Today’s Nuggets

Bitcoin Dominance Hits Cycle High

$365M In Bitcoin Futures Liquidations

The New Versus the Old Whales

Gold Beats Ethereum in 2024

The Crypto Cycle of Life

Raining Tokens in September and October

Solana Stablecoin Supply Surges

Global Liquidity Hits New All-Time High

This story will include some data that some may find offensive.

You are used to it and you like data and cold, hard truths as we try to identify where we are going from here. We will look at a bit of history, tokenomics, compendium scores, and much more.

After the sky falling, after the end of the world, guess what? Yes, Bitcoin is up 1% for the last seven days. Ethereum is up 0.71%, and Solana is up 1.19%. XRP has some dark green because the lawsuit was filed.

Then some red stuff like Cardano, Litecoin, Polkadot, Avalanche, and Binance.

We will spend a little bit of time on Bitcoin first as it drives everything.

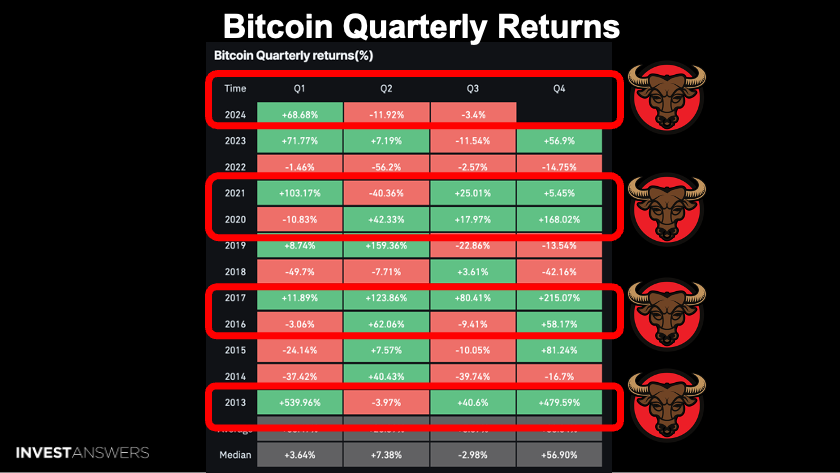

This graphic displays the Bitcoin quarterly returns in each of the seasons.

Bull runs typically last two years but can be volatile. Note that we had a lot of weird stuff happen in Q1 2020 with COVID-19 that took it down minus 11%; otherwise, BTC would probably have been green in that box.

In Q3, we are down 3.4%. I do believe this will turn positive because Q3 runs until the end of September. I do believe Q4 will be extremely green. We are probably a little over halfway done with this bull market run.

I do not believe we are going to have diminishing returns this cycle despite it being a bigger asset class for the following reasons:

The perpetual bid from ETFs;

Bitcoin and crypto are a new dedicated asset class; and

Bitcoin is very scarce.

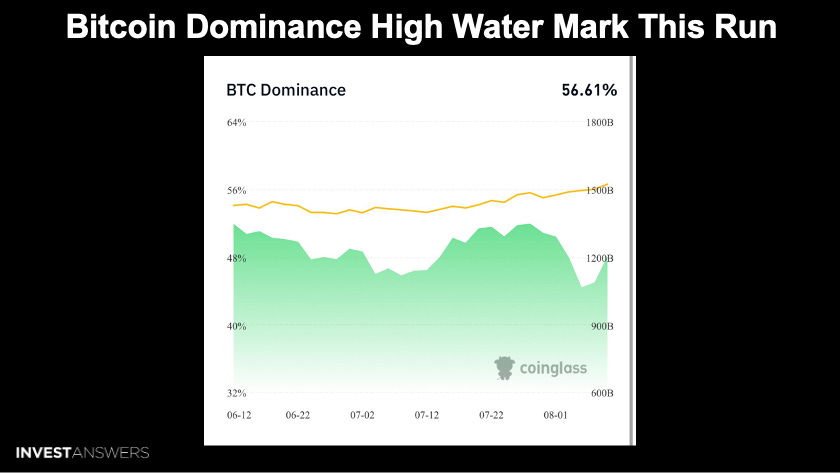

Bitcoin's dominance has hit its high watermark for this run-up at 56.61%.

