Today’s Nuggets

Biggest BTC Liquidation

Bittensor Halts Network After Exploit

Labor Department Lies Continue

Ethereum Outflows Accelerate

All of the Sectors in Crypto are Down

$58.4K is Key

Owning an Asset and Crashing its Price?

The Potential Impact of Mt. Gox

Solana versus the World

Miners Turning Off Rigs

The Monster Tesla Rally

On the 4th of July, we had the biggest dump in quite some time and many people got scared.

For this OCTA, we are going to break down all of the on-chain analytics to figure out exactly what is going on:

How much are governments selling?;

How much Mt. Gox will sell?; and

Who got scared yesterday and dumped everything?

I have been asking myself those kinds of questions all day.

Is the storm over, or are things going to get worse? We will try to arrive at an answer.

Crypto Market Update:

The crypto market has fallen to about $2.07 trillion. The last time I did this was $2.3 trillion.

Fear and Greed is down to 29. Everybody is very much afraid again.

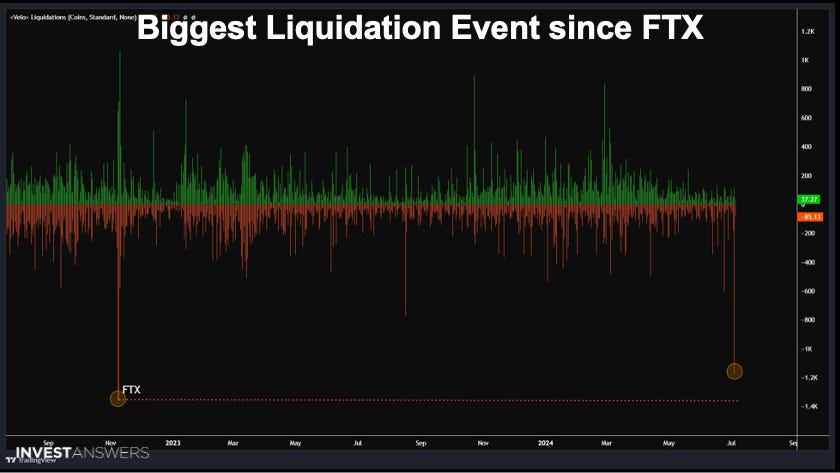

The FTX liquidation - the biggest one ever - took place in November 2022. It was a long liquidation during which many people lost a lot of money, about 2,000 Bitcoin.

The noteworthy unlocks this week include the following:

HFT = 3.2%

ENA = 0.87%, this will unlock forever

1INCH = 0.01%, not bad

XAI = classic tokenomics scam by putting AI on the name and then just dumping tokens for years

IO = another naming play like XAI

IMX, Aptos, Optimism, Stark, and Cyber keep on raining down tokens, which is why they are such poor performers

I was asked six or eight weeks ago what I thought of Bittensor (TAO) - was it not the leading one? I responded that, no, it was not.

Now, breaking news, they halted their network after an $8 million wallet exploit.

On-chain analyst Zach XPT, who does amazing work, reported that $8 million worth of TAO was stolen, possibly due to private key leakage. The incident caused a 17% drop in TAO's value.

Be careful where you invest!

How do you find out if something is a poop coin or not?

We have a thing called the Crypto Compendium to spot them from a mile away.

It is straightforward - do not be fooled!

Manufacturing jobs have been flattered down for a large part of this year. However, government jobs are growing.

If you work for the government, you will be just fine.

Every single month, the Labor Department revises jobs downwards. It is as if they pretend to say, “Oh, jobs are really good”.

Then, hopefully, 12 weeks later, nobody is watching when they revise them down to zero. But now the gig is up.

People are beginning to see through these government lies.

Over 120,000 jobs were revised down in both the May and April jobs reports. That means 10 of the last 15 monthly jobs reports have been revised lower. Technically, on a net basis, the economy only added 95,000 jobs this month, which is nothing.

Unemployment is going up very fast.

This ties into the rate cut discussion, which I will also cover later.

I have been talking about the gig economy for a long time.

The U.S. government added a whole bunch of jobs. In reality, they are counting gig workers who drive for Uber or work two hours a day at a coffee shop or something and earn very little money. That is the gig economy.

The full-time jobs in purple are flat to down. This is the reality of the job market.

Everything that you read is not true...

It has been a rough July, as Bitcoin is down 9.6%.

If you compare that to April, which was down 14%, it is not too bad. June was down 6.8%. The other day was a rough, nasty surprise, but overall, not too bad, considering exactly what was happening.

The Fear and Greed is back down to 30. Everybody is very, very scared.

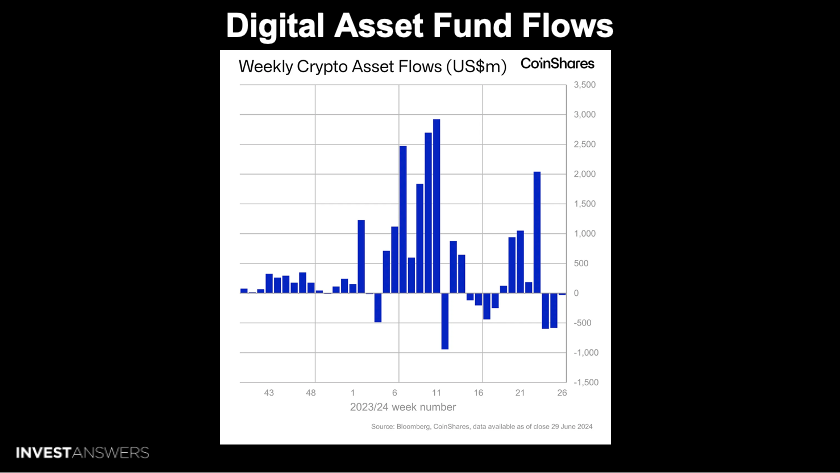

The digital asset funds flows were slightly negative last week. This was the third consecutive week of outflows, but they were only $30 million, so it is not too bad.

There is more happening behind the scenes.

This was a surprise to me.

Ethereum saw the largest outflow of $61 million since August 2022 and $120 million over the last two weeks, making it the worst-performing asset year - to date - in terms of net flows.

Hold on a second, we are getting an ETF next week! Why would they dump it out of funds?

Talk about buying the rumor, selling the news. What is going on with ETH? Who knows? We

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.