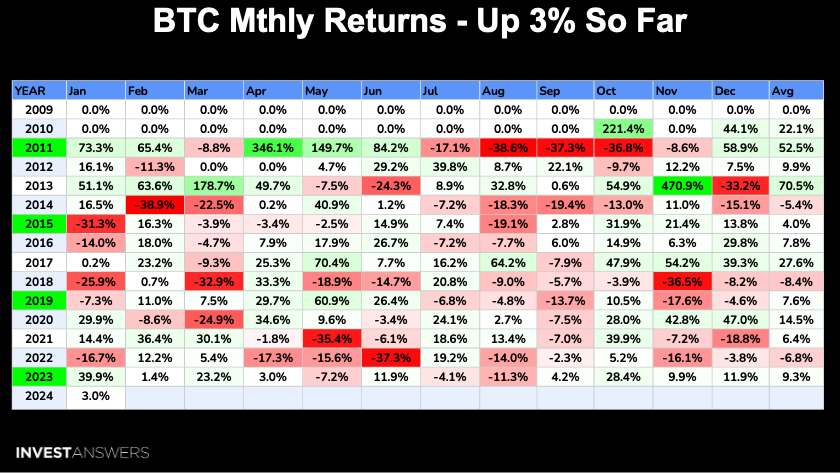

Bitcoin is up 3% for the month of January 2024. It is going to be a wonderful year. We will have some bumps along the way, but that is just the nature of the beast.

The Fear & Greed Index bounced right back from the 40s to 61. This led me to wonder if there is a signal there that we can use to stack Bitcoin.

In this one day chart, I overlaid the Fear and Greed Index onto the Bitcoin price chart to see if there is a pattern that people who do not have access to sophisticated tools can use. You can see a huge dip in Fear & Greed back in May 2023 which indicated a perfect time to buy. Then, in July 2023, the same pattern emerged. Finally, in September-October 2023, you see a massive dip in Fear & Greed, presenting another perfect opportunity to buy. The recent Fear & Greed dip was significant, but much less so in the price action of Bitcoin.

This approach worked well over the last 12 months. So next time you hear me say this index fell to 35 or 40,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.