Remember, you are looking at a very mixed bag and 98% of crypto is trash. ETH has also been weak, which propels BTC dominance, so bear that in mind as well.

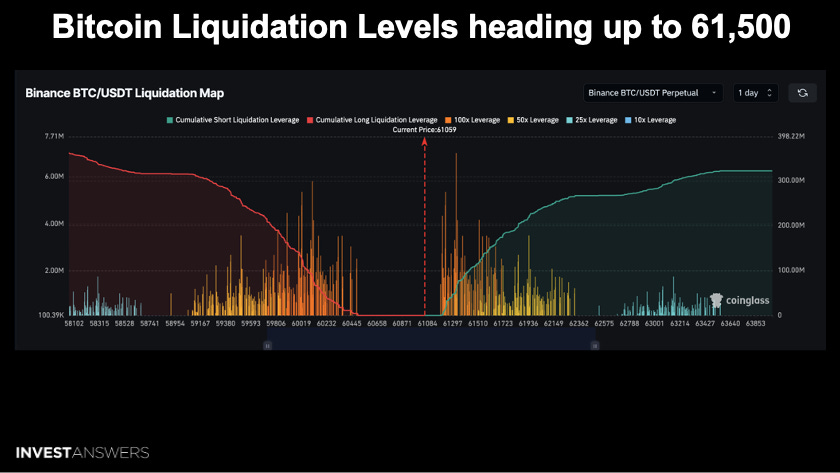

This chart helps you clearly determine if liquidations have been all cleared out.

If market makers go to the left, they will not hunt much. However, if they go to the right, they will. Therefore, I believe the next target is $61,500 for Bitcoin is the next target.

Sunday is pump day but markets are still a little bit edgy and we are still in August with people on vacation, making volumes low.

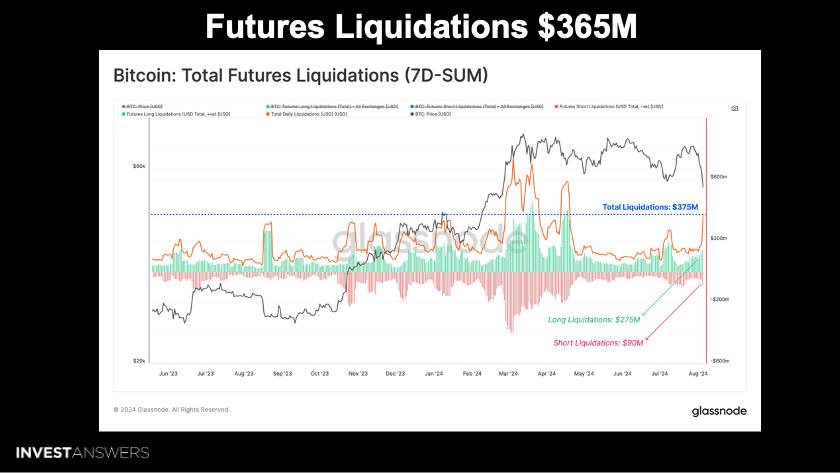

It was a rocky week but the derivatives markets saw huge volumes of long positions that were forced to close, totaling about $365 million alongside about $90 million for the short side.

People got clobbered both ways. Across the whole crypto class, I think a billion dollars was lost in liquidation.

Be careful with leverage out there, everybody.

This is probably the chart of the day from CryptoQuant. There are a couple of lines on this that I want to draw your attention to:

Gray = total sell-side liquidity for all exchanges

Pink = 30-day balance change of permanent holder demand that is going up and to the right

Black = Bitcoin price

Blue = liquidity inventory ratio (months)

This chart displays that the pink and blue lines are converging, which suggests that more Bitcoin is being moved out of exchanges and into self-custody, reducing the amount for sale. The trend is driven by increased demand from new market participants, like the new ETFs, which I told you would shake up a lot of the on-chain stuff. They are locking Bitcoin into wallets with no history of selling. For example, BlackRock has never sold so far since January 11th.

The liquidity inventory ratio suggests there is less than a month left of liquid inventory (i.e., Bitcoin available for sale) to satisfy the demand of the pink line.

What happens when these two converge?

There will be

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.